A Growth Spurt: Looking At Private Equity In Early-Stage Franchises

Private equity (PE) is no longer a peripheral player in franchising; it’s central. FRANdata estimates that more than 12.4% of active U.S. franchise brands (regardless of how long they’ve been franchising) now have some level of PE ownership or investment backing. That represents hundreds of brands, spanning nearly every sector of franchising.

One notable trend is that PE firms are no longer waiting for brands to become fully mature before investing. In many cases, they are entering early, sometimes when brands are operating only a handful of locations. The number of brands that start franchising with PE investment behind them has grown significantly in the past 10 years.

These PE firms function as incubators, bringing professional leadership, marketing resources, technology, and franchise development expertise to help emerging brands grow from five to 10 units to 50 to 100 or more. This model is especially attractive to founders who want to scale quickly but need outside capital and expertise to do so.

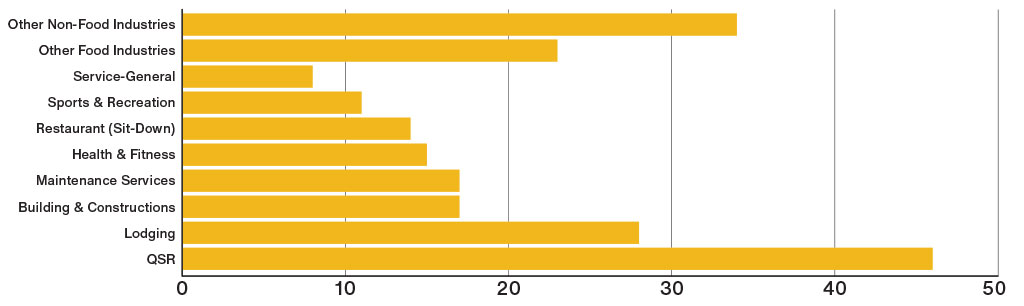

While investment in early-stage food brands outpaces non-food brands, there has been interest in nearly every industry.

Private equity investors are increasingly drawn to the franchise business model because it offers a combination of steady revenue streams, scalability, and risk sharing. The foundation of most franchise systems is the royalty and fee income that franchisors collect from their franchisees based on sales. These recurring, predictable cash flows are highly attractive to investors seeking dependable returns.

Franchising also offers a highly scalable growth model; rather than requiring large amounts of capital to open corporate-owned units, franchisors can leverage the investments of franchisees to expand with relatively limited capital outlay. In addition, the structure of franchising places much of the operational duties on franchisees, enabling franchisors, and by extension, their investors, to focus on supporting growth and brand development rather than day-to-day operations.

Finally, the market offers attractive exit opportunities: Well-run, fast-growing franchisors with strong unit-level economics can command premium valuations when sold to larger PE firms, strategic buyers, or via public offerings, making franchising an appealing sector for capital appreciation.

For emerging franchisors seeking to attract PE investment, or simply to understand how investor involvement may affect their competitive landscape, it is important to recognize how PE firms evaluate opportunities. Investors are selective; they seek brands with strong unit-level economics, proven franchisee success, and clear potential for scalable growth. Professionalism is essential. Franchisors must have well-documented systems, transparent financial reporting, and leadership teams capable of managing rapid expansion. Equally important is growth readiness. PE firms prefer to invest in brands that have already demonstrated market fit and operational maturity rather than concepts still in development.

Finally, franchisors should understand that not all PE investments are structured the same way. Some investors take controlling stakes and become actively involved in day-to-day management while others prefer to act as minority partners and strategic advisors. It is critical for franchisors to be clear about what kind of partnership they want and what level of control they are willing to share as they engage with potential investors.

The growing role of private equity is reshaping the franchising world. PE-backed groups are often better capitalized, faster-moving, and more sophisticated than traditional owner-operators. This can raise the competitive bar for other brands in terms of marketing, technology, and franchisee support.

At the same time, the presence of PE also opens doors for founders of emerging brands, offering new avenues to scale, new partnership opportunities, and in some cases, paths to personal liquidity.

Paul Wilbur is COO of FRANdata, where he is instrumental in building the company’s research and consulting framework. He manages the research, information management, marketing, and IT departments and plays an integral role in the strategic development of FRANdata’s suite of franchise solutions. Contact him at 703-740-4700.

Share this Feature

Recommended Reading:

| ADVERTISE | SPONSORED CONTENT |

FRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Franchise Growth

- Franchise Operations

- Open New Units

- Franchise Leadership

- Franchise Marketing

- Technology

- Franchise Law

- Franchise Awards

- Franchise Rankings

- Franchise Trends

- Franchise Development

- Featured Franchise Stories

FEATURED IN

Multi-Unit Franchisee Magazine: Issue 3, 2025

| ADVERTISE | SPONSORED CONTENT |

$250,000

$250,000

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.