The Running of the Bull: How durable is 2024's market rally?

“Risk means the chance of being wrong—not always in an adverse direction, but always in a direction different from what we expected.”—Peter Bernstein

One of the most frequent questions we get from clients is, “How sustainable is the current market rally?” The question implies that the strong double-digit rise over the past six months must be too much of a good thing. But according to market technicians (those who follow chart and price movement patterns), “the trend is your friend” and a rally in progress is likely to continue in that direction, even if there is some choppiness along the way.

After a brutal 2022 with its double-digit declines in stock and bond markets, both key asset classes found their footing by late 2023, reaching new highs by year’s end. Early on in the equity market rally, the returns were generated by just a handful of stocks—the “magnificent Seven”—all beneficiaries of the latest Wall Street darling du jour, artificial intelligence. Importantly, the rally broadened out by the end of the year, carrying wide swaths of individual stocks, industries, locales, and market capitalization tiers with it.

While an interim pullback of 10% to even 15% or more would not be unusual, we see enough underlying strength to suggest the current bull has longer to run. In fact, given a host of structural trends, a multi-year positive trend is possible. Listed below are a few key underpinnings to a positive case as well as a few potential headwinds to keep things balanced.

Tail Winds

The economy is humming along nicely with solidly employed and spending citizens and decelerating inflation. Decelerating inflation has the U.S. Federal Reserve and other Central Banks sending strong hints that the interest-rate-hiking cycle is over. This gives creditors and businesses alike the opportunity to firm up models and makes them more likely to go forward with plans for expansion, capital expenditures, and other business combinations.

Artificial intelligence has hit the mainstream after more than a decade of experimentation by companies in a wide swath of industries, including energy, healthcare, technology, logistics, retail, investment, services, etc. Data center spending has ramped up markedly as demand for processing power has accelerated.

In addition, investors’ risk appetite has returned, and the market rally continues to broaden in scope. Potential investors are looking for lower valuations and feel comfortable going further afield in their searches.

Substantial fiscal stimulus remains in the U.S. system thanks to the CHIPS and Science Act, the Inflation Reduction Act, and the Infrastructure Investment and Jobs Act. Spending on many infrastructure, grid, reshoring, and other major projects is only just now starting to flow.

There have been nascent signs of life in the mergers and acquisition market. Cash coffers raised in recent years at private capital and VC firms need to be spent.

Companies continue to rightsize their businesses and innovate, as evidenced by a host of announcements during the most recent earnings season. Corporate margins remain near all-time highs as recent pricing power holds even while cost pressures lessen.

Headwinds

Two hot wars in critical commodity and shipping regions continue to pinch progress in select areas. Escalation, or the involvement of other regional players such as Iran, could destabilize markets.

Political strife and a long contentious presidential election cycle could impact current congressional action/inaction and weigh on investor psyches. The election itself, depending on the specific outcome, could lead to changes in corporate policy for energy, imports, immigration, and more, particularly if there is a single-party sweep of the White House and both houses of Congress.

Dislocations in some regions and segments from rolling maturity walls in various types of commercial real estate, including downtown office, multi-family, and warehouse, could prompt bumpy market behavior and/or a rethink of the “risk on” attitude.

A suspicion

Markets are always a complex interplay of countervailing trends. Given a preponderance of constructive secular themes, we suspect enough positives undergird the present situation to allow the bull to continue its overall positive bias for some time to come.

Carol M. Schleif is chief investment officer at BMO Family Office, a wealth management advisory firm delivering investment management services, trust, deposit, and loan products and services through BMO Harris Bank. To learn more, visit bmofamilyoffice.com.

Share this Feature

Recommended Reading:

FRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Franchise Growth

- Franchise Operations

- Open New Units

- Franchise Leadership

- Franchise Marketing

- Technology

- Franchise Law

- Franchise Awards

- Franchise Rankings

- Franchise Trends

- Franchise Development

- Featured Franchise Stories

FEATURED IN

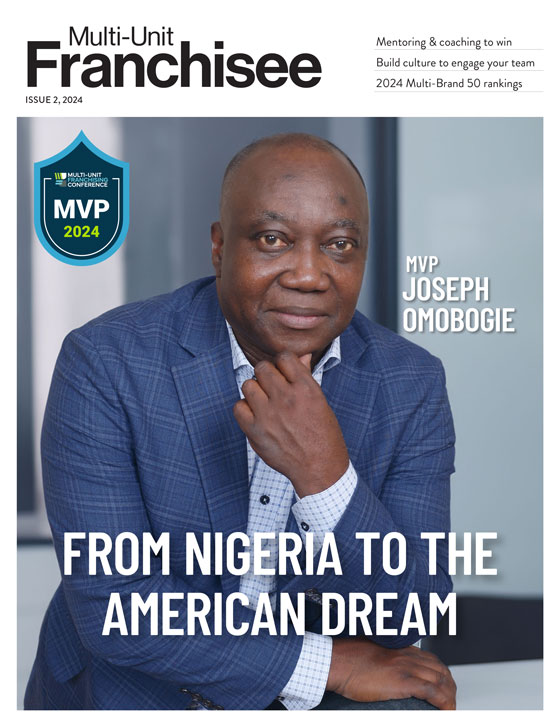

Multi-Unit Franchisee Magazine: Issue 2, 2024

$150,000

$500,000

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.