Mutual Aid Society: Landlords and Tenants Are in this Together During Covid-19

The world has changed… and we are all facing uncertain times in our lives and our businesses. Landlords and tenants alike are trying to figure out how to get through these uncharted waters.

As landlords, we are negotiators and we are collectors. In general, we are not prepared to deal with widespread rent relief requests. In most cases, the tenant has been forced to close their business because of state and local mandates. Tenants are forced to furlough their employees, and revenue is virtually cut off. Landlords are faced with rising vacancy rates and downward pressure on rent relief from tenants.

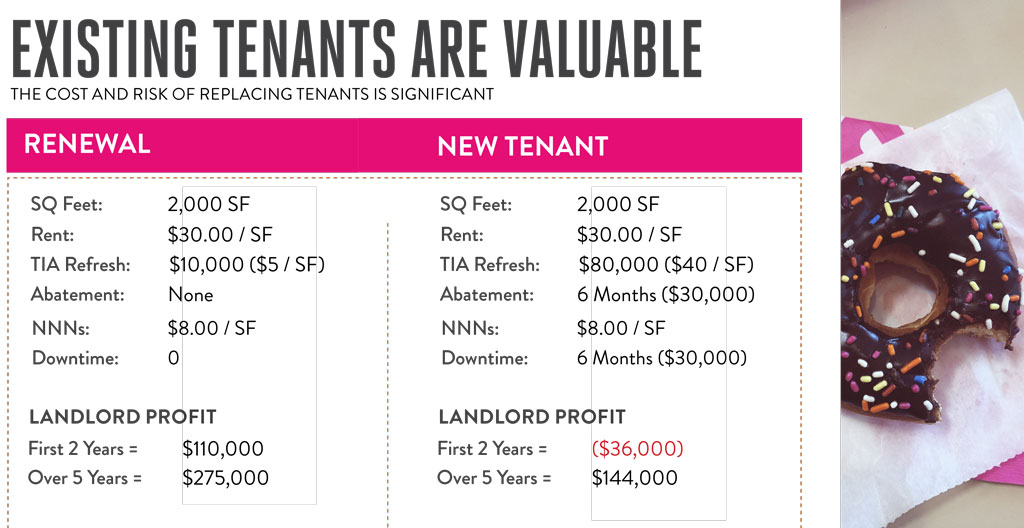

As tenants, we believe we are valuable… Recently, I did a comparison for a client where we compared an existing tenant to a new tenant over a 5-year period. Based on an assumption of a 2,000-sq.ft. space at $30/sq.ft., the existing tenant would generate a profit of approximately $110,000 in the first 2 years and $275,000 over 5 years – while the cost of a new tenant after downtime for build-out and landlord improvement costs, would net a loss of $36,000 in the first 2 years and generate a profit of approximately $144,000 over 5 years.

What should a tenant ask for?

What is reasonable? Before I make any suggestions, I would share this with you:

Most of my tenant clients have requested 3 months of rent relief, either in abatement or deferral. If you are able to secure an abatement, that would allow you time to reopen and ramp up again with no pressure on rental payments. If you are able to get a deferral, I would ask that payments get spread over the balance of the lease term, affording you ample time to repay the deferred amount. Be sure to remind the landlord that you are confident you will get through this if they can assist, and you look forward to rebuilding your business.

Another option is to consider using some or all of your security deposit during these tough times. If you have been a model tenant, the landlord should be comfortable with having you use your security. This is so please realize the landlord is not giving up anything and getting paid in full. At the end of the day, try to get a reasonable relief agreement with your landlord. give your landlord attitude or shut down the conversation.

Please try to stay away from discussions regarding a long-term lease extension. No one knows just yet what the market will look like when this is over. The market may be 10% lower and more space available in many areas.

Of course the landlord will say that federal funds are available, you should submit your application, and then you can pay your rent. Although this may be true, if you have applied I am sure you realize it may take up to 4 to 6 weeks to get funded, if not longer.

Of course the landlord will ask if you have business interruption insurance. Most policies exclude epidemics, etc. Please let the landlord know that they have a copy of your policy and they are also listed on the policy as “Additional Insured.” They also have business interruption in their policy. How is that working out?

Another popular response is: Please submit a long list of documents including the last 3 years of your tax returns. Frankly, this is absurd!

On March 31, you were a tenant in good standing. On April 1, you are considered in default if you were not able to make April rent. This is a nationwide epidemic, not an isolated one.

I would ask: “Can you pause my rent until I send you the information and until you are able to review all the information?” We all realize you are closed, and that there is revenue. This is just a stall tactic to prolong any decision.

In many states, there are mandates that preclude any evictions resulting from non-payment of rents during Covid-19. No one wants to have lawyers involved. That will just add costs to both parties at a time when both need to minimize their expenses and not add to them, just because they can’t seem to agree on what I consider an absolute national epidemic. Hopefully, your conversation does not end up going down that rabbit hole.

Some final advice

Your landlord is a long-term partner you will need to work with in the future.

1) Communicate early… communicate in writing… communicate reasonably.

2) Know your lease. Be sure to review it you communicate with your landlord.

3) Put all requests in writing.

4) Do not act impulsively or with emotion. This is not the landlord’s fault.

5) Leverage your track record of on-time payments and stress your ability to overcome this temporary situation with some assistance from your landlord.

Hoping you are all safe and strong. This too, shall pass, and make us even stronger as entrepreneurs.

Rocco Fiorentino is the Franchise Practice Leader at Keyser. He can be reached at 609-206-4300 or [email protected].

Share this Feature

Recommended Reading:

FRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Franchise Growth

- Franchise Operations

- Open New Units

- Franchise Leadership

- Franchise Marketing

- Technology

- Franchise Law

- Franchise Awards

- Franchise Rankings

- Franchise Trends

- Franchise Development

- Featured Franchise Stories

FEATURED IN

Franchise Update Magazine: Issue 2, 2020

The franchise listed above are not related to or endorsed by Franchise Update or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The franchise listed above are not related to or endorsed by Franchise Update or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.