Balancing Act: Slow and Steady Wins The Race

Whipsaw (verb, informal): to subject (someone or something) to two very difficult or intense and often opposite forces either simultaneously or in quick succession.

If “whipsaw” doesn’t sum up the headlines from the past couple of years, we don’t know what does. It seems almost unfathomable that, less than 24 months ago, all the rage was over SPACs, meme stocks, and cryptocurrencies, helping to drive a raucous and risk-on market throughout much of 2021.

Barely 12 months later, as 2022 dawned, both stock and bond markets crafted the worst dual declines in nearly 100 years thanks to the invasion of Ukraine, double-digit inflation as the economy shook the spiderwebs out of its supply chain, and a sharp set of interest rate hikes that moved short rates from near zero to near 5% in less than a year.

Then 2023 emerged with a bit more optimism. As of this writing, tech stocks are sporting triple-digit gains from their recent bottoms, the S&P 500 has crossed back into bull market territory, and anything related to artificial intelligence is carrying on so exuberantly that it brings back memories of the dot.com era.

The long view

As headlines vacillate wildly from bullish to bearish and back again, what is a long-term investor to do? First, admit to yourself that market timing doesn’t work over the long term. Numerous studies show that those who trade too often fare substantially worse than if they had stayed put. Transaction fees, taxes, and the need to be right about both selling and buying at the right time get in the way of success. Even prognosticators who have been at this for decades are seldom right consistently. Many would-be soothsayers will admit that markets are unpredictable because they move up and down in response to the aggregate of human decisions.

The time may never “feel” right to get started. My career started in the early 1980s, and the one constant is that every year there have been dire headlines that would have prevented one from wanting to invest. Yet, the Dow Jones Industrial Average has grown from just above 1,000 back then to its current level, now approaching 35,000 as of mid-July. We frequently see new investors stay on the sidelines waiting for that “perfect” time to step in, when everything “feels” comfortable—only to realize that they’ve missed a sharp uptick and then try to wait for some pullback to get in. When the pullback comes, however, it still feels too scary, so they hesitate. Rinse and repeat.

Finding your comfort level

There are many ways to step in carefully and programmatically to ease this tendency to freeze. First, develop a long-term target based on what “fully invested and diversified in a normal market” looks like. Then, buy an initial slice of each asset category, setting calendar targets to invest consistent amounts on a regular basis (dollar-cost averaging). This simple programmatic approach can help take the emotion out of it. Better yet, once your comfort level with how your portfolio responds and behaves takes hold, you can always accelerate if particular markets correct, or delay if they become too frothy. It’s amazing what putting some guardrails around your plan can do to ensure that you are able to participate in what Einstein reportedly called the greatest invention: the value of compounding.

As you are setting your mental expectations, it is important to remember that the financial media do not exist to make you feel comfortable about your portfolio. In much the same way that health magazines in January each year don’t make us confident in our skin, weight, workout regimen, or hair thickness, the financial media is there to gather eyes and ears, not necessarily to reassure us.

Final thoughts

As you develop and implement your plan, focus on the factors you have some control over. For example, opting for low-cost mutual funds, ETFs, or trades; limiting taxable turnover; ensuring you are diversified by asset type, geography, and style; and ensuring that any funds you will need to cover expenses in the next two to three years are put at risk in markets. Taking these steps can help you craft a plan that will aid your ability to withstand potentially being whipsawed down the road.

Carol Schleif is chief investment officer at BMO Family Office, a wealth management advisory firm delivering investment management services, trust, deposit, and loan products and services through BMO Harris Bank. To learn more, visit www.bmofamilyoffice.com.

Share this Feature

Recommended Reading:

Comments:

comments powered by Disqus| ADVERTISE | SPONSORED CONTENT |

FRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Growth

- Operations

- Open New Units

- Leadership

- Marketing

- Technology

- Legal

- Awards

- Rankings

- Trends

- Featured Franchise Stories

FEATURED IN

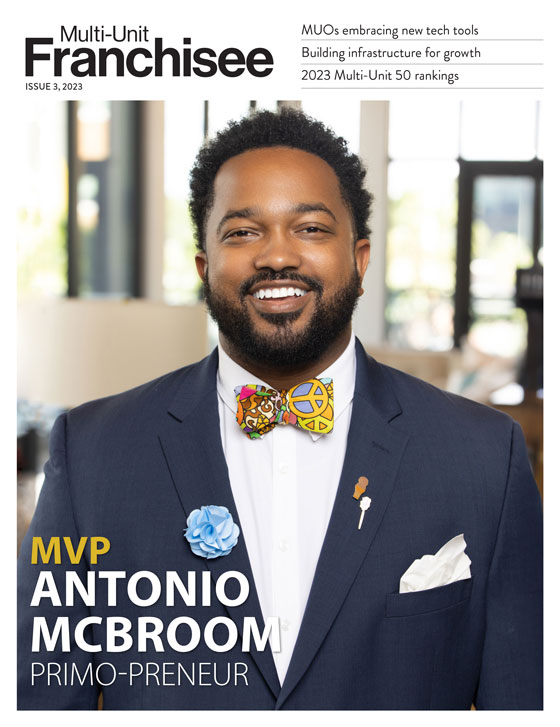

Multi-Unit Franchisee Magazine: Issue 3, 2023

| ADVERTISE | SPONSORED CONTENT |

$100,000

$2,000,000

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.