FRANdata's Q1 New Franchise Concepts Report Identifies 86 Brands

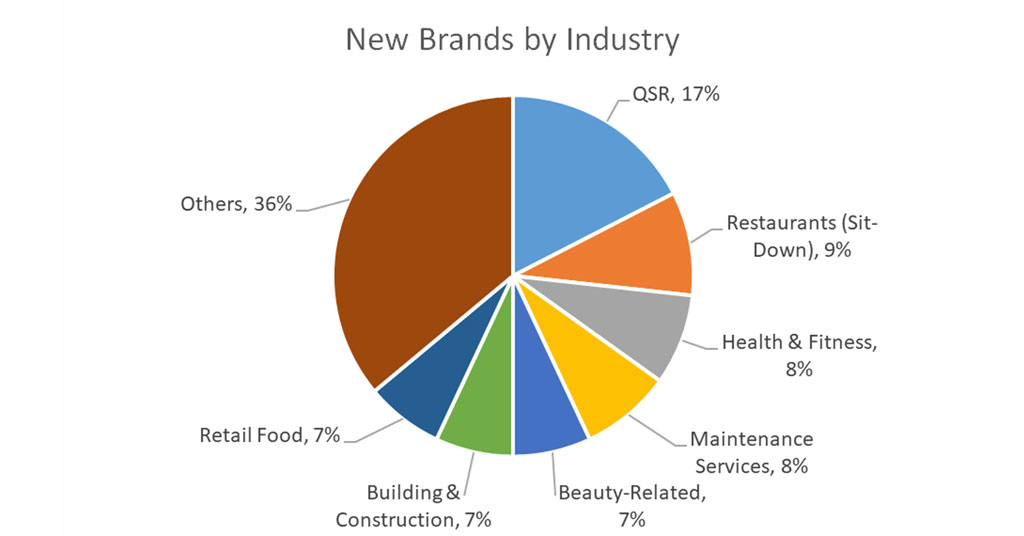

FRANdata identified 86 new franchise brands across 23 industries in Q1 2022. Most of the new brands are in the QSR and Sit-Down Restaurant categories, followed by Health & Fitness and Maintenance Services. Food concepts continue to make up the largest percentage of new franchise concepts, a trend in line with the previous quarter. The other leading categories are shown in the pie chart.

Restaurants continue to be the fastest-growing segment. The QSR segment is the largest category of new restaurants opened this past quarter. However, the number of new brands in QSR and sit-down restaurants fell to 23 in Q1 2022, down from 34 in Q4 2021. The decline could be explained by rising food, labor, and occupancy costs, along with issues related to supply of key food and beverage items. Despite interim issues, FRANdata believes that the sector will continue to see growth bolstered by improving vaccination rates, increasing household income, and the ability of restaurants to attract customers through online delivery, fast service, expanded variety of food items, and new international cuisine options.

As in the previous quarter, Health & Fitness witnessed high growth in new brands in Q1. These brands spanned fitness centers, medical clinics, and wellness spas. Compared with the previous quarter, Q1 saw an upsurge in the number of new brands in Beauty-Related services. These brands offer a range of services that include hair care, cosmetic aids, and tanning centers.

Seven international brands entered the U.S. franchising market in Q1 2022. These brands are from United Kingdom, India, Taiwan, South Korea, and Germany. Most of these brands are food-related. Others cover tax services, education, and auto repairs.

Brands with high average unit revenues (AUV)

Of the 86 new brand concepts identified, 41 reported annual average unit revenues (gross sales). The average annual sales for these 41 brands was $1,299,297. Compared with the previous quarter, brands reporting more than $1 million in annual sales doubled from 11 to 22 in Q1 2022.

|

Brand |

Primary Industry |

Average Unit Revenues |

|---|---|---|

|

Patriot Pipeline |

Maintenance Services |

$9,065,212 |

|

Peachwood Floor Coverings |

Decorating & Home Design |

$5,205,326 |

|

The Juicy Crab |

QSR |

$4,734,263 |

|

Smalls Sliders |

QSR |

$2,395,834 |

|

iFoam |

Building & Construction |

$2,289,263 |

|

EverLine Coatings and Services |

Building & Construction |

$2,052,513 |

|

Deer Solution Repellent Service |

Maintenance Services |

$1,714,276 |

|

Bubblelicious Milk Tea and Fruit Tea |

Retail Food |

$1,650,000 |

|

Sweet Red Peach |

Baked Goods |

$1,549,410 |

|

RISE Commercial District |

Business-Related |

$1,501,331 |

|

El Fresco Mexican Grill |

QSR |

$1,360,810 |

|

Mama’s Meatball |

Restaurants (Sit-Down) |

$1,337,017 |

|

Parlor Doughnuts |

Baked Goods |

$1,295,031 |

|

VanGo Medical Spa |

Beauty-Related |

$1,277,428 |

|

Mici Handcrafted Italian |

QSR |

$1,274,353 |

|

Gregoire |

Restaurants (Sit-Down) |

$1,262,011 |

|

Oh My Burger |

QSR |

$1,128,931 |

|

Lifetime Green Coatings |

Building & Construction |

$1,049,983 |

|

Sip Fresh |

QSR |

$1,037,081 |

|

Sticks Kebob Shop |

QSR |

$1,027,421 |

|

ThrIVe Drip Spa |

Health & Fitness |

$1,022,207 |

|

Bubbles |

Beauty-Related |

$1,012,714 |

|

Brunch |

Restaurants (Sit-Down) |

$1,009,488 |

Brands that require high initial investments

The average initial investment for the 86 concepts identified this quarter was $519,608. Establishing outlets for the following 10 brands requires significant investment compared with the rest of the new concepts.

|

Brand |

Industry |

Midpoint Initial Investment |

|---|---|---|

|

RISE Commercial District |

Business-Related |

$12,701,750 |

|

Island Wing Company |

Restaurants (Sit-Down) |

$2,843,250 |

|

Abbey Road Institute |

Education-Related |

$1,615,250 |

|

Brunch |

Restaurants (Sit-Down) |

$1,186,000 |

|

Smalls Sliders |

QSR |

$1,178,300 |

|

Beefaroo |

QSR |

$1,066,850 |

|

Dirty Birds |

Restaurants (Sit-Down) |

$1,028,250 |

|

Beauty Bungalows |

Beauty-Related |

$914,642 |

|

The Juicy Crab |

QSR |

$860,000 |

|

Parlor Doughnuts |

Baked Goods |

$853,250 |

The top concept, which exceeds an initial investment of $5 million, is the establishment and operation of an industrial warehouse that requires a significant investment for building construction, furniture and fixtures, and operating supplies and equipment.

Brands with high growth expectations

As of the end of Q1 2022, 16 brands had no franchised units. The following brands project they will add 10 or more locations in the coming year.

|

Brand |

Industry |

Projected units |

|---|---|---|

|

Math Reactor |

Child-Related |

35 |

|

Valhallan |

Sports & Recreation |

33 |

|

Pokémoto |

QSR |

28 |

|

Dee-O-Gee |

Pet-Related Products/Services |

27 |

|

The Juicy Crab |

QSR |

24 |

|

Mobiledumps |

Services-General |

18 |

|

Dumpster Dudez |

Services-General |

17 |

|

Noble Locksmith |

Security-Related |

16 |

|

IntegriServ Cleaning Systems |

Maintenance Services |

15 |

|

Parlor Doughnuts |

Baked Goods |

14 |

|

Egg N Bird |

Restaurants (Sit-Down) |

12 |

|

Level Up Your Home |

Computer Products and Services |

12 |

|

Lifetime Green Coatings |

Building & Construction |

12 |

|

Patriot Pipeline |

Maintenance Services |

12 |

|

Christie’s International Real Estate |

Real Estate |

11 |

|

Bosch Auto Service Shop |

Automotive |

10 |

|

Success on the Spectrum |

Health & Fitness |

10 |

|

TaxAssist |

Business-Related |

10 |

Beneficiaries of previous franchise experience and affiliated service providers

Of the 86 identified emerging brands, 45 have at least one affiliated service company to support the franchise system; and 16 are affiliated with existing franchise brands through their parent company. Of these 16 brands, 9 are affiliated with two or more brands belonging to same parent company.

Interestingly two brands, iFoam and Door Renew, are associated with platform companies Horsepower Brands and Phoenix Franchise Brands, respectively. Another brand, Christie’s International Real Estate, is owned by PE firm Quad-C Management, while Egg N Bird, which is associated with Yogurtland, is indirectly connected to Bravo Equity Partners, the private equity firm that has ownership interests in Yogurtland.

Some heavy hitters entering or reentering franchising

The following concepts caught our attention because of the success they experienced in their country of origin. We’re excited to see what they can do in the U.S. franchise market.

|

Brand |

Of Note |

|---|---|

|

Bubbles |

Full-service hair salons specializing in color treatments and haircuts. Wholly owned subsidiary of HC Salon Holdings, which also operates 491 Hair Cuttery salons. After filing for bankruptcy protection during the shutdowns from Covid, HC Salon is back to offering the Bubbles brand of hair salons with 15 currently operating, mostly in the DC/VA area. |

|

The Yellow Chilli |

Casual dining restaurants designed by Indian celebrity chef Sanjeev Kapoor to bring Indian dishes developed by him and specialty food, beverage, and other items to diners internationally. |

|

Goobne |

A quick-service casual restaurant that specializes in the sale of oven-roasted chicken with signature spices and sauces as well as other Korean traditional food items for dine-in, takeout, and online ordering. |

|

Beefaroo |

Fast casual/quick service restaurant serving burgers, freshly cooked roast beef sandwiches, milkshakes, fries, and salads. Parent company Next Brands & Development has a portfolio that includes Installed Right, Penguin Point Burgers, and Fresh Healthy Cafe (as a franchisee) |

|

Bosch Auto Service Shop |

Provides on-vehicle service, diagnosis, and repair services. |

The Yellow Chilli

The Yellow Chilli brand is owned by popular Indian chef and TV personality Sanjeev Kapoor through his parent company SK Restaurants. In addition to the Yellow Chilli, SK Restaurants owns and franchises popular Indian restaurant brands that include Ninja! Hong Kong, Sura Vie, Khazana, India Green, and Grain of Salt. Kapoor, founder of the brand, hosted the TV show Khana Khazana, the longest-running show of its kind in Asia. The show was broadcast in 120 countries, and in 2010 had more than 500 million viewers. He is also the first chef in the world to own a 24x7 food and lifestyle channel, Food Food. The first Yellow Chilli location opened in 2001. At present, there are around 80 outlets open and under development across India and other foreign markets such as Dubai and Canada.

Goobne

Goobne, a Korean oven-roasted chicken brand, was launched in 2005 in South Korea. The brand offers healthy chicken options cooked without oil. Goobne gained huge popularity in South Korea, and by 2011 had 850 operational stores in South Korea. Over the next few years, the brand expanded to neighboring countries including Vietnam, Hong Kong, Macau, and Japan. Today, the brand is spread across 10 regions including Australia, Singapore, Malaysia, and China.

Wushiland Boba

Wushiland Boba started in 1994 in Tainan, Taiwan. The brand quickly grew popular and entered the U.S. market in 2016, opening its first store in San Diego. Since then, Wushiland Boba has five company-owned outlets and is projected to add one franchised outlet this year. The brand is part of the bubble tea and boba market, which has seen rapid growth in recent years in the U.S. The global bubble tea market is expected to grow at a CAGR of 7.4% to $4.5 billion in the 2021–2028 period.

Bosch Auto Service Shop

One of the largest suppliers of technology and services, Robert Bosch GmbH’s first foray into franchising in the U.S. is through the Bosch Auto Service Shop franchise. The brand’s locations provide on-vehicle service, diagnosis, and repair services. Robert Bosch GmbH is also the indirect parent company of Bosch Automotive Technical Service (Beijing), which offers franchises and has been operating Bosch shops in China since 2014. There are more than 515 franchised Bosch shops in China.

FRANdata is an independent research and consulting company supplying information and analysis for the franchising sector since 1989. To learn more, call 800-485-9570 or visit their website.

Share this Feature

Recommended Reading:

| ADVERTISE | SPONSORED CONTENT |

FRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Franchise Growth

- Franchise Operations

- Open New Units

- Franchise Leadership

- Franchise Marketing

- Technology

- Franchise Law

- Franchise Awards

- Franchise Rankings

- Franchise Trends

- Franchise Development

- Featured Franchise Stories

The franchise listed above are not related to or endorsed by Franchise Update or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The franchise listed above are not related to or endorsed by Franchise Update or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.