2012: Taking Control: You Can't Change The Economy, So Change Yourself!

Last year the headline on our Annual Lead Generation Survey story read: "Adapt or Die." Responses to two new questions this year indicate franchisors have taken this lesson to heart.

In responding to the question "Do you believe the fundamental lead generation process used before the recession must be changed to effectively recruit today's buyers?" three out of four (77 percent) said Yes. And to a similar question about the franchise sales process, 74 percent said Yes.

"Don't wait for the recruitment environment to change. You need to change your approach to succeed in this environment," said Franchise Update Media Group President Steve Olson, who unveiled the results of the 14th annual survey at the annual Franchise Leadership & Development Conference in October.

This year's survey gathered data on sales and recruitment practices from 110 franchisors representing 109,936 franchised and company-owned units (79,254 franchised and 30,682 company-owned). Participants consisted of franchisors who registered for the conference and filled out the forms of the in-depth survey. The responses--which are analyzed to provide an in-depth view into the recruitment and development practices, budgets, and strategies of a wide cross-section of franchisors--provide the basis of our Annual Franchise Development Report (AFDR).

"It's not just catching up with where you were before," says Olson. "If you have 30 percent fewer buyers in the market, you have to improve your recruitment performance." Today's potential franchisees, he adds, are asking not "How much can I make?" but "How fast can I get to ROI?" And franchisors better have a good answer, or those prospects will find another brand that does.

Many of the changes in the recruitment environment, of course, are the result of the economic shifts of the past few years. "The impact of the recession on the buyer has created caution and shrunk the pool of buyers, so you have to get a much larger slice of the pie to continue to grow--or fish in different ponds," says Olson. Compounding the challenge, he adds, there have been more closings of franchise units in recent years, so brands first have to catch up before they can grow.

"There are fewer buyers in a shrinking pool, and we don't know when it's going to change, so we have to change our processes to more effectively target our audiences," says Olson. This is not simple. It means, among other challenges, overcoming the fear factor in buyers, the ongoing lack of financing, more attention to unit economics and validation, and increased use of technology tools to monitor and quantify results of lead generation and the sales process. "It's not the go-go days any more, so measurement is more necessary than ever and the tools are improving every year," he says.

One way to fish in new ponds is to expand your pool through outbound prospecting. "This has never been done before, it's always been inbound," says Olson. Examples include calling on local chambers, attending industry trade events, and exploring vertical markets. Fishing in vertical markets involves learning the characteristics and traits of your most successful franchisees and going where they go, finding people in vertical industries with the same skill sets.

Growth plans for 2012 among respondents target a total of 8,262 new franchise units and 4,441 new franchisees; that compares with 3,850 new units 3,100 franchisees targeted for 2010. To hit those goals, says Olson, franchisors will have to provide a compelling business opportunity, which involves strong unit economics, transparency in Item 19 (including costs, as well as sales numbers), and refining your recruitment process to match what potential franchisees are looking for, not only in content and tone, but also in using every available channel to present your offer.

The following is a high-level summary of some of the in-depth findings from the 2012 AFDR. To order a copy of the complete report, Click Here

- Recruitment budgets. In one of the more interesting changes from the past two years--when median recruitment budgets dropped from $88,000 in 2010 to $80,000 in 2011--2012 median recruitment budgets are $125,000, an increase of more than 50 percent. That number, however, is still below the $138,000 medians of 2008 and 2009. "Franchisors have recognized the changes," says Olson. "To grow again franchisors have to invest again--in lead generation and in improving the efficiency of their sales process."

- Â Where the money goes. Internet spending, which held steady in the 47 percent to 50 percent range from 2008 through 2011, is projected to fall to 40 percent in 2012. Spending on print (17 percent) and trade shows (14 percent) has remained fairly steady since 2008, and is expected to remain so in 2012. One change: public relations spending is budgeted at 15 percent for 2012, up from 10 percent in 2011 and 11 percent in 2010. "Other," at 14 percent, has risen steadily in the past 5 years, most likely from increased spending on social media and optimization of franchisors' own websites.

- Internet spending. The most notable shift here is the decline in spending for online ad portals, which fell from 61 percent in 2010 to 51 percent this year; 2012 projections are about the same, at 50 percent. Spending on search engine optimization (SEO), after rising from 18 percent in 2010 to 24 percent last year, is budgeted to fall slightly in 2012 to 21 percent. Pay-per-click spending, at 15 percent and 14 percent in 2010 and 2011, respectively, is expected to climb to 19 percent next year. Spending for social networking is expected to remain at last year's level of 10 percent, up from 6 percent in 2010.

- Top sales producers. For the first time since 2007, the Internet was not the top lead producer, falling to second place (30 percent), just behind referrals at 31 percent. Sales produced through external Internet sources have fallen steadily from the 41 percent level recorded in 2007. Referrals, which produced 37 percent of sales in 2007, dwindled to 25 percent in 2010 before rebounding to 31 percent last year. Broker sales remained steady at 17 percent for three consecutive years. In a puzzling development, especially in an era of improved metrics and technology tools to track sales sources, the "Other" category has risen steadily from 4 percent in 2007 to 20 percent in 2011. In other words, one in five respondents either doesn't know where sales are coming from, or the choices of Internet, referrals, brokers, and print did not apply; or perhaps more sales are coming from franchisors' own websites, thanks to improved SEO.

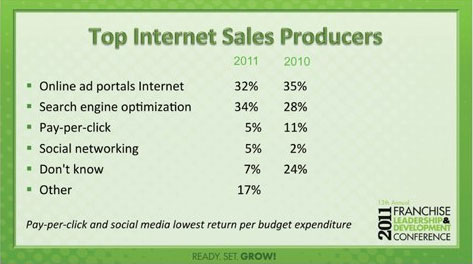

- Top Internet sales producers. In terms of sales (versus spending), for the first time ever, SEO topped the list at 34 percent in 2011, up from 28 percent in 2010. "That's good," says Olson. "SEO should be the top sales tool for franchisors, especially with the increasing use of Google Analytics. All roads lead to your website." One strong indicator that franchisors have improved at tracking the results of their Internet spend: the "Don't Know" category fell significantly from the previous year, dropping from 24 percent to just 5 percent in 2011. Online ad portals, at 32 percent in 2011, were down from 35 percent in 2010, but still ranked near the top. Pay-per-click and social media provided the lowest return, but while PPC dropped from 11 percent to 5 percent from 2010 to 2011, social networking rose from 2 percent to 5 percent.

- Â Online alternative resources. One important trend to note here, says Olson, is that this category is beginning to produce more sales. Selling franchises through social media platforms still ranks quite low on the totem pole in terms of total sales, but the numbers are climbing as franchisors learn to use these new channels. In 2011, 90 of the 110 respondents (82 percent) placed online ads, videos, or press releases on social or business networks, blogs, YouTube, Craigslist, etc., compared with 58 of 126 respondents (46 percent) in 2010. In 2011, 13 of 110 franchisors (12 percent) reported sales from social media, compared with only 5 of 126 (4 percent) the previous year. Olson says franchisors should continue experimenting with social media as a sales tool, integrating it into their overall sales strategy.

- Social media deals in 2011. The trend here is the gradual growth of social media as a sales source. Although the totals are still small, they are steadily growing. Facebook led the way with 11 deals, followed by LinkedIn (9 deals), YouTube (8 deals), craigslist (6 deals), and blogging (3 deals). Facebook showed a dramatic upswing, says Olson, climbing from no sales in the previous two years to lead the category in 2011. Interestingly, he notes, "Craigslist has produced sales every year since we started monitoring it. You don't have to optimize it, just post 'Franchise Opportunity Available.' It doesn't require the same upkeep and staff time adding content as other online resources. It's low maintenance, like an old classified ad. Everyone should be on it."

- Overall closing ratios. Survey respondents reported a modest improvement in 2011. Leads-to-sales ratios rose to 1.5 percent, following a 1 percent rate in 2009 and 2010. Applications-to-sales ratios rose to 10.5 percent, compared with 8 percent last year and 10 percent in 2009. And discovery days-to-sales ratios remained at 65 percent, the same as each of the previous two years. Commenting on the improvement in applications-to-sales closing ratios, Olson says, "In my opinion, this means better qualification of candidates by franchisors, as well as more efficient use of sales staff. There's more quality on the front end. Don't start them and keep them moving through the pipeline when you know it's not going to be a deal because they need more capital." During the boom years of easy credit, he says, the application-to-sales ratio was about 20 percent.

- Brokers. The use of broker networks (56 percent), the percentage of franchisors closing deals (67 percent), and the median broker commission ($15,000) remained level from 2010 to 2011. The big change is in the median of applications resulting in sales, which fell from 8 percent in 2010 to 3 percent in 2011. The lesson here, says Olson, is that 2012 will require more applications from brokers to hit 2010's numbers. "Don't be too hard on brokers," says Olson. "It does require more applications to make the same number of deals. For those particular brokers not qualifying your candidates, just fire them. It immediately solved the problem when I was selling." One continuing advantage in working with brokers: with budgets still tight, franchisors don't need to invest as many dollars up front, and brokers bring in additional qualified buyers franchisors would never have gotten otherwise. And, as noted above, the percentage of sales produced through brokers has remained steady at 17 percent for 2009 through 2011.

- Franchise sales performance. Setting sales goals has become more challenging in the uncertain economy of the past several years. In 2009, only 9 percent of respondents exceeded their goals, and in both 2009 and 2010, 59 percent fell short. Optimism based on the go-go years, combined with an expected economic recovery, produced goals that were too high. In 2010, sales forecasts improved slightly in terms of matching goals with real-word results: 19 percent exceeded goals in 2010, though in 2011 that number fell to 15 percent. However, the percentage of franchisors meeting their sales goals improved from 2010 to 2011, rising from 21 percent to 33 percent. Other positive news: the percentage of franchisors falling short in 2011 fell to 52 percent from 59 percent the previous year, and those meeting goals in 2011 rose to 33 percent from 21 percent in 2010. Buyer uncertainty, tight credit, and a lack of savings, family, friends, and home equity as a source of start-up capital continued to slow franchise growth, an environment not expected to change significantly in 2012.

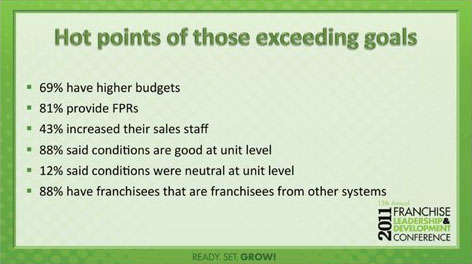

- Franchisors exceeding goals. Franchisors that surpassed their sales goals in 2011 shared several important characteristics: 69 percent have higher budgets; 81 percent provide FPRs; 43 percent increased their sales staff; 88 percent said conditions at the unit level are good and 12 percent said they were neutral; and 88 percent have franchisees who own brands with other systems. "Unit economics is critical to successful growth, in that all of those exceeding goals had unit economics that were either good or neutral," said Olson. "This slide is a picture of best practices in development."

- Measuring cost per lead and per sale. After years of sub-par performance, franchisors are continuing to improve in these two categories. In 2011, 72 percent tracked cost per lead, up 3 percent from the previous year; the flip side, of course, is that more than one in four still don't. Among those who do, their median cost per lead of $60 rose $6 in 2011 from the previous year. Looking at cost per sale (the more important number), 68 percent of respondents track that, also up 3 percent from 2010. The flip side here is that one in three still don't--a deficiency almost unconscionable in today's competitive, cash-strapped environment.

Some good news: median cost per sale fell significantly in 2011 among those who track it--from $10,000 in 2010 to $8,565 in 2011. "A lower cost per median sale reflects a combination of technology, measurement tools, and better sales and marketing performance," says Olson. Many also are using outside firms to help them manage and track their ROI on sales expenditures. - Referrals. "Referral programs have grown tremendously," says Olson, "not only to franchise owners, but also to suppliers and employees." As noted, referrals took the lead as the top sales producer at 31 percent, displacing the Internet as number one. This, says Olson, is due to more franchisors offering referral fees, promoting them more aggressively to franchisees, and increasing fees (or other rewards) when a referral signs on. Referrals, he says, also are three times more apt to buy than a non-referral. "These are much stronger leads," he says, and the numbers back this up: at 54 percent, referrals have the highest close ratio of all lead generation sources. More franchisors are getting with the program and offering incentives: in 2011, 67 percent provided incentives to franchisees who referred prospects that buy, up 5 percent from the year before. The median referral fee of $3,500 remained level from 2010. While referrals still haven't regained their 37 percent share of sales producers, the trend is clearly upward.

- Qualifiers. In the quest to make the sales process more efficient and productive, more franchisors are turning to qualifiers to screen leads before turning them over to their more highly paid sales team. "The use of qualifiers has continued to creep upward," says Olson. Last year the number of brands employing qualifiers was 38 percent "Forty-one percent employ one today, the first time qualifiers have broken the 40 percent level," says Olson. Why? Simple: It saves time and money and boosts productivity.

At this year's Franchise Leadership & Development Conference, the session on high-performance sales growth generated a flurry of questions from attendees. In a lively discussion about the pros and cons of using brokers, panelists noted that in-house qualifiers serve one of the same purposes brokers do. "The broker does a lot of legwork to qualify leads and answer all the big initial questions," said Steve Dunn, vice president of franchise development at Denny's. Panelist JD Sun, co-founder of Brightstar Healthcare, where the use of a pre-qualifier has been highly successful, put it more bluntly: "You don't want your sales people wiped out from stupid calls." A franchisor in the audience said, "We hire a $27,000 lead qualifier who gets $1,000 per sale. It's worth it." Qualifiers can also be outsourced, but the result is the same: better prospects and a more productive sales team.

2012 AFDR Now Available!

The AFDR, the only sales and lead generation benchmark report available in franchising, identifies industry sales trends and top lead generation sources for meeting your sales goals. For example:

The 2012 AFDR is packed with timely information and benchmarking data that can help your franchise system grow faster and close more deals--while saving thousands in cost per sale. Based on in-depth interviews with 110 franchise organizations actively expanding their franchise systems, this thoroughly researched report reveals the franchise success drivers that are sure to boost the output of your sales department. Packed with the most comprehensive sales and lead generation data in franchising, the 2012 AFDR is a must-buy selling tool for franchisors, development consultants, and advertising and marketing suppliers. The AFDR is ideal for benchmarking and building budgets and media plans. The complete report, with analysis and benchmarks, is available now for $399. For ordering information, call Sharon Wilkinson at 800-289-4232 x202 or sales@franchiseupdatemedia.com, or go to www.franchising.com/franchisors/afdr.html. |

Share this Feature

Recommended Reading:

Comments:

comments powered by DisqusFRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Growth

- Operations

- Open New Units

- Leadership

- Marketing

- Technology

- Legal

- Awards

- Rankings

- Trends

- Featured Franchise Stories

FEATURED IN

Franchise Update Magazine: Issue 4, 2011

The franchise listed above are not related to or endorsed by Franchise Update or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The franchise listed above are not related to or endorsed by Franchise Update or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.