Know Your Brand's FUND Score

And make financing easier for your franchisees

Most lenders you meet are on the business development side of banks. They are "selling" you on why their bank's money is greener than other banks' money. What do lenders really think of your brand? To know that, you need to talk to the credit departments where deals are underwritten, decisions to lend are made, and deal terms are established.

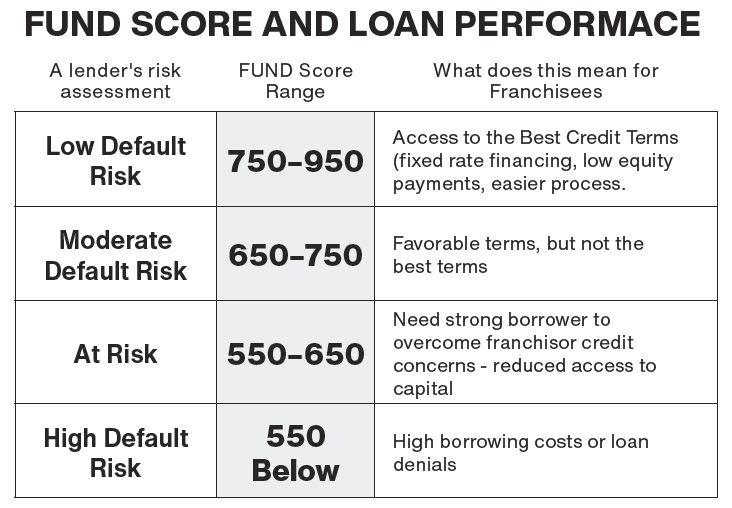

What do credit departments look at to make those decisions? Of course, there's borrower information, starting with FICO scores. For decades, lenders have used FICO scores as one tool to screen individuals associated with businesses. Over time, lenders stratified individuals by FICO ranges. Low-risk lenders migrated to the higher FICO score individuals and offered the best terms. High-risk lenders pursued low FICO score individuals and charged for the additional risk they were assuming with businesses associated with such individuals--if they were willing to do the deals at all.

When lenders sought a standardized, objective way to assess thousands of franchise brands, they turned to FRANdata to develop credit risk profiles of franchise brands. This has evolved over the past decade into a predictive credit risk scoring model that banks collectively representing over a trillion dollars of assets have been using to make credit decisions about which brands to include in their lending programs and the kinds of credit terms they should require.

Understanding your brand's FUND Score will help you see how the actions you take affect your franchisees' access to and cost of capital. How does a failed unit affect lender assessment of your system? What is the cost of not letting lenders easily see your system's unit economics? A FUND Score answers those questions.

Want to grow your system?

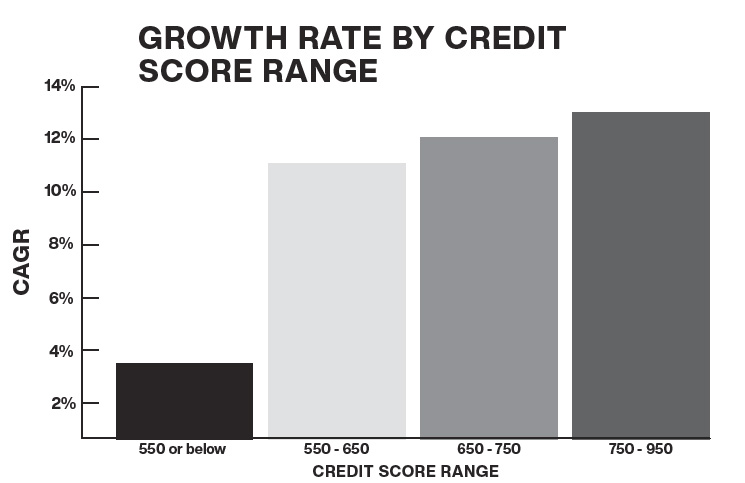

There is a strong correlation between a brand's FUND Score and how fast the brand grows. Brands in the highest category of FUND Scores are growing their systems more than seven times faster than brands in the lowest category of FUND Scores.

In conclusion

Lenders have a credit risk perspective that seems to be aligned with brand performance. Knowing your brand's FUND Score and understanding the elements that inform that score helps you make better business decisions, which result in more growth, more access to capital, and more favorable terms for your franchisees. Knowledge is indeed power. So I ask you, What's your FUND Score?

Edith Wiseman is president of FRANdata, an independent research company supplying information and analysis for the franchising sector since 1989. She can be reached at 703-740-4700.

Share this Feature

Recommended Reading:

FRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Franchise Growth

- Franchise Operations

- Open New Units

- Franchise Leadership

- Franchise Marketing

- Technology

- Franchise Law

- Franchise Awards

- Franchise Rankings

- Franchise Trends

- Franchise Development

- Featured Franchise Stories

FEATURED IN

Franchise Update Magazine: Issue 2, 2019

The franchise listed above are not related to or endorsed by Franchise Update or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The franchise listed above are not related to or endorsed by Franchise Update or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.