Keep It Legal: Tipping rules should align with state and federal guidelines

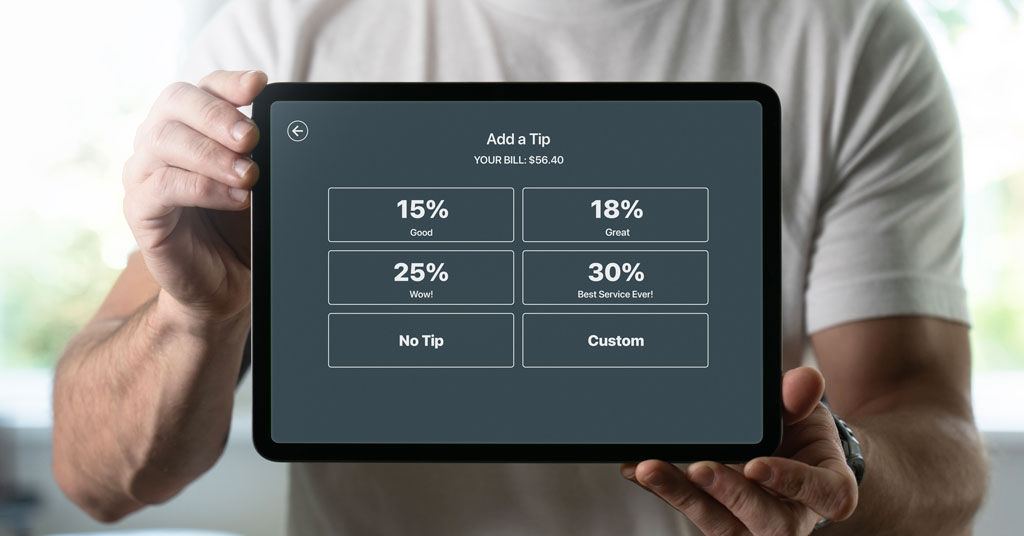

To tip or not to tip?

This is a question that companies are asking themselves today. Is accepting tips worth it? Tips today are used to increase the employees’ wages to remain competitive in a market. However, there is a cost to the employer. On average, employers pay approximately 11% in taxes on tips. It is also the responsibility of the company and management to know who on the team can receive tips and to ensure the business complies with the Fair Labor Standards Act (FLSA).

The FLSA prohibits employers from keeping any portion of employees’ tips for any reason whether directly or through a tip pool. Supervisors, managers, or employers are not eligible for tips even where a tipped employee receives at least the federal minimum wage (currently $7.25 per hour).

Who can be tipped?

Managers and supervisors are not eligible for tips. This role includes any employee (1) whose primary duty is managing the business, department, or region in the company; (2) who customarily and regularly directs the work of at least two or more full-time employees; and (3) who has the authority to hire or fire employees or whose hiring and firing recommendations have weight.

A manager or supervisor may keep only those tips they receive directly from a customer for the service they directly and solely provide. For example, a restaurant manager who serves their own tables may keep their tips from customers they served but would not be able to receive other employees’ tips by participating in a tip pool.

When an employer pays its employees a cash wage of at least the federal minimum wage per hour, the employer may impose a mandatory tip pooling arrangement that includes employees who are not employed in an occupation in which employees customarily and regularly receive tips. This is sometimes known as a nontraditional tip pool. For example, an employer that implements a nontraditional tip pool may require tipped employees, such as servers, to share tips with non-tipped employees, such as dishwashers and cooks, but only if all workers receive a direct cash wage of at least the federal minimum wage. An employer may not receive tips from such a tip pool and may not allow managers and supervisors to receive tips from the pool.

If assistant managers, team leaders, or shift managers’ primary role is to assist the GM in operational functions, manage administration and staff, and maintain the facility, they are not allowed to participate in the tip pool. If the role meets the first two prongs of the three-part test, they are not tip eligible.

Please research your state law. Some states have tip pooling requirements that are more restrictive than the FLSA, so not allowing the assistant managers and team leaders to participate in tip pooling would be advised.

Legal entanglements

Major lawsuits that have been in the news are:

- In March 2018, the Hennepin County District Court approved a settlement in a class action lawsuit against Surly Brewing Company in Minneapolis. The settlement made the news because of the settlement size, $2.5 million, and it highlighted the tipping rules of the Minnesota Fair Labor Standards Act. There were three tip-pooling arrangements in place at the company. The courts found this to be a violation of the Minnesota FLSA.

- Dos Amigos Burritos, a restaurant in Concord, New Hampshire, wrongfully included managers in its employee tip pool, which led to the recovery of $61,788 in tips and liquidated damages for 39 workers.

- Starbucks has reached a $6 million settlement to resolve a class action lawsuit that claimed the company violated state law regarding tips and wages. The class action includes Starbucks employees in Oregon who had deductions taken from their wages for taxes on imputed tips.

- Bar Vegan allegedly paid tipped employees $2.13 an hour while requiring them to give up 25 percent of tips they earned. To date, there has been no settlement.

Please refer to your labor attorney if you are unsure of whether or not your employees are eligible for a tip pool. Companies can be sued for tipping violations even if the owners don’t know they’re breaking the law. Do your research and make sure tipping is right for you.

Mary Lou Atkins sHRBP, is the vice president of human resources at Chicken Salad Chick. Mary Lou is a seasoned and strategic HR executive with 40-plus years of experience in the restaurant industry. She is skilled in talent and performance management as well as employee relations. Mary Lou joined Chicken Salad Chick in 2019 as human resources director after previously holding various positions within operations, training, and HR at Popeyes over the course of 35 years.

Share this Feature

Recommended Reading:

FRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Franchise Growth

- Franchise Operations

- Open New Units

- Franchise Leadership

- Franchise Marketing

- Technology

- Franchise Law

- Franchise Awards

- Franchise Rankings

- Franchise Trends

- Franchise Development

- Featured Franchise Stories

FEATURED IN

Multi-Unit Franchisee Magazine: Issue 1, 2024

$300,000

$250,000

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.