Keep Calm: Why Deals are Taking Longer

Over the past several years, there has been an extension of what once were normal timelines for most industry-related transactions. These include multi-unit franchisee approval, franchisee-to-franchisee transfers, private equity/family office investments, refranchising, and recapitalizations with both regulated and non-regulated capital providers.

Let’s face it, time kills deals. Longer deal cycles exacerbate execution risk by exposing transactions to franchisor approval sentiment, changes in lending conditions, and macro or geopolitical events. Although managing through the deal process has become increasingly difficult and time-consuming, approaching it with the right focus, time, and effort up front can make it easier—and allow you to return to your real job of growing your business.

Quality of financial information. If your business is in growth mode, it’s time to transition away from basic accounting systems like QuickBooks, and retain an accounting firm with the industry and multi-unit franchise expertise to upgrade and implement the appropriate systems and controls. There is no one-size-fits-all approach. Some companies outsource everything; others bring most of the needed financial functions in-house; and many, if not most, develop a hybrid approach. Interview several firms and speak with peers in your industry and area who have gone through a similar growth phase. Ensure you have financial integrity and credibility early in the process. Tighten up your finances and associated controls, because once your deal gains traction, the quality (or lack thereof) of your books and records will greatly affect asset valuation, transaction timing, retrading, and overall scrutiny of the deal.

Legal representation. When selling an asset that most likely is a substantial portion of your net worth and life’s work, hire an experienced franchise and/or M&A attorney, especially if they already have an existing client base within your brand. Depending on the type of deal, you can expect your attorney to be involved with the purchase and sale agreement, franchisor negotiations around territory rights and development requirements, loan documents, leases, and landlord consents. You need a true expert to guide your transaction through a process filled with time-delaying pitfalls and drama. Most likely they will know the key deal points and decision-makers at the brand level. Moreover, they will have current data on which funding sources helped clients make it to the closing table—and which ones threw up roadblocks that either caused transactions to stall or ultimately die on the vine.

Lenders and investors. The lending process has been evolving over the past several years and has become increasingly complicated. Unpredictable franchisor capital demands, new growth requirements, and the inability to have consistent accretive revenue growth as costs escalate has given lenders pause. Lenders are demanding more data on a borrower’s ability to manage labor and food costs, the amounts, timing, and return on capital expenditures, marketing plans, brand initiatives, etc. If a transaction is above a size threshold for investment, expect a quality of earnings (QE) report. QE reports are now standard on most transactions involving family offices, PE firms, mezzanine or unitranche lenders, and larger senior credit facilities. QE reports take time, cost money, and almost always question some aspect of the business’s financial performance or reporting, which may leave the buyer vulnerable to deal renegotiation. Make sure your capital provider is experienced in your brand or similar concepts. Vet the lender and their outside support team (QE, legal, etc.). If your firm is not well-versed in raising capital and how to properly arrange the capital stack, retain a professional firm to assist. Again, experience matters. While there is significant capital available, the process simply takes longer to complete.

Franchisor. Many brands are now taking a deep dive into the details of a transaction and critically reviewing financial results, capital plans, minority or new partners, and even term sheets from lenders. In addition, Tier 1 franchised brands are often inserting mandated development requirements as a condition for their consent. This requirement is becoming more widespread and increases the risk of cannibalization on existing stores achieving ROI benchmarks. A solid relationship with the franchisor and transparency are absolutely necessary for growth. Based on the overall relationship with the franchisee, franchisors will show some flexibility in timelines and requirements. The most successful franchisees are those who spend time educating the franchisor on what they are doing in their markets while seeking macro guidance from the brand.

Above all, when it’s your time to be involved in a deal, stay calm. No one group or factor is responsible for the realities of today’s elongated deal times. Rather, focus on what you can control. Tighten up your finances, spend the smart money early in the process to hire the right team, and get to work. And remember above all else, keep your eye on the prize.

Carty Davis is a partner with C Squared Advisors, a boutique investment bank that has completed hundreds of transactions in the multi-unit franchise and restaurant space. Since 2004 he’s been an area developer for Sport Clips in North Carolina with more than 70 units. Contact him at 910-528-1931 or carty@c2advisorygroup.com.

Share this Feature

Recommended Reading:

Comments:

comments powered by DisqusFRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Growth

- Operations

- Open New Units

- Leadership

- Marketing

- Technology

- Legal

- Awards

- Rankings

- Trends

- Featured Franchise Stories

FEATURED IN

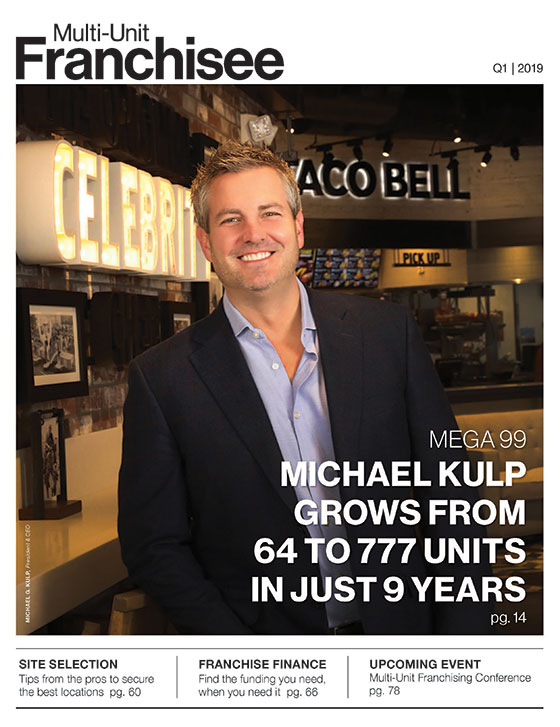

Multi-Unit Franchisee Magazine: Issue 1, 2019

$400,000

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.