How Do You Measure Up? First-ever Annual Franchise Marketing Report Can Show You

2019 marked the debut of the Annual Franchise Marketing Report (AFMR).

This new annual report provides franchise consumer marketers with invaluable data and analysis they can use to benchmark their performance against other brands, within franchising and in their industry sector--a resource they can use to improve the effectiveness of their marketing efforts.

Franchising's increasingly competitive landscape has strengthened the need for marketers to better understand how their brand measures up against the competition and is performing in the wider marketplace. The AFMR is intended to assist franchise consumer marketers in understanding how their team compares with their peers and, more importantly, help them allocate their limited resources to the most effective channels for achieving their system-wide goals.

Brands participating in the first AFMR represented more than 13,000 locations, $8.3 billion in annual revenue, and $131 million in annual marketing budgets. Diane Phibbs, executive vice president and chief content officer at Franchise Update Media, presented highlights from the report this past June at the 2019 Franchise Marketing Leadership Conference.

Participants consisted of franchise marketing leaders who completed an in-depth questionnaire online. Responses were aggregated and analyzed to produce a detailed look into the marketing practices, budgets, and strategies of a wide cross-section of franchise brands and sectors. The data and accompanying commentary and analysis provide the basis of the 2019 AFMR. Below are selected highlights from the new report.

Leads/Traffic Count

In terms of leads and traffic counts, seven in 10 (71 percent) respondents reported that leads or traffic count were up (56%) or the same (15%) in 2019, while only 22% responded that they were down. Despite today's economy and tight employment picture, this indicated positive business conditions for the majority of respondents at the local level.

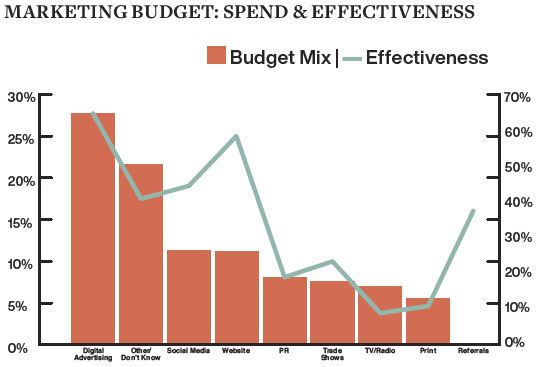

Marketing Budget: Spend & Effectiveness

To engage their customers, marketers have implemented an integrated, omnichannel marketing strategy. Respondents reported a somewhat balanced spend--with the exception of digital advertising, which played the largest role in their overall budget mix. Social media and websites were the next two leading categories. The "Other/Don't Know" category consisted of respondents who completed the survey but may not have had the marketing mix or access to results.

"While digital advertising is balanced in the amount of spend versus effectiveness, social media and websites are very effective versus the amount of budget allocated to each," said Phibbs. She says there are two schools of thought on this: 1) Would the results increase if more dollars were allocated to social media or websites?; and 2) Are the websites and social programs being maintained properly?

"With so much of the buyer's research being done online before the purchase, it's important to have the customer-interfacing tools working at their optimum to achieve the purchase," she advises.

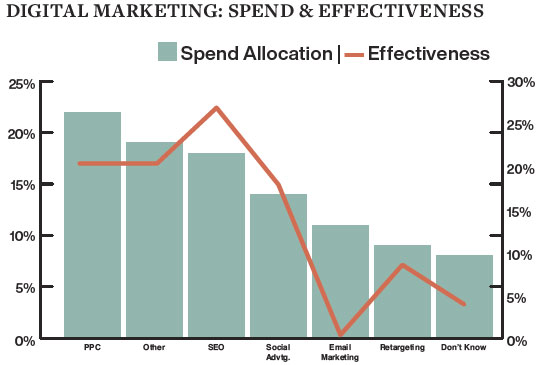

Digital Marketing: Spend & Effectiveness

Digging deeper into the digital category, we asked participants how they spend their digital dollars and what's performing for them. While PPC accounted for the highest spending percentage, SEO performed best in terms of how respondents ranked the effectiveness of their digital marketing spend, outpacing all other digital categories. The "Other" category represents digital marketing efforts that were not specified in this slide, such as other business websites.

"There are many studies, including our own data, that show email marketing success," said Phibbs. "Perhaps marketers could evaluate their email marketing strategy to determine improvements for engagement and click-throughs. Subject lines, headlines, and types of content all make a difference in engaging with the customer."

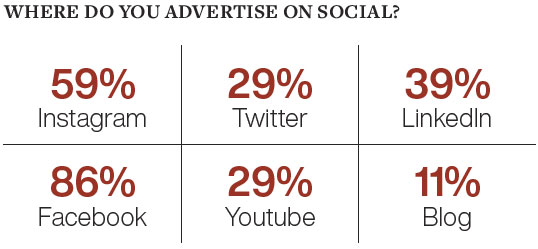

Where Do You Advertise on Social?

Social media has become known as a cost-efficient way to engage customers in conversations with your brand. It's no surprise respondents named Facebook as their primary platform for marketing spend (86%) and for driving revenue (83%). One surprising statistic was the use of Instagram for advertising (59%), yet only 13% said it was driving revenue for them. This is something we'll track in the coming years as social media marketing choices by franchisors continue to evolve in response to changing consumer preferences. Phibbs emphasized the importance of ensuring that your social media vehicle of choice is a match with your target audience.

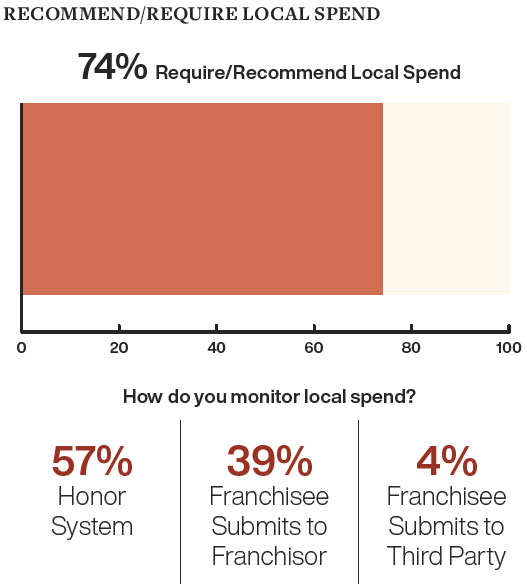

Recommend/Require Local Spend

Responses to this question provided a picture of how franchisors address and monitor local marketing spend. Three of four respondents require or recommend spending on local marketing. What was surprising is that 57% of the brands responding did not have systems to ensure that each location was spending at the local level. And only 39% had franchisees submit local marketing spend reports and/or receipts to corporate, while 4% had a third-party reporting program.

"I was surprised to see these results," says Phibbs. "Local store marketing is critical to growing unit revenues, and it's critical to building brand awareness to sustain sales until there are additional locations developed in the market. From that point, each location must continue to market within the community to further build the advertising dollars that will help them grow into additional forms of media (TV, radio, and print).

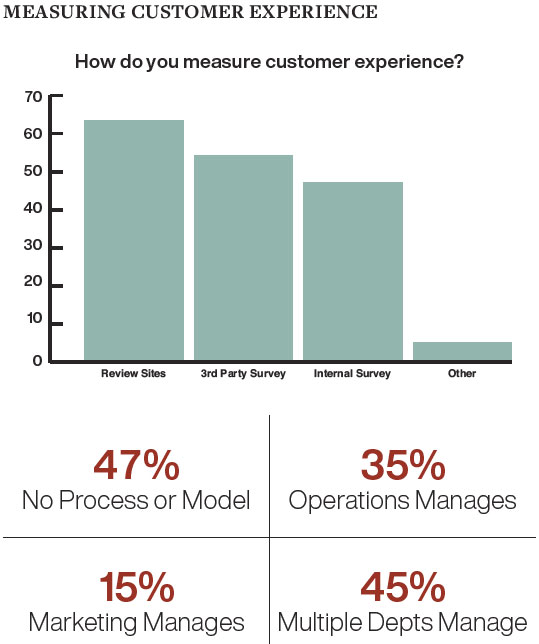

Measuring Customer Experience

Customer perception of brands is no longer simply transactional. Today's consumers want to have an experience with your brand, to feel they are part of something special. Accordingly, customer experience has become a huge focus for brands looking to identify the processes, metrics, and responsibility for the guest experience. While nearly half (45%) reported that multiple departments manage this, slightly more (47%) said they had no process or model for this. About a third (50%) said operations had sole responsibility for the customer experience, but only 15% said marketing was responsible.

Ordering Information

For more information and to order the 2019 AFMR, visit afmr.franchiseupdate.com. The price is $175 until December 31, 2019 and $299 after that.

Share this Feature

Recommended Reading:

FRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Franchise Growth

- Franchise Operations

- Open New Units

- Franchise Leadership

- Franchise Marketing

- Technology

- Franchise Law

- Franchise Awards

- Franchise Rankings

- Franchise Trends

- Franchise Development

- Featured Franchise Stories

FEATURED IN

Franchise Update Magazine: Issue 4, 2019

The franchise listed above are not related to or endorsed by Franchise Update or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The franchise listed above are not related to or endorsed by Franchise Update or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.