Franchise Recruitment Website Insights: The Good, Bad, and the Ugly

This is the fourth article in a series on how Covid-19 has affected franchise sales and buyer behavior through the first half of 2020. Our study resulted in data-driven insights from 607 brands representing every market, industry, and size from January 1 through June 30, 2020 and it’s revealed some very interesting calls to action. The first article is available here, the second here, and the third here.

In this article, we examine how the pandemic, unemployment, civil unrest, and a struggling economy have affected lead generation and deals attributed to franchise recruitment websites.

Marketing decisions have affected website sales performance

In the first quarter, website leads were the #2 top source of leads, representing 27% of the total. While maintaining its #2 position in Q2, websites represented a decline in leads of 29% attributed to the Covid-19 virus.

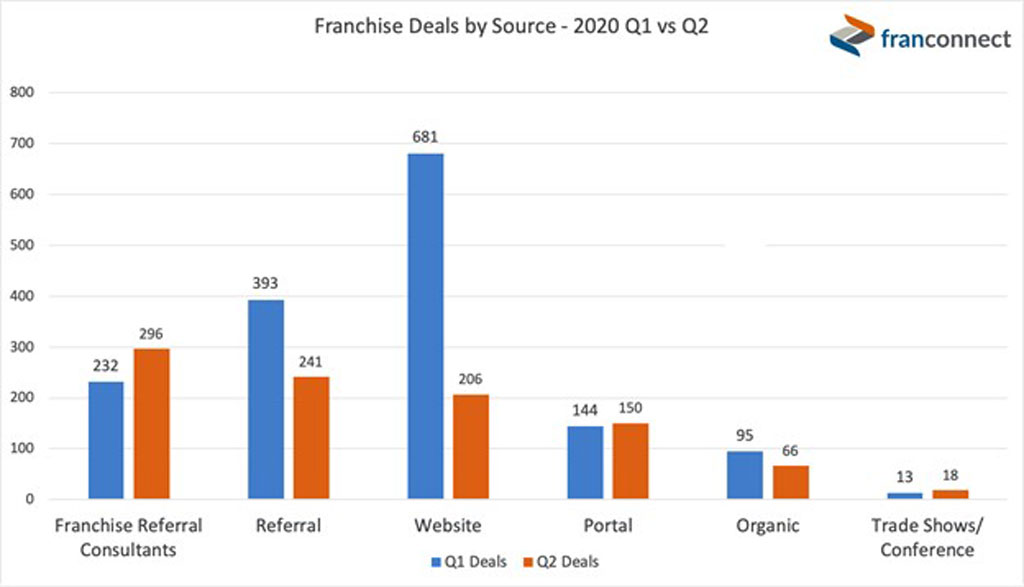

One would expect this decline would likely result in a relative decline in the number of accomplished deals, but this was not the case. In Q1 2020, websites were the #1 source of deals at 681 transactions, representing 31% of all sales. Unfortunately, during Q2, websites dropped to 206 deals, a dramatic decline of 64%, representing just 14.7% of all deals in the quarter. The two lead sources that rose to the #1 and #2 sources of deals were franchise referral consultants (brokers), followed by referrals.

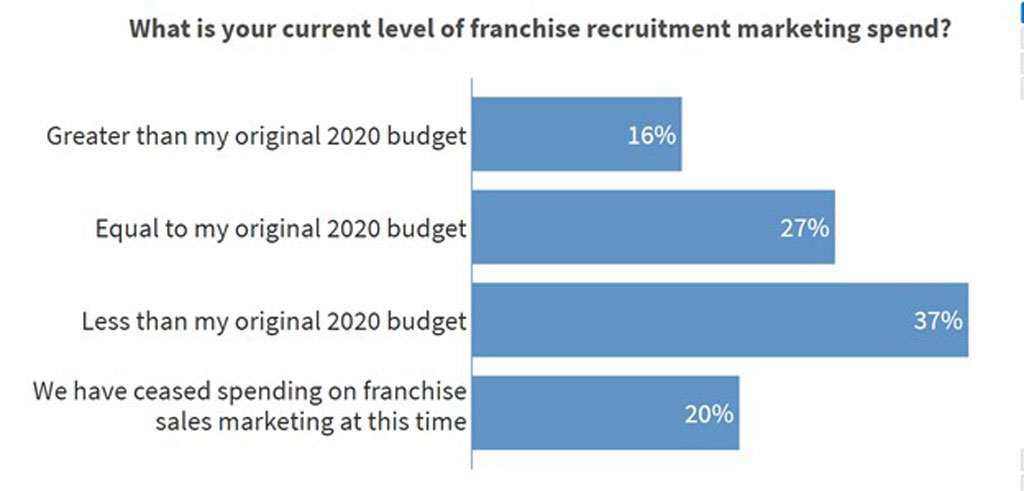

This is likely a result of reductions in marketing spend, which according to a live poll of 227 franchisors we conducted during Q2, was substantially reduced. We found that 37% of respondents indicated that their then-current level of franchise recruitment marketing spend was less than their original 2020 budget, while another 20% indicated that they had ceased all spending on franchise sales marketing at that point in time.

Website lead generation favors venerable brands

Buyers more and more are turning to trusted sources for unbiased recommendations and referrals, which is why franchise referral consultants and organic referrals are surging.

The fact that website leads were down 29% while deals were down 64% is obvious when you see that lead-to-deal conversion rates fell from 1.5% to only 0.6%. Compare this with the franchise referral consultant lead-to-deal conversion rate of 5.3% in Q2, and with referrals at 4.9%. Even organic inbound marketing at 1.8% and paid advertising at 0.8% outperformed websites, giving further credence to the direct correlation between marketing spend and website performance.

Trust that a brand is stable and venerable may be a factor when we see that there were far fewer declines in the number of leads generated quarter to quarter for brands with 200 or more locations – plus the possibility that larger brands were spending at higher levels than other segments. In fact, website leads increased as a percentage of total leads by segment. jumping from 53.6% of leads to 65% of leads, primarily at the expense of mid-market brands with 76 to 200 locations. Mid-market brands saw website leads fall by 60% and decreasing from 31% of leads distributed to segments to just 18%.

Covid-19–affected industries also declined the most in website sales

When filtering deals by industry, we see that the businesses hardest hit by the pandemic and forced to close locations had the greatest declines in sales. The hardest hit of these in Q2 were in the QSR and fast casual categories, where deals dropped by 91%, and in the personal services category, where deals declined by 83%.

Another eye-popping metric is that of website lead-to-deal conversion rates by vertical. The total for conversion rates dropped from 1.5% to 0.6% while only retail products & services increased from 1.8% in Q1 to an impressive 2.9% in Q2. We found that QSR and fast casual brands had the greatest declines, slipping from the highest conversion rates in Q1 (3.1%) to the lowest in Q2 (0.3%).

Timely website recommendations for the balance of 2020

With an average time from lead to deal ranging between 123 and 259 days (depending on market segment), it’s going to take at least four months to rebalance your pipeline. Q3 is showing a strong rebound in leads, and marketing budgets should return to pre-pandemic spending levels. Now is the time to invest in driving more activity to your website.

Ensuring that your content is fresh has become more important than ever to place high on Google, and your SEO requires you to keep your content current and relevant, according to Lorne Fisher, CEO of Fish Consulting. After all, given the extent of today’s unemployment, qualified buyers are looking for new opportunities, and seeing evidence will certainly increase potential buyers’ interest and trust.

Fisher reported that his firm’s franchise clients are encountering more media sources interested in knowing how their businesses performed during the pandemic – and so are your franchise prospects! Clearly, your website needs to reflect the changes you have made in your operations to perform well and show how you have supported your franchisees during the pandemic. Those who have are those who are winning at this time.

Keith Gerson is President of Franchise Operations at FranConnect, a recognized leader in franchise management software. For the past decade, he has worked closely with executive boards and leadership teams that are part of the company’s portfolio of more than 800 brands and 150,000 locations, with a focus on helping franchisors achieve their desired goals in sales, operations, and marketing. For more information, best practices, and guides, visit the company’s Resources Page.

Share this Feature

Recommended Reading:

| ADVERTISE | SPONSORED CONTENT |

FRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Franchise Growth

- Franchise Operations

- Open New Units

- Franchise Leadership

- Franchise Marketing

- Technology

- Franchise Law

- Franchise Awards

- Franchise Rankings

- Franchise Trends

- Franchise Development

- Featured Franchise Stories

| ADVERTISE | SPONSORED CONTENT |

The franchise listed above are not related to or endorsed by Franchise Update or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The franchise listed above are not related to or endorsed by Franchise Update or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.