Invest in Tech: Maximize the value of your business

Multi-unit operators focused on running their business can lose sight of key drivers that improve financial results. Investing in and incorporating up-to-date technology is more important than ever, especially if you are considering a sale of your business in the near future. To remain relevant among the competition and maximize the value of the business upon sale, sellers should ensure that the technology for their business is keeping pace in today’s dynamic environment.

Buyers also will want to ensure that any acquisition target has the appropriate technological infrastructure to compete. If it doesn’t, sellers should not expect buyers to pay top value because buyers do not give sellers credit for initiatives that they implement post-sale.

Complete digital platform

The early winners during the Covid pandemic were brands that invested in technology. The best performers included concepts that had a complete digital platform offering online ordering, mobile ordering, loyalty, and third-party delivery capabilities. Valuations for brands that were not digitally ready have lagged behind brands that invested in technology early on.

These investments have continued to pay dividends as off-premises sales, particularly dining, continue to be favored by many post-Covid. Customers have become accustomed to the accuracy, speed, and convenience online and mobile ordering provide. Established leaders in technological innovation typically practice continual improvement to stay ahead of the competition and customer demand.

Big data and AI

To remain relevant among consumers and in the M&A market, brands must continue to evolve by investing in technological advancements, including big data and AI. Right now, we are in the initial phase of AI’s impact on business. Successful adoption of new ideas and processes will accelerate change at all levels of your organization at a pace no one has ever experienced. Brands and companies that best figure out how to incorporate and implement AI solutions into their businesses most quickly will have a clear advantage.

McDonald’s has opened its first highly automated restaurant in Texas. The unit is smaller than the brand’s average footprint and eliminates staff interaction with customers. Orders are placed through the app or a kiosk, and a conveyor belt distributes them through a drive-up window. Similarly, Wendy’s is moving to an AI-enabled drive-thru, and Taco Bell is implementing an automated factory-like store. The best brands and leaders will use AI to reduce costs, enhance the experience, and generate a more cohesive growth strategy. These advances are still a work in progress, but expect rapid changes and adoption of technology that works.

Operators have been able to use behavior-related data gleaned from apps to provide customers with better, more consistent experiences at their stores, resulting in revenue growth. In real time, apps can provide customers with rewards, promotions, and enticements to try new products. Location services are another game changer for operators who use them. Apps and companies providing comprehensive location analytics can be extremely useful for operators looking to understand their customers and attract new ones. Location apps also help with site selection and can even reach potential candidates for employment.

Companies also are using technology to improve and enhance their relationships with employees. Technology can make scheduling, benefits, and PTO much easier to manage. Shift and store managers will be more successful as they become more comfortable with using tech tools.

Capital markets and technology

As technological innovation accelerates, buyers, risk capital, and debt will flow to the brands and franchisees that have best adapted to changing technology. Those with the management and staff to incorporate and drive future innovations will cut costs, improve service, and enhance the unit economics of their brands. Brands and their franchisees that have developed a strong technological infrastructure recognize that these enhancements improve not only the day-to-day management of the business, but also their prospects for a successful capital raise or premium valuation upon exit. If sellers want a premium in an exit or best alternatives in a capital raise, it is best to invest and incorporate enhancements before going to market. Buyers and capital sources rarely give credit for what might happen, especially when it comes to proposed technology upgrades and accompanying improvements.

Conclusion

What should brands and operators do now? First, allocate time and resources to evaluate different technology-related solutions. Pay attention to what i`s being done successfully at competing brands and in different, but related, industries. Make sure what you are implementing has been tested and provides value. Be an early adopter, but not a guinea pig, and be prepared to make corrections and adjustments.

Failure to adapt won’t result only in reduced sales and profitability—it could make your brand obsolete. To maintain market share, brand leaders must focus on what’s next. Implementing new technology enhancements is not a one-time undertaking. Technology is ever-changing and demands continual improvement, which is particularly important if you are looking to maximize the value of your business upon sale.

Carty Davis is a partner with C Squared Advisors, a boutique investment bank that has completed hundreds of transactions in the multi-unit franchise and restaurant space. Since 2004, he’s been an area developer for Sport Clips in North Carolina with more than 70 units. Contact him at 910-528-1931 or [email protected].

Share this Feature

Recommended Reading:

FRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Franchise Growth

- Franchise Operations

- Open New Units

- Franchise Leadership

- Franchise Marketing

- Technology

- Franchise Law

- Franchise Awards

- Franchise Rankings

- Franchise Trends

- Franchise Development

- Featured Franchise Stories

FEATURED IN

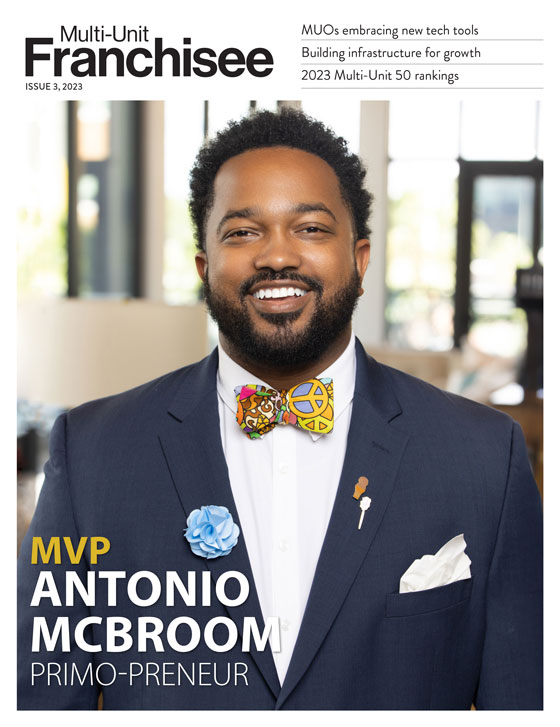

Multi-Unit Franchisee Magazine: Issue 3, 2023

$400,000

$300,000

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.