2017 AFDR Highlights: Sales Closing Ratios for 2011–2016

This is the seventh in a series of highlights from the 2017 Annual Franchise Development Report (AFDR). The 2017 AFDR, unveiled in late September at the Franchise Leadership & Development Conference, is based on responses from 167 franchisors representing 60,989 units (51,789 franchised and 9,200 company-owned).

Participants in the survey consisted of franchisors that completed an extensive online questionnaire. Responses were aggregated and analyzed to produce a detailed look into the recruitment and development practices, budgets, and strategies of a wide cross-section of franchisors. The data and accompanying commentary and analysis provide the basis of the 2017 AFDR. (Ordering information is below.)

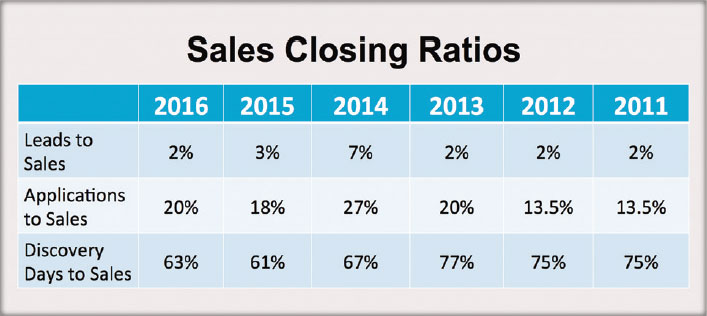

Sales closing ratios, 2011–2016

Not much change from the previous year (see graphic). Although the ratios for 2015 and 2016 were lower than those in 2014, our panel of experts for that year categorized the 2014 figures as unusually high, more of an aberration than a norm. At 2 percent, the lead-to-sales ratio in 2016 was more in line with the numbers from the past 5 years. The applications-to-sales ratio, at 20 percent, is in line with 2015 and 2013, and much improved from 2011 and 2012. While the discovery days-to-sales ratio held fairly steady compared with the two previous years, those ratios dropped noticeably from 2011–2013.

Last year we wondered if more unfit candidates were getting through to discovery day, if franchisors were becoming more selective in the final stage of the award process, or if the economy or financing issues were the reason for the decline. This year we’re hearing that greater uncertainty stemming from the sluggish economic recovery has dampened the appetite for risk among candidates, and that increased competition for prime real estate sites for the many brands that have similar footprints are contributing factors to the decline here. In the legal panel at the Franchise Leadership & Development Conference, many questions were about external threats to the franchise business model from regulators and legislators. Whether the threats are real or not, this could be another factor as candidates question the long-term viability of a brand’s profit model in light of possible future restrictions. Franchisors must examine their discovery day process to see where candidates are dropping out and conduct exit interviews with those who drop out, asking why.

Next time: Franchisors exceeding goals.

Ordering Information

The complete 2017 AFDR, with analysis and benchmarks, is available for $350. For ordering information, call Sharon Wilkinson at 800-289-4232 x202, email sales@franchiseupdatemedia, or click here.

Share this Feature

Recommended Reading:

Comments:

comments powered by Disqus| ADVERTISE | SPONSORED CONTENT |

FRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Growth

- Operations

- Open New Units

- Leadership

- Marketing

- Technology

- Legal

- Awards

- Rankings

- Trends

- Featured Franchise Stories

| ADVERTISE | SPONSORED CONTENT |

The franchise listed above are not related to or endorsed by Franchise Update or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The franchise listed above are not related to or endorsed by Franchise Update or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.