Economic Obstacles

Despite the economy, it's been a good time to be a multi-unit operator

Multi-unit franchise operators are about to exceed the 55 mph speed limit (or in this case, the 55% limit). We can now officially say that they control 55% of all franchised units in the U.S. The 80/20 rule also applies now to franchising. Those 55% of all franchised units in the U.S. are controlled by 20 percent of all franchise unit operators. Both are records.

The steady expansion of multi-unit dominance got started in the late 1980s so it is relatively recent in the context of the franchise business model. As recently as eight years ago there were more units controlled by single unit operators. The pace of change has been consistent and rather predictable with a current rate of change of about one percent each year. There are two big drivers of this change. The first driver is that we raised a generation of franchisees with growth on their minds. They pushed through the older "buy a job" mentality with business plans aimed at multi-unit expansion from the time they started in business. The other driver is cooperative franchisors that went from being concerned by too much franchisee power to actively designing development programs around multi-unit models.

Some of the largest franchisees include:

- NPC INTERNATIONAL INC: 1,158 units, most of them are Pizza Hut restaurants

- TARGET CORPORATION: 1,147 units, most of them are Pizza Hut express locations

- HEARTLAND AUTOMOTIVE SVC INC: 529 units, most of them are Jiffy Lube businesses

- HARMAN MANAGEMENT CORP: 466 units, most of them are with QSR brands

Reflecting the four franchisees noted above, industries with the highest concentrations of multi-unit franchisees are in food. As the table below shows, over 82 percent of franchised QSR businesses are controlled by multi-unit franchisees followed by restaurants (sit-down) at 77 percent and baked goods at 72 percent. Also of note is the rise up the industry concentrations for some non-food industry classifications, such as business-related, automotive, real estate, clothing retail, and education-related.

On the other end of the spectrum, less than 5 percent of franchised travel businesses are controlled by multi-unit franchisees, followed by computer products and services (5.7%) and photographic products and services (8.5%). Perhaps the most important point to note is that multi-unit franchising has penetrated all industries where the franchise business model is found.

There are some interesting geographic distinctions as well, creating a sort of north-south divide. There are only four states in which the majority of units are actually in the hands of single unit franchisees - Maryland (51%), Vermont (52%), New Jersey (56%) and Montana (57%).

At 64 percent, West Virginia has the highest concentration of units controlled by multi-unit franchisees. All other states with high concentrations of units in the hands of multi-unit franchisees are southern states including: Arkansas, Mississippi, Kentucky, and Alabama with 62 percent each.

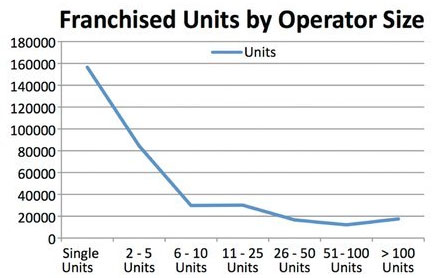

Here are some more statistics that shed light on the profile of multi-unit operators. Based on a large sampling of franchised businesses for which gender information was available, 28 percent were women-owned. Almost exactly 40 percent of women-owned franchised businesses are controlled by multi-unit franchisees. Of the close to 40,000 multi-unit franchisees, 7 percent or about 2,700, operate units across several brands. While that doesn't seem like a high percentage, it is growing quickly. The distribution of units controlled by multi-unit operators is shown below.

Finally, of the roughly 450,000 total business format franchised units in the U.S., about 360,000 of them are represented in the following graph, the underlying data of which was drawn from our contact list database. Compared to similar graphs from a few years ago, it shows that not only do we have a growing concentration of units controlled by multi-unit operators, we have a growing concentration of units controlled by larger multi-unit operators.

Across all units, the average multi-unit franchisee owns 5 franchised locations, up from about 3.5 in 2007. This obvious skewing is the result of larger franchisees gaining in size at a faster relative clip than single unit and small multi-unit operators are adding units. The economy has been bad for most companies but it has greatly assisted this concentration trend. In the 2008 - 2010 period, many single unit operators either sold to larger operators or closed because of sales and financing pressures. While the sales levels have improved somewhat, in the past two years lenders have concentrated their lending at the lower end of the business risk spectrum, which, of course, is represented by none other than multi-unit operators. Despite all the economic obstacles, it's been a good time to be a multi-unit operator.

Share this Feature

Recommended Reading:

FRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Franchise Growth

- Franchise Operations

- Open New Units

- Franchise Leadership

- Franchise Marketing

- Technology

- Franchise Law

- Franchise Awards

- Franchise Rankings

- Franchise Trends

- Franchise Development

- Featured Franchise Stories

FEATURED IN

Multi-Unit Franchisee Magazine: Issue 3, 2013

$87,325

$220,000

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.