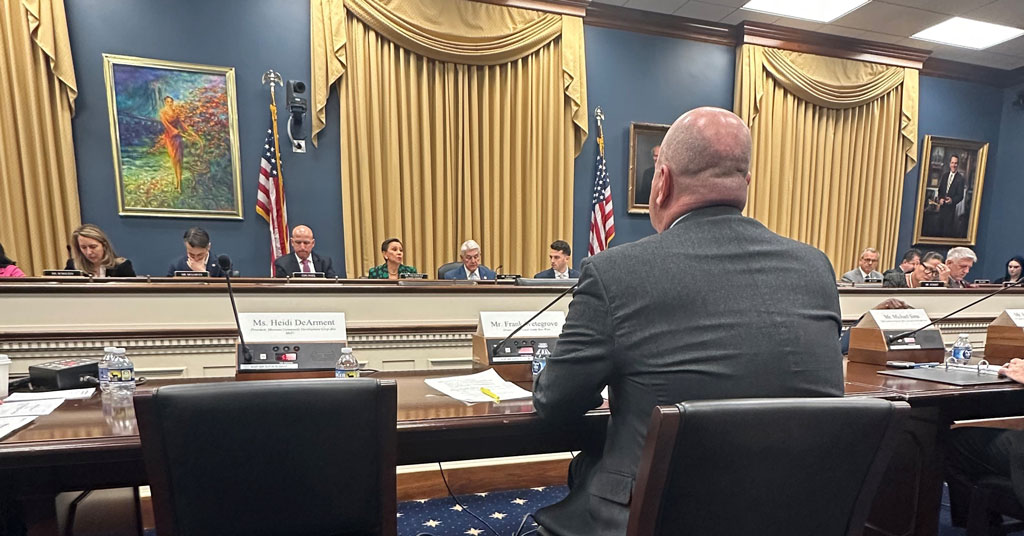

Wetegrove Testifies About SBA Loans

Frank Wetegrove, an International Franchise Association (IFA) member, U.S. Army veteran, and owner of five Texas-based Camp Bow Wow franchises, appeared before Congress to discuss the importance of U.S. Small Business Administration (SBA) loan programs on small businesses, especially for aspiring business owners to get their start. Testifying before the U.S. House Small Business Committee, Wetegrove discussed his franchising journey and the role that the SBA had in owning his small business.

Wetegrove, a retired colonel with 34 years of service in the Army Reserve along with eight years in active duty, emphasized two key points to lawmakers:

1) SBA loans and their access to capital from its lending programs are an instrumental part of the franchise success story. In fiscal year 2024, the SBA guaranteed $31.1 billion in 7(a) loan volume and $6.7 billion in 504 loan volume. Historically, franchises have represented about 20% of SBA loans by dollar volume.

2) Recent efforts to streamline government-supported lending programs, including the elimination of the concept of affiliation by control which also resulted in the elimination of the Franchise Directory, may put many franchise brands at a disadvantage accessing capital. He urged lawmakers to work with the franchise community to better understand how these changes have affected franchise lending.

In discussing his franchise success story, Wetegrove said, "None of this would have been possible without the support of the federal government's Small Business Administration lending program. The SBA's assistance was instrumental in getting my business off the ground. I know for a fact that many of my fellow franchisees—and countless other small businesses—would not exist without these critical funding programs."

A full copy of Wetegrove's testimony is available here.

Entitled Driving Economic Growth: SBA Lending Programs and The Vital Role of Community Banks, the hearing took place days after IFA released its 2025 Economic Outlook showing that franchise growth exceeded projections for 2024 while also forecasting that franchises will grow an additional 2.4% in 2025, a faster rate than the 1.9% projected for the broader economy by the Congressional Budget Office.

Share this Feature

Recommended Reading:

| ADVERTISE | SPONSORED CONTENT |

FRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Franchise Growth

- Franchise Operations

- Open New Units

- Franchise Leadership

- Franchise Marketing

- Technology

- Franchise Law

- Franchise Awards

- Franchise Rankings

- Franchise Trends

- Franchise Development

- Featured Franchise Stories

| ADVERTISE | SPONSORED CONTENT |

$200,000

$250,000

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.