Franchising Health: FRANdata Reports on the State of Franchised Health Brands

Little has changed in health-related brands since last year's report. FRANdata still tracks 11 sectors across four industries: child-related, health and fitness, QSR, and retail food. The vast majority of brands aim at helping shed excess pounds, treating weary bodies through massages, or on handling the decline of physical abilities through home healthcare; only a minority focus on what goes into our bodies by trying to influence what we eat.

At the end of 2011, the latest year with complete data, more than 400 health-related brands operated about 33,000 franchised businesses. Fifty-three operated at least 100 franchised locations and controlled 28,665 units, 86 percent of the total. Only 15 percent of health-related brands started offering franchises before 2001. The oldest brands have roots in the 1960s, e.g., Gold's Gym (fitness centers) and Interim Healthcare (home healthcare).

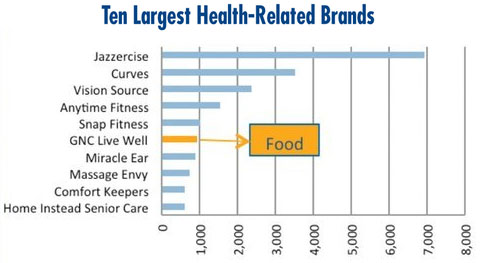

As of 2011, the 10 largest brands this industry were dominated by fitness concepts such as Jazzercise and Curves. Since it peaked at 7,885 franchised units in 2005, Curves has continuously lost units at an average annual rate of 12%; as of 2011, it was down to 3,523.

Only GNC operates in the food-related segment (some may argue whether brands of this type are strictly in food as GNC focuses on supplements, not healthy meals). With 924 franchised businesses, GNC is also the only food brand in this segment that operates close to 1,000 franchised locations. The next largest concept in food is Smoothie King, with 532 franchised businesses. In fact, the only food brands that have managed to gain scale are dietary supplement outfits such as GNC or Complete Nutrition. However, of the 10 largest food brands in the health-related sector, 8 are smoothie concepts, and Smoothie King and Jamba Juice have blazed the trail.

More recent developments affecting health food concepts include changing demands and new regulations. In anticipation of consumer demand and possible federal regulations, regular restaurant chains not known for a specific focus on health have started adding more nutritious choices to their menus. For example, Sbarro now offers a "skinny slice," with a different mix of cheese and more vegetables at 270 calories.

This may have interesting implications for food brands with an exclusive "health" focus. So far they have not managed to gain a significantly higher market share in the health space. However, as their less healthy cousins in QSR discover opportunities through providing healthy options, they may add to consumer choice and thus increase the overall share of healthy eating choices in the coming years. If and how smaller and less well-known health food brands will rise with the tide will be an interesting trend to observe.

Source: FRANdata, "Franchising in the Health Industry: A Report on the Growth in Franchised Health Brands," February 2013.

Share this Feature

Recommended Reading:

FRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Franchise Growth

- Franchise Operations

- Open New Units

- Franchise Leadership

- Franchise Marketing

- Technology

- Franchise Law

- Franchise Awards

- Franchise Rankings

- Franchise Trends

- Franchise Development

- Featured Franchise Stories

FEATURED IN

Multi-Unit Franchisee Magazine: Issue 2, 2013

$100,000

$225,000

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.