Silver Linings Seen for Franchise Sales in FranConnect's Q3 2020 Report

This is the fifth article in a series on franchise sales by the numbers throughout the pandemic, and is a preview of the latest findings from FranConnect’s ongoing study of franchise sales insights coming out of its September 2020 Franchise Sales Index Report. The information presented here is based on the data from 607 franchise brands that has been aggregated and anonymized in the hopes of helping you evolve as the franchise market is evolving.

Editor’s note: The first article is available here, the second here, the third here, and the fourth here.

In recent articles running here, I asserted that, based on Q2 trends, it appeared there were changes occurring in buying behaviors that were being highly influenced by trust and transparency that manifested in referrals. And after another quarter, it is clearly becoming one of the single most important changes required to drive sales.

Leads down, deals up

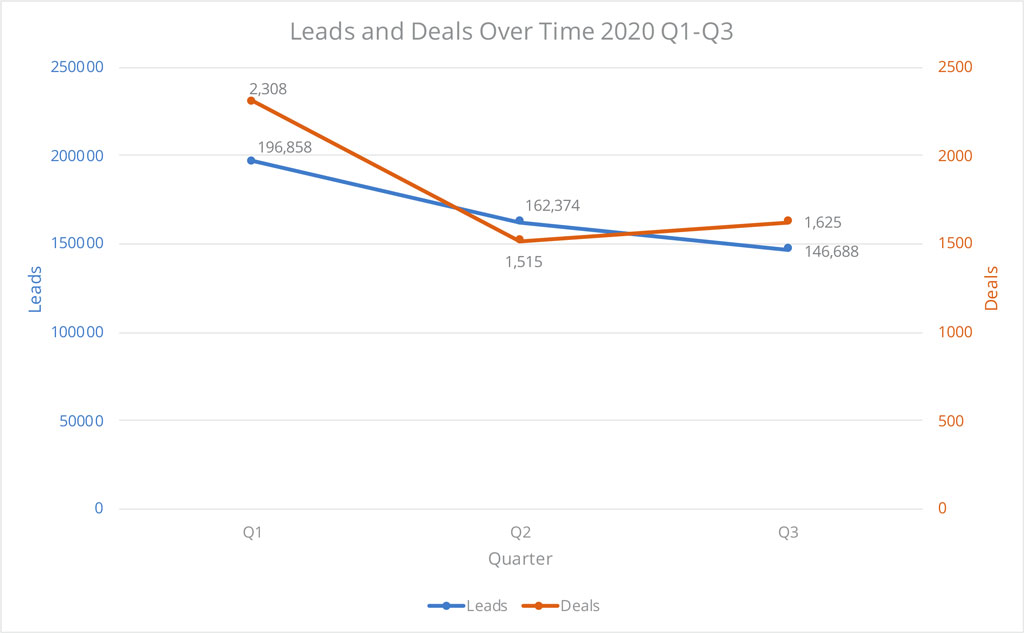

The bad news is that the first of our data insights shows that leads continued their decline from their peak in Q1, falling from 196,858 to 146,688 in Q3, a decline of 25.4%.

The greatest declines occurred in Personal Services, down by 36%, and in Retail Food, down by 13% in Q3. Conversely, when looking at the change quarter to quarter, Commercial & Residential Services rose by 6% and QSR by 4%. One vertical, Business Services, is seeing more leads than pre-pandemic. The factors here appear to align in favor of essential vs. non-essential businesses.

Where we find the good news is that deals actually increased in Q3 to 1,625m from 1,515 in Q2. This represents an increase in deals of 21% – despite a decline of leads of 10% within the same quarter. For those still leery about asking for a sale during the pandemic, be aware that just within the FranConnect system we have seen 3,140 sales accomplished in the past 6 months.

These numbers reflect improvements in conversion rates, which increased from 0.9% in Q2 to 1.1% in Q3, which is higher overall than our data showed in 2019 when conversions were running at 1.02%.

Greater sales efficiencies realized

Deal conversion rates increased in every franchise industry sector except Retail Products & Services, which saw a significant spike in both Q1 and Q2, but slipped to 1.5% in Q3 (still trending above the overall average of 1.1%).

When analyzing the data by market segment, we found that based on size – ranging from Micro-Emerging (10 or fewer locations), Emerging (11 to 75 locations), Mid-Market (76 to 100 locations) and Enterprise (200+ locations) – every segment had greater lead-to-deal conversion rates in Q3 than in Q2.

My belief is that although we are seeing a decline in total leads, those we are getting are of a higher caliber, coupled with economic motivating factors such as unemployment rates of 7.9% (BLS, September).

Trust and transparency have become the biggest driver of leads and sales

Deals in Q3 attributable to franchise referral consultants (brokers) actually exceeded the number of such deals in Q1, before the pandemic fully struck. We also found that non-broker referrals (friends, family) increased in both Q2 and Q3, as did deals attributed to franchisor websites.

Now, more than ever, the value of trusted lead sources has risen as prospective franchise buyers consider an entry into franchising. And, it appears from the data, trust in (or at least reliance on) franchise referral consultants also has grown as prospects seek expert advice during these uncertain times. During the pandemic, franchise referral consultants have exceeded the number of leads and deals they have generated compared with their pre-pandemic numbers.

My conclusion is that this is a function of two current trends: 1) buyers’ reliance on trusted friends, family, and advisors; and 2) a move toward a “self-service” buying process in which prospects are turning to brands that can be researched without having to engage directly with the sales staff until they have narrowed their search to a select few. There is ample evidence that buyers are turning to portals, online news, industry news, and franchise websites where such information is readily available.

Referrals

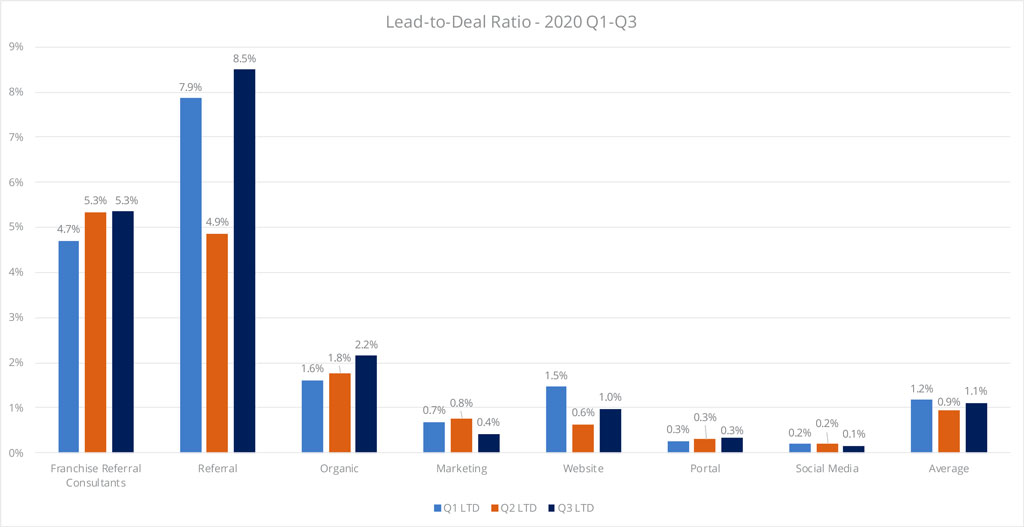

As you’ll see in the next chart, the conversion rates for referral sources in Q3 speak for themselves:

- Referrals converted at a rate of 8.5%

- Franchise referral consultants (brokers) converted at a rate of 5.3%

These are dramatically superior lead-to-deal rates than the average of all lead sources at 1.1%, and are performing better than before the pandemic.

When analyzing the performance of referrals – the top source for lead-to-deal conversions – we aren’t finding enough franchisors calling on their franchisees and asking them for their support in promoting the brand. More are taking the path of least resistance, which is offering them referral fees. I actually spoke with a franchisor this week who is increasing the amount that they will pay a franchisee for making a referral that becomes a sale – an unprecedented payout of $30,000. As this should be something that is reported in the FDD, it will likely have the opposite effect on a prospective buyer who will likely conclude that the individual referring has too much of a vested interest in making the sale, which will erode trust.

Additional insights and best practices for achieving referrals

• 65% of new business comes from referrals from friends or family

• Referred leads (non-brokers) have a 30% higher conversion rate than contacts acquired by other marketing means

• Businesses with referral programs in place experience an average of 69% faster time to close

My recommendation to franchisors is to recognize that when the marketing department manages a referral program, their companies have a 3x greater chance to achieve their revenue goals. Yet only 10% assign referral campaign management to the marketing department

Ask your franchisees for a testimonial

Now is the time to ask your franchisees to provide a testimonial. Why are testimonials so effective? They build trust, they aren’t sales-y, and they overcome skepticism.

You can easily assemble a collection of videos from your franchisees for use on your websites and through campaigning through email and video campaigns. If you’re not doing this, you are missing one of the most important sales strategies. Simply asking your franchisees to take out their cellphones and hit the record button is all it takes. You can also have them start a Zoom meeting and hit record. It couldn’t be easier. Consider these guiding questions:

- What issues were you facing before you became a franchisee?

- What hesitations did you have before becoming a franchisee?

- Can you share your experience after becoming a franchisee?

- If you had it to do over again, would you buy our franchise again?

Once the testimonial video is recorded, it can be uploaded on a transfer site such as WeTransfer or Dropbox. It’s really quite easy to accomplish, and before you know it you’ll have dozens to incorporate into your email and text nurturing campaigning and for adding to your website.

The top lead generation providers from Q3

Franchise lead referral consultants (brokers). These top 4 performers represent an average 5.3% closing effectiveness rate, 60% of leads from all brokers sources, and 65% of all broker deals:

|

Consultant/Broker |

Leads |

Deals |

|---|---|---|

|

FranChoice |

21% |

28% |

|

FranNet |

10% |

14% |

|

IFPG |

14% |

13% |

|

FranServe |

15% |

10% |

Franchise portals. The top 5 performers represented 68% of all leads and 69% of sales:

|

Portal |

Leads |

Deals |

|---|---|---|

|

BizBuySell |

5,709 (13.4%) |

37 (26.4%) |

|

Franchise Gator |

4,421 (10.4%) |

16 (11.4%) |

|

Franchise Help |

7,890 (18.5%) |

15 (10.7%) |

|

Franchise Opportunities Network |

7,258 (17.0%) |

15 (10.7%) |

|

Franchise Direct |

3,785 (8.9%) |

13 (9.3%) |

Conclusion

We are seeing rays of light on the horizon as more franchisors report improvements in the quality of leads, the ease in which they are able to engage with their prospects, and the reengagement of leads previously moved to a “dead lead” status through lead nurturing campaigns.

Finally, consider the wisdom of Jim Rohn, who said, “Successful people do what unsuccessful people are not willing to do. Don’t wish it were easier; wish you were better.”

Keith Gerson is President of Franchise Operations at FranConnect, a recognized leader in franchise management software. For the past decade, he has worked closely with executive boards and leadership teams that are part of the company’s portfolio of more than 800 brands and 150,000 locations, with a focus on helping franchisors achieve their desired goals in sales, operations, and marketing. For more information, best practices, and guides, visit the company’s Resources Page.

Share this Feature

Recommended Reading:

| ADVERTISE | SPONSORED CONTENT |

FRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Franchise Growth

- Franchise Operations

- Open New Units

- Franchise Leadership

- Franchise Marketing

- Technology

- Franchise Law

- Franchise Awards

- Franchise Rankings

- Franchise Trends

- Franchise Development

- Featured Franchise Stories

| ADVERTISE | SPONSORED CONTENT |

The franchise listed above are not related to or endorsed by Franchise Update or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The franchise listed above are not related to or endorsed by Franchise Update or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.