The Mystery Persists

Our annual mystery shopping survey shows some improvement, with much room for more

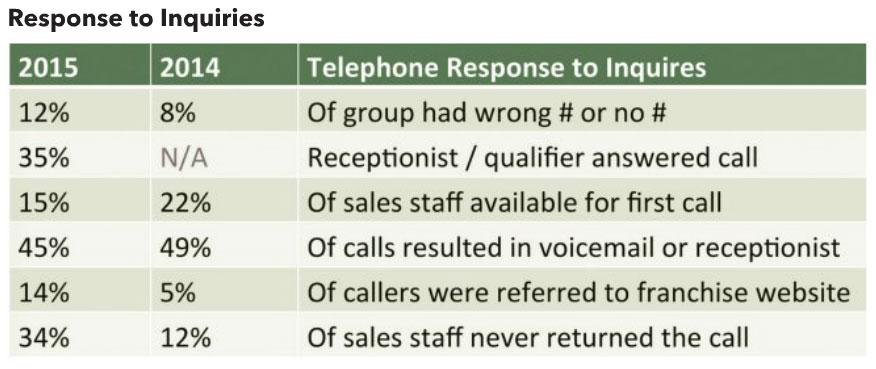

Franchise recruiting is serious business. Incredibly, year after year, franchise brands continue to fumble the fundamentals. They are not executing the X's and O's. They are failing to meet prospects where they are (mobile devices anyone?), providing flat-out wrong information, responding too slowly to prospect inquiries, and worse, not getting back to them at all. These are just some of the key findings of Franchise Update Media's 2015 annual mystery shopping survey.

Every brand that registered by August 15 to attend this year's Franchise Leadership & Development Conference was mystery shopped by a "qualified, perfect candidate," said Gary Gardner, chair of Franchise Update Media, during his presentation of the survey results at the conference in mid-October. The brands were evaluated by telephone query, website response, website best practices, social media, and franchisee satisfaction.

Gardner noted a few eyebrow-raising statistics during his presentation. "Of the 137 brands that were shopped this year, 34 percent never returned a call from the initial contact from the prospect," he noted. And 14 percent simply referred them to their website. "To me that's inexcusable," he said. "Some people are doing some great things, and some people have some work to do."

But there is good news. The needed improvements can be made, and the strategies and tactics for doing so are simple to implement. Brands and their development teams just need the discipline to do it. We asked each of the mystery shopping researchers who participated in this year's study--Franchise Business Review, Landmark Interactive, and FranConnect--to discuss and interpret their findings and provide their thoughts on how brands can make positive changes (see Best Practices sidebar).

Franchisee satisfaction

Franchise Business Review (FBR) measured franchisee satisfaction and performance at 44 franchise companies representing more than 19,000 business units. Survey responses from 5,775 franchisees were compared with FBR's benchmark data from more than 21,000 franchisees representing franchise brands across all industry segments.

Eric Stites, FBR's CEO, said franchisees completed an independent survey consisting of more than 50 questions related to their business performance, satisfaction with their brand, and general business demographics; 33 of the 50 questions were rated on a 100-point scale called the Franchisee Satisfaction Index (FSI).

Satisfaction was measured across eight key areas: Training & Support, Franchise System, Leadership, Financial Opportunity, Core Values, Franchisee Community, Self-Evaluation (franchisee performance), and General Overall Satisfaction. Individual question ratings ranged from the low 80s down to the mid 50s, with an average overall FSI score of 70.

FU: Describe the key findings and results of your research.

Stites: Overall, the Franchise Update test group FSI score (70) was nearly identical to FBR's franchise sector benchmark (70.7), which represents more than 350 leading franchise brands. The 1 percent overall variation is not statistically significant and is within the research margin error. That being said, several key areas did show a statistically significant negative variation from the benchmark, specifically in the area of Financial Opportunity.

FU: What were some of the key strengths identified by the benchmark satisfaction questions?

Stites: There were four strong areas. 1) Franchisee Self-Assessment: "I enjoy being part of this organization" (82.0 FSI); "I enjoy operating this business" (81.8 FSI); 2) Core Values: "I respect my franchisor" (80.3 FSI); "My franchisor acts with a high level of honesty and integrity" (78.9 FSI); 3) Community Engagement: "My fellow franchisees are supportive of the brand" (77.0 FSI); and 4) General Satisfaction: "I would recommend my franchise to others" (77.8 FSI).

FU: What challenges were identified by the benchmark satisfaction questions?

Stites: 1) Financial Opportunity: "Current financial picture" (57.9 FSI); "The total investment in my business, including both time and money, has been consistent with my expectations" (60.4 FSI); and "The fees I pay my franchisor are fair" (60.4 FSI). 2) Training & Support: "Marketing and promotional programs" (58.2 FSI); and "Effective use of technology" (59.4 FSI). 3) Leadership: "Senior management involves franchisees in important decisions" (60.8 FSI).

FU: What surprised you most about your findings?

Stites: We found that franchisees in the test group reported annual pre-tax incomes 8 percent lower than other franchisees, despite being in business slightly longer on average ($74,216, compared with $80,479 reported by other franchisees across all industries).

FU: What are you seeing in the overall performance numbers of franchisees?

Stites: Looking at trend data over the last three years, the Franchise Update test group has shown slight improvement in all categories year over year, improving on average by 3 to 5 percent from 2013.

FU: What are franchisors/development teams doing well?

Stites: The data clearly shows that the brands within the test group are providing their franchisees with strong brand leadership and are building solid franchisee-franchisor relations. The overwhelming majority of franchisees enjoy operating their business, enjoy being part of their brand, and ultimately would recommend their brand to other franchisee candidates.

FU: Where do franchisors/development teams need improvement?

Stites: Based on the research findings, and specifically very low ratings on questions related to financial opportunity and reported annual pre-tax income, it is clear that many of the companies in the test group could be doing a much better job of setting clearer and more realistic financial expectations with franchisee candidates during the recruitment process.

FU: Based on the findings, what are your recommendations for franchisors? How can they do a better job of sales/recruitment?

Stites: Setting clearer financial expectations with candidates on the front end of the recruitment process will go a long way toward moving franchisee satisfaction in a positive direction. These specific steps will help:

- Update your Item 19 to clearly illustrate both the median gross and net earnings of your entire system. Too many companies share only gross numbers, or massage their financial data to focus only on top performers. Also, break out Item 19 data by franchisee tenure to clearly illustrate the typical ramp-up period of your business and time to break-even, as well as typical time to median unit performance. Great Item 19 examples include Wild Birds Unlimited, Fastsigns, and BrightStar Care.

- Review your Item 7 data to make sure it depicts the true experience of the majority of franchisees. Include an allowance for initial working capital, as well as any other items that may be required to get the business off the ground.

- Require all new franchisees to take a full-day small business financial course as part of their initial training, and offer refresher courses at your annual conventions. Understanding income statements, balance sheets, cash flow, and the key financial drivers of your business model are critical to their success.

- Share median resale data with candidates and franchisees, and have them do the exercise of a 10-year financial plan (assuming median performance within your system) to gain a clear and realistic understanding of their potential return on investment.

Prospects' online search behaviors

To better understand franchise prospects and the franchise buying process, Landmark Interactive analyzed data from more than 40 million Internet visits since 2010 to the leading franchise portals. These included Franchise.com, FranchiseOpportunities.com, FranchiseSolutions.com, FranchiseGator.com, and BusinessBroker.net. Landmark President Michael Alston said they looked for changing patterns in how prospects access the Internet, how they use portals, and how the profile is changing among late-stage prospects who contact a franchisor through a lead form.

FU: What were the key findings and results of your research?

Alston: The number of high-value franchise prospects has surged in the past two years. Interest in franchises requiring more than $100,000 nearly doubled in that time, up 91 percent, and interest in $250,000-plus businesses tripled, with a 201 percent increase over summer 2013. Investment interest for $50,000 to $99,000 franchises also nearly doubled, with 90.4 percent growth. And prospects for opportunities under $50,000 saw steady growth, with a 12.9 percent increase under $25,000, and an 8.3 percent increase in the $25,000 to $49,000 segment. Research also showed that mobile phones are now the predominant Internet channel for franchise development. Smartphones generated 51 percent of franchise recruitment leads this summer, more than twice the share of 2013, and up from a mere 2 percent of franchise leads only 5 years ago.

FU: Any other surprises in your research findings?

Alston: We were astonished at what a clear picture the profile data painted for us. Other measures of business optimism show the outlook improving in fits and starts, but this willingness to invest in higher-cost businesses is a stronger show of confidence among savvy entrepreneurs. As the economy improves, we expect more high-value buyers and first-time prospects to come off the sidelines. So understanding franchisee personas and profiles will become even more important for effective franchise development. We were not surprised to see a surge in high-value leads being submitted by mobile phone. For the Internet in general, that's the new normal. Google recently announced that the majority of its global searches are now performed on smartphones.

FU: Based on your research, how can franchise brands do a better job of sales/recruitment?

Alston: As the U.S. economy continues to improve, prospective franchisees are likely to come to the table with greater financial assets. Successful franchisors will gather as much data as they can to better understand the changing investor profile, to improve the return on their development processes, and to choose the best franchise owners.

Websites and social media

FranConnect analyzed two components of the franchise discovery process: the franchise website and social media presence. Tim Johnson, president of brand development at FranConnect, says sites were scored based on adherence to proven best practices for the franchise discovery process. "There was no judgment for usability nor design, and the results were based on actual content and functionality to produce the overall score. The search was conducted through the eyes of a franchise prospect, not a person familiar with the franchise industry," he says. Uniform guidelines were applied to all brand assessments, with very little left to a qualitative judgments, he said.

FU: What were the key findings and results of your research?

Johnson: It appears that attendees took heed of what was shared last year as important and embraced the initiatives. Franchise websites that contain a process for learning (a stepped approach to learn about the opportunity) almost doubled, and the number of those having a mobile-optimized site rose from 17 to 52 percent. Conversely, not all best practices on the social front appear to have been as broadly embraced. Having uniform branding on local Facebook pages only went from 31 to 38 percent, and sharing the franchise opportunity on Facebook remained flat at 30 percent.

FU: What surprised you most about your research findings?

Johnson: On the website front, it was that still only 52 percent of franchise sites are mobile-friendly, despite the fact that about half of all franchise inquiries were from a mobile device (according to Landmark Interactive's data). Furthermore, there's still not a majority using video. And socially, there was a decreased activity on LinkedIn, despite it being the business social network.

FU: Why do these poor performance numbers keep occurring year after year?

Johnson: The franchise industry has historically been late to adopt technology trends because of the challenge of scaling changes across a multi-location network. In addition, they give too much credit to their franchise website because that is where most leads traditionally get completed, regardless of the original source that drove the interest. Social sites play a major role in driving awareness, and online prospect research uncovers how you manage your reputation and what customers are saying about your franchisees.

FU: What are franchisors/development teams doing well?

Johnson: Social awareness and engagement are improving. Our research showed a positive trend in responding to and managing online reputation/brand perception--still at only 24 percent, but significantly more than the 4 percent from last year. This affects lead generation and ultimate conversion more than any canned copy on a franchise website. That said, there's strong adoption of franchisors of making their franchise sites more user-friendly by guiding them through navigation.

FU: Where do franchisors/development teams need improvement?

Johnson: By providing content in the format that candidates and customers want it: mobile and/or video. It's interesting that most brands are quick to provide that on the consumer side, but not on the franchise development properties.

FU: Based on the findings, what are your recommendations for franchisors? And how can they do a better job of sales/recruitment? Johnson: Franchisors need to evaluate their concept from the vantage point of a candidate. Google your brand for keywords and using different cities to see what your prospects see. Your franchisee presences and reviews play a major role in how you are perceived, and make the difference in generating an inquiry or ultimately awarding a franchise. Focus discovery on how they will be successful generating customers instead of all the wonderful things you do to train and support them.

FU: Any other thoughts or observations about any of your research?

Johnson: Social media or what people are saying about your brand is more important than what you say about your brand, and it seems to be downplayed as still being a non-result-producing "nice to have" instead of a strategic "must have" that is a major component of the discovery process.

Only 40% had video on their franchise website vs. 39% last year; not providing content how prospects want it

Just 28% had some level of activity in the last week on LinkedIn vs. 40% last year

Best Recruitment Website Practices

When Tim Johnson and his associates at FranConnect set about measuring how well franchise brands were doing with their franchise recruiting websites for this year's mystery shopping survey, they needed a standard to measure their analysis. They used the scorecard of Franchise Update Media's best practices, created years ago and tweaked and updated continually to keep it relevant to the changing marketplace and technologies.

"The best practices represent the data point that drove the score," says Johnson. "They are best practices because the most progressive and thriving brands execute on them. Most of these reflect common sense, can be substantiated, and will withstand stand any argument." The following are the criteria FranConnect used to measure website effectiveness during their mystery shopping.

1. Basic SEO (meta/keyword tags)

Title tags (very important for SEO and social sharing)

- company name only or title of page only

- company name plus "franchise" and same on all pages or has title of page next to it

- a few unique franchise or business opportunity keywords

2. Website usability

Franchise content accessibility (from home page)

- 3 different links to access franchise page or 1 link in main and unique button

- 2 different links (1 in main navigation, 1 elsewhere)

- 1 link in main navigation

- hard to find (only at bottom)

Process of learning (how does someone find out more about the brand)

Effective use of technology--video

- Video testimonials

- Video spokesperson

- Click to call

- Online chat

- Twitter/Facebook/social media links

Overall Site Presence (look and feel)

3. Key content

About Us/History

- Dedicated page

- Franchise team listed

Benefits of franchising

Benefits of company franchise

Territory map

- Standard map/detailed area

- Map

Investments

- Investment chart

- Mention build-out and franchise fee and royalty

- No investment mentioned

Requirements (what will it take to become a zee)

Frequently Asked Questions

- Solid FAQs with good descriptions and answers

- Few basic FAQs

- None

Testimonials

- Sprinkled throughout site or has a dedicated page with video, text, pictures, etc.

- At least one testimonial

- None

Industry background and growth

Earnings claims (Item 19 or other)

Franchise award process (how things will happen)

Initial request form

- Short form with contact info only

- Short form with financial qualifiers

- Short form with time frame

- Short form with lead source

Application

Website Response Form Mystery Shopping Results

Callback Response to Web Inquiry Form- 31% 0-4 hours

- 26% 4-24 hours

- 8% Within 48 hours

- 4% More than 48 hours

- 18% Did not respond with a call

- 13% No online inquiry form or broken form

2015 vs. 2014

2015 |

2014 |

|

Returned calls within 24 hours |

57% |

35% |

Responded with a call and email |

67% |

33% |

Called and left the "right messaging" |

44% |

20% |

Website Mystery Shopping Result

s- 25% provide unique starting points on franchise site (21% last year)

- 54% provide a process for learning (29% last year)

- 40% have video on the franchise site (39% last year); not providing content how prospects want it

- 46% have an investment chart (35% last year); not properly qualifying?

- 44% have financials on the qualification form (34% last year); again, not properly qualifying?

- 52% of franchise sites are mobile-friendly (17% last year)

Social Media Results

- 25% had responses to negative reviews on page 1 of Google Map results (4% last year)

- Average of 24 reviews per listing (7 last year)

- 60% of Google listings are not branded (profile image) (85% last year)

- 38% had consistent branding on local pages on Facebook (31% last year)

- 30% communicate the franchise opportunity somewhere on their Facebook profile (30% last year)

- 28% have some level of activity in the last week on LinkedIn (40% last year)

AFDR Stats

- Only 45% of franchisors measure the percentage of unique visitors to their home page that convert to leads

- 4,320 average unique visits monthly

- 139 average leads monthly

- 15% is the median conversion rate

- Only 37% of franchisors measure the percentage of visitors on their information request forms that convert to leads

Share this Feature

Recommended Reading:

FRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Franchise Growth

- Franchise Operations

- Open New Units

- Franchise Leadership

- Franchise Marketing

- Technology

- Franchise Law

- Franchise Awards

- Franchise Rankings

- Franchise Trends

- Franchise Development

- Featured Franchise Stories

FEATURED IN

Franchise Update Magazine: Issue 4, 2015

The franchise listed above are not related to or endorsed by Franchise Update or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The franchise listed above are not related to or endorsed by Franchise Update or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.