2023 AFDR Highlights, Part 3: 2022 Digital Spend-Budget vs. Effectiveness

Highlights from the 2023 Annual Franchise Development Report (AFDR) were unveiled at the Franchise Leadership & Development Conference (FLDC) in October.

Participants consisted of franchisors that completed an in-depth questionnaire online. Responses were aggregated and analyzed to produce a detailed look into the recruitment and development practices, budgets, spending allocations, and strategies of a wide cross-section of franchisors. The data and accompanying commentary and analysis provided the basis for the 2023 AFDR.

A total of 101 franchisors participated, representing 21,802 franchised units and 2,044 company-owned units. Despite predictions of a recessionary year ahead, participants plan to open a total of 1,725 new franchised units in 2023.

Highlights from the report were presented in an FLDC general session by Franchise Update Media EVP and Chief Content Officer Diane Phibbs and Wild Birds Unlimited Chief Development Officer Paul Pickett. Below is the third in a series of selected highlights. All conference attendees received a complimentary copy of the 2023 AFDR.

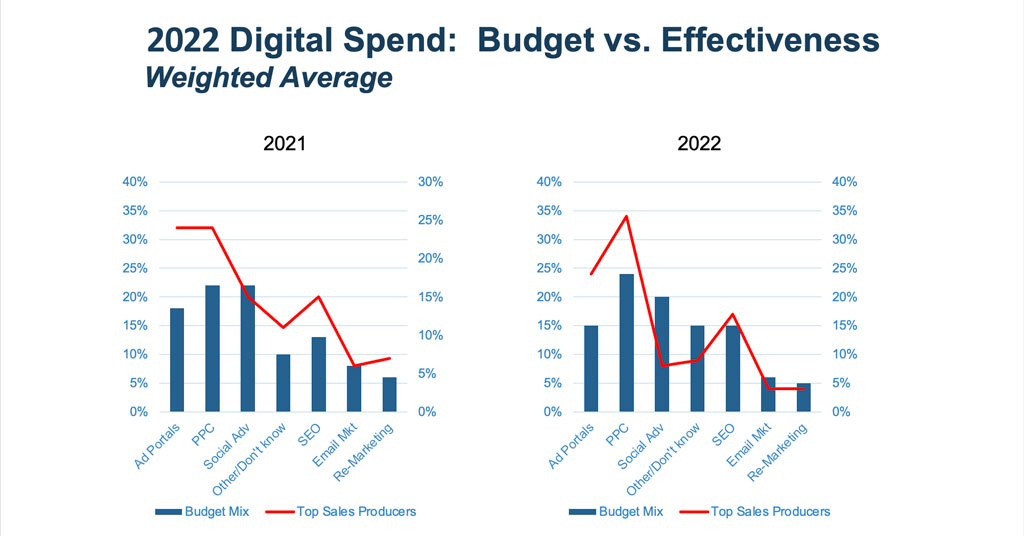

2022 Digital Spend: Budget vs. Effectiveness

Somewhat surprisingly during the ongoing pandemic, both digital spending and effectiveness dropped in most categories from 2021 to 2022.

- Spending on advertising portals as a portion of the total digital budget dropped from 18% in 2021 to 15% in 2022; effectiveness as a sales producer remained steady at 24%.

- PPC spending remained steady at 24%, of brands’ digital budget mix; however, its effectiveness leapt from 24% to 34% YOY.

- Social advertising spend dipped slightly YOY from 22% to 20%, a negligible change; its effectiveness, however, plummeted YOY from 15% to 8%.

- SEO’s portion of brands’ digital budgets remained steady at 15% YOY, as did its effectiveness of 15%.

- Email marketing spend, which had been enjoying a resurgence in the hearts and budgets of development teams, dropped a bit YOY, from 8% to 6% of brands’ budget mix; effectiveness also fell, from 8% to 4% YOY.

- Remarketing, the final category here, fell slightly from 6% to 4% YOY; effectiveness also dropped, from 6% to 4% YOY.

Next time: Portal leads.

Share this Feature

Recommended Reading:

FRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Franchise Growth

- Franchise Operations

- Open New Units

- Franchise Leadership

- Franchise Marketing

- Technology

- Franchise Law

- Franchise Awards

- Franchise Rankings

- Franchise Trends

- Franchise Development

- Featured Franchise Stories

FEATURED IN

Franchise Update Magazine: Issue 4, 2022

The franchise listed above are not related to or endorsed by Franchise Update or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The franchise listed above are not related to or endorsed by Franchise Update or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.