Franchise Topics

Browse several key topics for the franchise industry on the worlds largest content network.RECENT HEADLINES

April 26th, 2024

|

Does $2.2 million systemwide average annual unit volume (AUV) in an 8-hour operating day get your attention? How about flexible real estate options including conversions of second generation restaurant spaces?

|

The franchisee group will immediately acquire 6 restaurants in Oregon

- M. Scott Morris

- 810 Reads 2 Shares

The agreement calls for 30 units with the first slated to open in early 2025

- M. Scott Morris

- 664 Reads 1 Shares

Bill Edwards' biweekly newsletter rounds up international franchise news, stats, trends, and more from a worldwide network of correspondents

- Eddy Goldberg

- 762 Reads

Board members support franchise education through mentorship, internships,

- M. Scott Morris

- 667 Reads 1 Shares

Our February roundup of international franchise news travels to Canada, India, Israel, Italy, Japan, Mexico, the Netherlands, South Korea, Southeast Asia, Spain, and the U.S.

- Eddy Goldberg

- 636 Reads

How to maintain consistency in employee training, culture, and service quality across different locations

- Eddy Goldberg

- 947 Reads

Mixed news this month for commercial real estate, vacant office buildings still a challenge, technology to the rescue, and more.

- Eddy Goldberg

- 739 Reads

Explore Kris McDonald's journey in franchising, highlighting the pivotal role of mentoring female leaders, breaking barriers along the way

- Franchise Update Media

- 769 Reads 10 Shares

Explore Malorie Maddox's journey in franchising, highlighting the pivotal role of mentoring female leaders, breaking barriers along the way

- Franchise Update Media

- 737 Reads

Resale events with community organizations build goodwill while letting people sample the product.

- M. Scott Morris

- 1,000 Reads 3 Shares

The disconnect between the country's financial mood and personal economic reality perplexes experts

- Carol M. Schleif

- 1,119 Reads

Presidential election years typically result in a CRE slowdown, but is that warranted? There be bargains out there!

- Jason Fefer

- 1,050 Reads 2 Shares

Before signing or renewing a lease, learn these "Do's" and "Don'ts" to get the best deal

- Jonathan Keyser

- 940 Reads 1 Shares

Building a business that lasts demands navigating complex issues with finesse

- Kendall Rawls

- 1,151 Reads

The way to a customer's heart is through their email inbox, though that is changing. See how.

- Annie Oeth

- 1,331 Reads 3 Shares

In addition to Long Island, locations are planned for the Hamptons, Montauk, and Queens areas

- 913 Reads 1 Shares

Spending on services and experiences expected to rise as consumers continue to shift their spending habits in 2024

- Annie Oeth

- 993 Reads

Locations are scheduled for the California cities of San Joaquin, Danville, Stockton, and Modesto

- M. Scott Morris

- 907 Reads

The Franchise Customer Experience Conference (FCXC) returns to Atlanta June 17-20 for the annual gathering of franchise marketing pros

- Annie Oeth & Eddy Goldberg

- 949 Reads

Customer service expert John Tschohl outlines 6 foundational steps franchisees can take to deliver great customer service

- John Tschohl

- 1,059 Reads 2 Shares

Consumers expressed confidence in the job market, nonessential spending, and their ability to make ends meet

- M. Scott Morris

- 994 Reads

Explore Amanda Kahalehoe's journey in franchising, highlighting the pivotal role of mentoring female leaders, breaking barriers along the way

- Franchise Update Media

- 1,091 Reads 1 Shares

Explore Abby Fogel's journey in franchising, highlighting the pivotal role of mentoring female leaders, breaking barriers along the way

- Franchise Update Media

- 1,082 Reads 23 Shares

Planning for the business and personal aspects of the transaction is key to a smooth sales process.

- Carty Davis

- 1,152 Reads 1 Shares

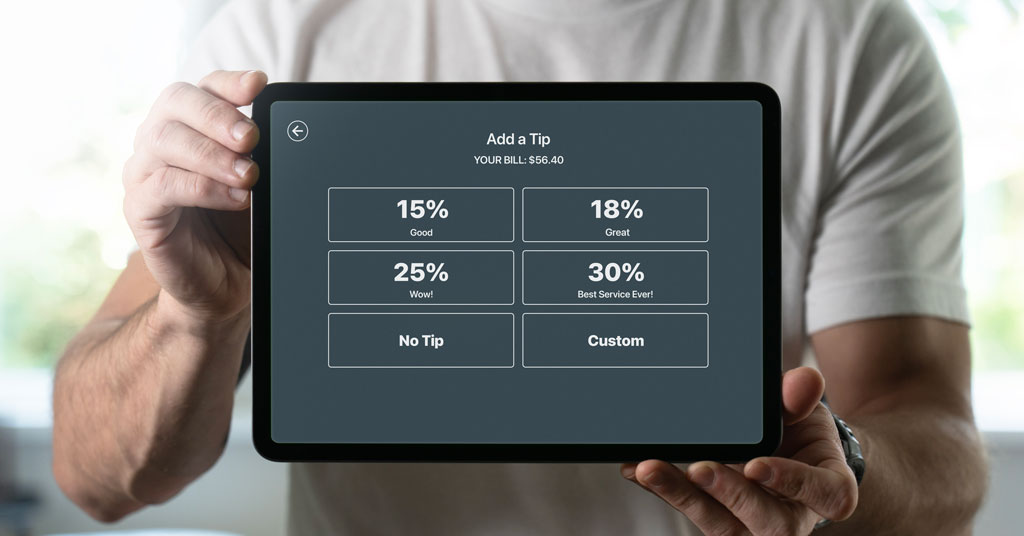

Companies can be sued for tipping violations even if the owners don't know they're breaking the law.

- Mary Lou Atkins

- 1,823 Reads 21 Shares

Service brand deal growth keeps up as Q2 2024 kicks off

- Eddy Goldberg

- 1,094 Reads

Buona and The Original Rainbow Cone Ice Cream Shop will be making their Texas debuts

- M. Scott Morris

- 1,171 Reads 1 Shares

Two Bach to Rock franchisees have grown their business by focusing on doing well to do good. Learn how they've done it!

- Franchise Update Media

- 1,184 Reads 4 Shares

Make sure you are training your employees on soft skills

- John DiJulius

- 1,355 Reads 2 Shares

New report reveals restaurants are turning to more tech to offer guests more control and convenience

- Kerry Pipes

- 920 Reads

| Page 1 of 241 | ^ Return to Top | 1 2345Next |

The franchise opportunities listed above are not related to or endorsed by Franchising.com or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The franchise opportunities listed above are not related to or endorsed by Franchising.com or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.