Reinventing Payday: Trim Your Payroll Costs With Electronic Distribution

Franchisees nationwide are looking for new ways to cut costs and improve efficiency. Payroll is an easy, and yet often overlooked, opportunity for companies to make operational changes that will have a direct, measurable impact on the bottom line. Electronic pay costs only 10 percent of the average cost of processing and distributing paper paychecks. The cost savings of having all employees use electronic pay is significant and provides added productivity as well as increased employee satisfaction. Electronic payroll also helps companies mitigate fraudulent activity that can occur when using paper paychecks. Despite the many benefits of electronic payroll delivery many franchisees approach to payroll has changed little over the years.

Employer Paycard Advantages

Employers will immediately eliminate the reoccurring costs associated with buying traditional paper paycheck stock with security features. Employers will also enjoy cost savings from decreased toner cartridge usage for their paycheck printers as well as significant decreases in wasted management time delivering paychecks or postage and overnight delivery charges for sending paychecks to employees at multiple work sites.

Other advantages of paycard deployment and use for employers include:

- Reduce payroll distribution costs by as much as 90%

- the reduction or elimination of bank service fees and account reconciliation costs, as well as stop payment fees for lost/stolen paychecks

- initiating final wage payments to terminating workers via a paycard in lieu of having to physically provide a final paper paycheck to them in person or via overnight delivery

- the elimination of escheatment liability for the employer in many cases, as it will be passed on to the financial institution that actually holds the employee's funds

- by decreasing the total number of paper paychecks having to be produced and sent out by the organization to pay employees their wages, employers can significantly minimize their exposure to paycheck fraud

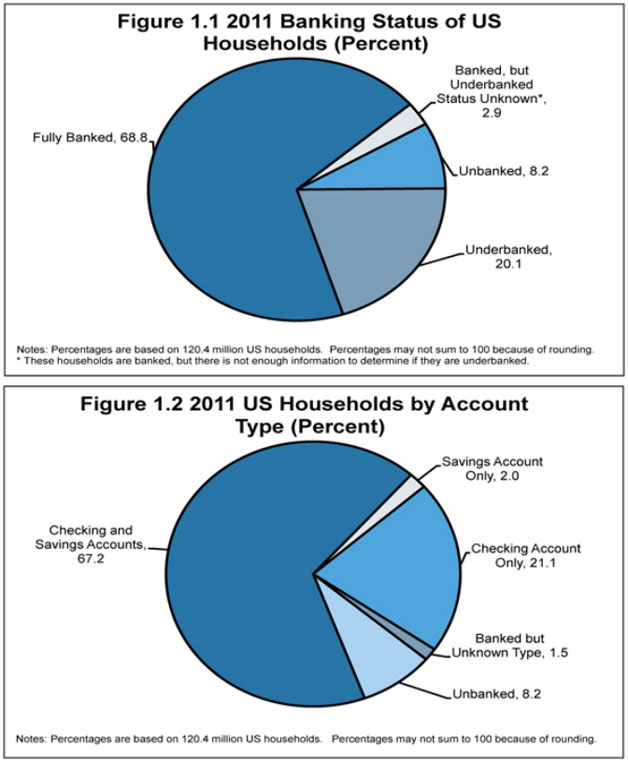

In a perfect payroll world, all employees within an organization would have their own bank accounts, and would elect to receive their pay via direct deposit. However, the reality is that not every employee has a bank account or can easily open one for a variety of reasons. If you are a franchisee in the hospitality, restaurant, retail, or transportation sectors of our economy, a greater portion of your workforce is likely to be part of the FDIC's estimated 17 million Unbanked Americans.

Source: 2011 FDIC National Survey of Unbanked and Underbanked Households

In the past, these unbanked employees presented a problem for employers that wanted to take advantage of the cost savings that can be achieved by increasing their use of the Automated Clearing House (ACH) system to initiate direct deposit transactions for their payroll disbursements. With the increased availability of paycards, employers now have a viable payment option they can use to electronically pay their unbanked workforce and achieve cost savings similar to those already realized with the use of direct deposit. In fact, both employers and their workers can share in the advantages that paycards offer.

Employee Paycard Advantages

From an employee's perspective, there are also intrinsic advantages and benefits when using a paycard offered to them by their employer instead of being paid each and every pay period via a traditional paper paycheck. With a paycard:

- employees immediately eliminate check-cashing fees that they may have historically paid to access their wages each payday

- trips to wait in line to cash paper paychecks at banks or check cashing establishments become unnecessary

- wages can be accessed via 24-hour ATM networks

- employees no longer are required to go to their worksite to pick up paychecks on days off or during vacations

- no more waiting for paychecks to arrive in the mail

- employees experience increased safety and security associated with not having to physically carry their entire pay on their person, in cash, after cashing their paycheck

- employees can now purchase goods and services at point-of-sale terminals within stores

- exposure to identity theft decreases as the likelihood of personal information on paychecks ending up in the wrong hands is eliminated when paychecks and pay statements are no longer issued to employees on paper

- employees can sometimes opt to have their employer issue a secondary card to allow family members access to wages nd

- employees help decrease the remote chance of not being paid timely due to unforeseen circumstances, such as natural disasters, that can impact the delivery of paper paychecks via air and/or ground transportation.

Since paycards were introduced thousands of companies have signed on to offer them to their employees. A paycard is simply a reloadable prepaid card that provides your company and employees with a convenient, low-cost or no-cost alternative to payroll checks. By eliminating cumbersome, paper-based payroll operations, companies automatically load employee pay directly onto paycards every payday. This can prove to be an efficient and flexible solution for employees without bank accounts, or those who prefer not to use their accounts for direct deposit. Better yet, everyone is eligible because no bank account or credit check is required.

Many unbanked employees often cash paychecks at check-cashing services where they are required to pay a fee and carry their entire paycheck in cash with them. Employees will appreciate faster access to funds, increased control over their finances, the convenience of worldwide acceptance and security enhancements that keep their funds safe.

Companies that utilize a paycard program reap the benefits of streamlined payroll processing, reduced administrative costs, increased management productivity, increased employee productivity and enhanced employee loyalty derived from providing employees a safe and convenient alternative to paper checks.

Paycards reduce payroll costs, increase efficiency and build employee loyalty all at the same time. That's how you re-invent payday and create paydays where everyone is a winner!

Matt Merriam is prepaid product specialist for WEX Inc. rapid! PayCard. He can be reached at 678-381-1733 or matt.merriam@wexinc.com.

Share this Feature

Recommended Reading:

Comments:

comments powered by Disqus| ADVERTISE | SPONSORED CONTENT |

FRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Growth

- Operations

- Open New Units

- Leadership

- Marketing

- Technology

- Legal

- Awards

- Rankings

- Trends

- Featured Franchise Stories

| ADVERTISE | SPONSORED CONTENT |

$150,000

$100,000

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.