2017 AFDR Highlights: Franchisors Exceeding Their Goals

This is the eighth in a series of highlights from the 2017 Annual Franchise Development Report (AFDR). The 2017 AFDR, unveiled last September at the Franchise Leadership & Development Conference, is based on responses from 167 franchisors representing 60,989 units (51,789 franchised and 9,200 company-owned).

Participants in the survey consisted of franchisors that completed an extensive online questionnaire. Responses were aggregated and analyzed to produce a detailed look into the recruitment and development practices, budgets, and strategies of a wide cross-section of franchisors. The data and accompanying commentary and analysis provide the basis of the 2017 AFDR. (Ordering information is below.)

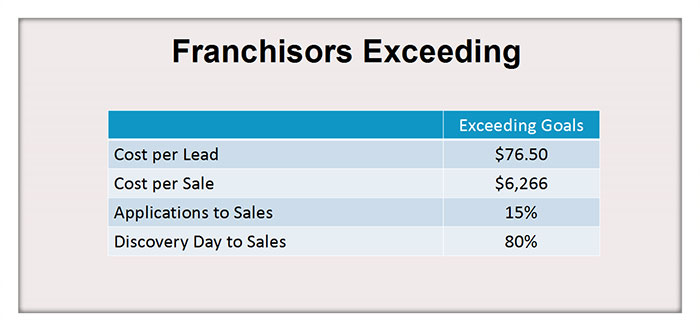

Franchisors exceeding goals

Several clear trends were apparent among brands that exceeded their goals in 2016. Their cost per lead, at $76.50, was significantly lower than the average cost per lead of $109 reported by all respondents. Cost per sale, at $6,266, also was much lower than the average of $7,558. This would indicate that the franchisors exceeding their goals are much more efficient in their recruitment spending.

Interestingly, the “exceeders” had a lower applications-to-sales ratio than the entire survey group (15 percent, compared with 20 percent). However, the discovery day-to-sales ratio of 80 percent for those who exceeded their goals was much higher than the average of 63 percent for the entire group. This could indicate that the most successful brands weed out non-viable candidates earlier in the process, rejecting more applicants before they get to discovery day.

Looking at money as a factor, 57 percent of those with an investment per unit above $250,000 exceeded their goals, compared with 71 percent the year before. There seems to be increasing evidence building that although lower-cost concepts are easier to afford for those starting out in franchising, the food sector is overcrowded and the big action is coming at the higher end, driven by ever-larger multi-unit operators. And twice as many brick-and-mortar service concepts exceeded their goals in 2016 than the year before. A comparison of the “exceeders” with last year’s respondents by industry category shows the following:

Franchisors Exceeding Goals, by Category

|

Segment |

2016 |

2015 |

|

Food |

44% |

59% |

|

Retail non-food |

9% |

11% |

|

Service (brick & mortar) |

30% |

15% |

|

Service (territory/pop.) |

9% |

11% |

|

Retail food |

9% |

4% |

Next time: How multi-unit franchisees find new brands.

Ordering Information

The complete 2017 AFDR, with analysis and benchmarks, is available for $350. For ordering information, call Sharon Wilkinson at 800-289-4232 x202, email sales@franchiseupdatemedia, or click here.

Share this Feature

Recommended Reading:

| ADVERTISE | SPONSORED CONTENT |

FRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Franchise Growth

- Franchise Operations

- Open New Units

- Franchise Leadership

- Franchise Marketing

- Technology

- Franchise Law

- Franchise Awards

- Franchise Rankings

- Franchise Trends

- Franchise Development

- Featured Franchise Stories

| ADVERTISE | SPONSORED CONTENT |

The franchise listed above are not related to or endorsed by Franchise Update or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The franchise listed above are not related to or endorsed by Franchise Update or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.