ApplePie Transforms Access To Capital For Franchisors

Securing financing for a franchise business should be quick and easy, with access to multiple options that meet a franchisee’s specific needs. Unfortunately, this is often not the case in today’s fragmented franchise finance landscape where one-size-fits-all solutions are all too common.

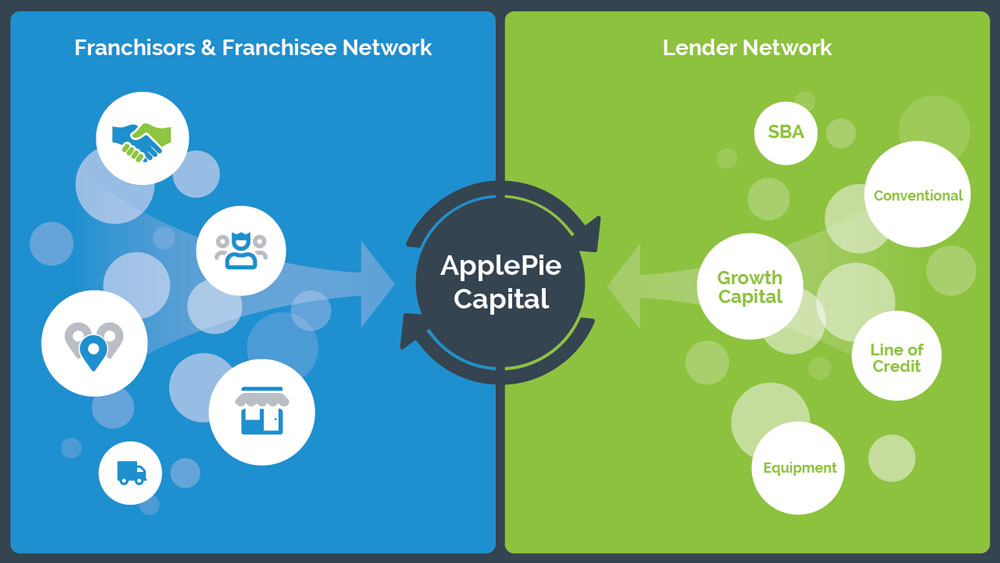

ApplePie Capital is changing the face of franchise finance with an approach that streamlines the financing process with modern technology, offers true product choice, and helps accelerate the growth of high-quality brands and their franchisees.

As the first and only online lender solely dedicated to franchising, ApplePie cuts through the chaos of dealing with multiple lenders. The San Francisco-based firm works closely with franchise brands and a diverse network of lending partners to provide a one-stop, simplified lending experience.

“We have built our business from the ground up to specifically address the needs of franchising,” says Denise Thomas, founder and chief executive officer of ApplePie Capital. “We provide franchisors with a wide range of efficient financing options for their franchisees, including our own proprietary loan product, which was designed to help open new locations faster than they could with a typical bank.”

ApplePie provides unmatched value as a consultative ally and capital markets advisor for franchisors. “Franchisors no longer have to waste time interfacing with and educating multiple lenders about their brand and their performance metrics,” says Thomas. “ApplePie takes care of that for them so they can focus on more important things.”

In addition, with ApplePie, franchise prospects no longer have to knock on multiple doors to find a financial partner. After completing a single online application, qualified borrowers have access to a wide range of funding options – saving time and money without jumping through the typical hoops to find the capital they need. “We’ve unified, standardized, and simplified the borrower experience,” says Thomas. “It’s completely digital, which our borrowers love, and is pretty unique in this space.”

“No single source may be able to provide all of the capital needed over a franchisee’s entire life cycle and oftentimes, a lender will get over-concentrated in a single brand and need to turn away otherwise qualified franchisees,” notes Thomas. “By maintaining a deep and diverse network of capital providers, ApplePie eliminates those constraints. We can access capital from across the network to fulfill all of the capital demand from a single franchisee or franchise brand. We ensure they have the liquidity they need to keep growing.”

ApplePie creates custom lending programs for each brand tailored to meet the full spectrum of financing needs for their franchisees, focused on future growth from the start. The company funds loans across the United States, ranging from a $10,000 equipment loan to a $20 million multi-unit acquisition and refinance.

In addition, for long-term brand partners, ApplePie prequalifies franchisee candidates and then creates unparalleled transparency into the brand’s new unit development pipeline with an online portal that provides real-time access to ApplePie’s CRM. Franchisors can quickly access the loan status of each franchisee and can provide updates that are posted directly to their CRM, where their originations team can access them.

ApplePie has already surpassed $400 million in loans originated since their official launch in 2015, and have secured an additional $500 million in committed capital from investors for new loans in the next few years.

Ready to meet your goals with a fresh, new approach to franchise finance?

Ready to meet your goals with a fresh, new approach to franchise finance?

Submit your inquiry online today at applepiecapital.com/getstarted or contact us at 1-844-734-GROW to schedule a free consultation to discuss your franchise growth plans. Together, we’ll plant the seeds for your success. Easy as ApplePie.

SPONSORED BY:

ApplePie Capital

ApplePie Capital provides a fresh new approach to franchise financing that is focused on your growth and success. Learn More

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.