What's the Deal? Buying and selling franchises during Covid

“Exceptional circumstances, such as those of Covid-19, require a blend of courage, clarity, and humility. The biggest enemies of good decision-making in times of crisis are neither uncertainty nor ambiguity; they are, rather, over-confidence, procrastination, and incomplete or biased data.” – Deloitte report

Franchise sales are taking longer. This is a great time to be a buyer. This is a great time to be a seller. No one’s doing deals right now. 2020 was slow, but 2021 will be a strong year for M&A. There are plenty of opportunities in 2021, but caution is advised.

These are just some of the opinions and predictions we gathered from multi-unit franchisees and franchise sales and M&A pros about what they saw in 2020, and where they see the market for selling and buying franchise units in 2021—unknowns and all. Despite all, decisions must be made, budgets (flexible ones!) finalized, and growth strategies firmed up.

“There was a very healthy market for franchise sales up until the moment Covid hit, which put a halt on pretty much all transactions for most of the time since,” says Greg Flynn, founder, and CEO of the Flynn Restaurant Group, the country’s largest franchisee with nearly 1,300 restaurants nationwide. “Like all transactions, everything was put on hold because people were focused on survival.”

“Acquisition has always been part of our growth strategy, but it’s now on hold,” says Gary Robins, a multi-unit franchisee with 65 Supercuts salons in Pennsylvania, New Jersey, Delaware, and Maryland. “I’m in an industry that has been hit very hard by the pandemic. Personal services in the restaurant, gym, and hair salon categories have not recovered like some of the other businesses. This makes it difficult to plan for the future,” he says.

“In my experience, there is an increase in the number of people wanting to sell their units. People also have identified themselves as wanting to buy units, but I haven’t seen many transactions happening,” says Robins. “There are plenty of sellers and plenty of buyers, but no transactions, so what does that mean?”

The past several years were very strong in M&A and buying and selling activity—that is, before Covid, says Dean Zuccarello, founder and CEO of The Cypress Group, a restaurant and franchise investment banking firm. “The volume of activity was a little bit quiet during the past three quarters of 2020,” he says, but heading into 2021, “we’re starting to see some things pick up a little.” Nevertheless, he says, even brands that did well during the pandemic were still cautious about selling into a market with so much Covid-related uncertainty.

“With the vaccines coming out there’s light at the end of tunnel, and I expect we will see increased activity across the board,” says Zuccarello. “People thinking about selling before Covid will pull the trigger, and we will see some opportunistic transactions to shore up balance sheets.”

“People are starting to believe they’re going to survive, especially in QSR where transactions are starting to come back to life,” says Flynn, whose current brands are Applebee’s, Panera Bread, Taco Bell, and Arby’s. “They’re coming back now, but very slowly. People are still unsure about this resurgence and how long it will last.”

TTL: THINGS TAKE LONGER

On the whole, deals are taking longer, for variety of reasons. “You have people in extreme situations, both good and bad,” says Ken Stein, founder and managing director of

Kensington Company & Affiliates, an M&A company with a focus on franchising. “Some deals might take longer, some might go quicker,” he says, determined by the specifics of each situation.

For instance, for new development, he says lenders and investors are being “very cautious.” On the other hand, “You’re getting these great leases, so it becomes exciting because of real estate opportunities that were not available before,” says Stein. “Smart money is thinking longer term, buying up new brands, getting rid of outliers, and looking for longer-term leases.”

“There seems to be a general sentiment that it’s the wrong time to sell a business because of Covid. This has depressed the market for sellers,” says Max Friar, a partner with Small Business Deal Advisors. However, because of supply and demand (which applies even during pandemics, perhaps more so), he sees a more positive environment for sellers than buyers.

“There is high demand for established, profitable businesses and a lower supply of businesses to purchase. If you’re a buyer and looking for a business that is underperforming, they’re out there, but I don’t think it’s been a buyer’s market,” he says. “Most sellers damaged by Covid have just hung on, not run to the exit door.”

As a result, says Matt Baas, also a partner at the firm, “Sellers are getting multiple offers on every opportunity, which is great for them.” And while multiple offers may drive up selling prices somewhat, he says multiples have remained about the same. However, the time to close a deal has not.

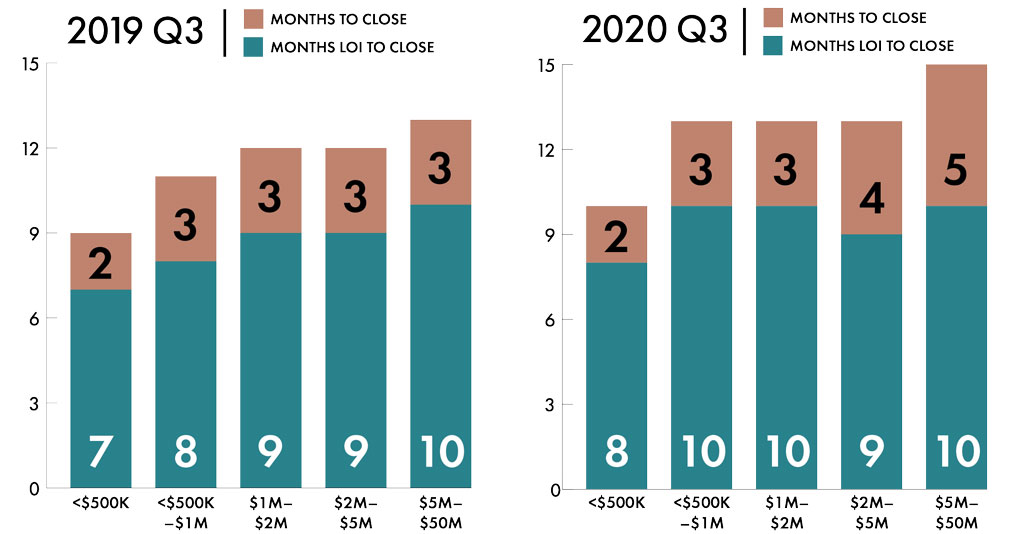

Due diligence is taking longer, bankers are being more cautious, and generally there are just more hoops to jump through in today’s environment than pre-Covid. Deals, says Friar, are taking about 30% longer on average, which can equate to 2 or 3 months, sometimes more.

Source: International Business Brokers Association (IBBA) and the M&A Source

“Everything is taking longer right now because of uncertainty, some disconnect between valuations, lenders taking longer, and if there’s a QE report required it’s going to be harder to close,” says Carty Davis, a partner with C Squared Advisors, a boutique investment bank that has completed hundreds of transactions in the multi-unit franchise and restaurant space, and an area developer for Sport Clips in North Carolina with more than 70 units.

Davis says it’s hard to determine exactly what Covid-related adjustments should be made to normalize earnings. “I sympathize with the third-party firms doing the QE report because it’s hard to account for Covid. Everyone was affected and will have to adjust earnings. This will complicate transactions in the short term.” Third parties looking at financial statements to determine if earnings are sustainable never had to do anything like this before, he adds.

“You need to be patient, creative, and prepared for unexpected issues. You can anticipate some noise in any M&A transaction. Unexpected issues will come up.”

VALUATIONS

“People are approaching me about buying their units, but I’m stuck for valuations. I’m not willing to pay pre-Covid pricing for a unit,” says Robins, the Supercuts operator. “I also recognize that if you were to use the same valuation methods during Covid that you used pre-Covid, the businesses are probably worth more than what that valuation would indicate from an empirical standpoint. The reality is that it’s somewhere in the middle.”

Bottom line for Robins entering 2021? “Because I haven’t seen other transactions, I can’t wrap my head around objective criteria about what that middle ground will be, so I’ve just stayed away.”

“What we’re seeing is what I’ll call the ‘normal’ M&A market on hold right now,” says Davis. “There is no ‘This is going to trade at this multiple’ because every situation is unique.”

“My general take is that valuations on QSRs are up. There’s still capital in the marketplace looking for transactions, and Covid shined a light on the resiliency of QSR,” says Zuccarello. “From a risk-adjusted point of view, this segment actually did well while others cratered, which has resulted in higher multiples in the QSR segment, while in other segments they are lower.”

Add to that the ongoing uncertainty about the extent and timing of a recovery from the pandemic—with the ongoing wild cards of anti-maskers, anti-vaxxers, politics, and the appearance of new forms of the virus—and many franchisees simply have decided to wait it out.

And while valuations are up generally for brands that increased revenue during the pandemic, other factors cloud the picture for both buyers and sellers. Valuations are not only a moving target, they can vary even within an individual franchisee’s holdings.

“We will be selling a network of five units in the same brand and getting very different types of multiples,” says Stein. “A lot of that has to do with how badly the seller wants to sell, which is dictated by two things: 1) debt, how leveraged they are; and 2) distance, as many operators with outlying stores don’t want to deal with that any more.”

MOTIVATED SELLERS

“People are looking for bargains, and there are great bargains,” say Stein. One potential source of bargains is multi-unit operators selling units outside of their prime geographical area. These could include units that don’t fit into the franchisee’s network any more or are not in their core concentration; or they need to raise cash because they’re over-leveraged and want to contract and preserve what they can.

For example, take a franchisee with 20 units in Massachusetts and 4 in Maryland. “It’s not far, but it’s not easy to fly and a long drive. Who wants to have that hassle?” says Stein. “There are a lot of opportunities out there where people are reconfiguring their network.”

Covid-19 travel restrictions have not only made short airplane hops or drives of even a few hours difficult, they’ve caused some multi-unit operators to rethink they have their units. This opens newfound opportunities on the buyer side for operators looking to expand into a new brand or increase the concentration of their existing brands in their geographical area.

“If you can’t drive it’s a lot more problematic than it was before Covid,” says Davis. His company was working with a franchisee looking to sell about 20% of the QSR units purchased as part of a bigger package because they were outside the buyer’s core area. “You can have more G&A synergies, more efficiencies, if units your are closer together,” he says.

Then there are the multi-unit operators who have accelerated their timetable to sell and retire, most notably Baby Boomers. “Many are saying ‘I’m done’ and are selling at reasonable valuations,” says Stein. They don’t want to deal with all the new regulations, from the onslaught of ever-changing governmental mandates to the rules (and expense) required to adapt to Covid-related health and safety protocols—with the possibility of one day wondering what to do with all that Plexiglass.

MOTIVATED BUYERS

“Smart young operators are buying, and there’s a lot of money on the street looking to lock in low market-value leases and interest rates,” says Stein. Those operators are mainly looking for two things, he says: 1) great brands doing well in fragmented markets with excellent margins that they can pick up for a reasonable price; and 2) securing great long-term leases, like many did in 2008 or 2009, in highly visible locations with ample parking.

“Some are getting 20-year leases, even at below today’s prices,” he says. These buyers are looking for consistent cash flow and, with an eye on the longer term, will pay the multiple being asked.

Another source of potential buyers is the thousands of corporate executives laid off in 2020—a traditional source of franchise candidates, especially when the economy tanks and people are looking for more control of their economic future. “We are seeing a surge in people wanting to get into business,” says Terry Monroe, founder and president of American Business Brokers & Advisors.

Disney, airlines, hotels, and many other sectors hit hard by the pandemic are laying off experienced executives and managers who were making upward of $100,000 a year and have capital to invest, says Monroe. “Where are they going to find a similar job at 50? They can try to get a new job or buy themself a job—a business or a franchise. If I were a franchisor, I’d be promoting heavily right now. The pandemic did purge the system of weak operators and units, so a lot of good real estate opportunities became available.”

CAUTIOUS LENDERS

Lenders also must navigate carefully in a time of uncertainty. “Most are asking for more forecasts, backlogs, and 2021 projections—a newer requirement, versus last year’s tax returns,” says Sam Scharich, director of business development at Small Business Deal Advisors—yet another factor in stretching out deal timelines.

Still, says Monroe, “This is the greatest time in the world to be a buyer or seller. Interest rates are as low as they’ll ever be, so you can buy more business for the same dollar.” He compares potential franchisees to house shoppers. “People don’t buy houses based on price, they buy them based on the monthly payment.”

“There have been historically n low interest rates for quite some time,” says Zuccarello. “It’s been a great interest rate environment for several years. I don’t see that changing.”

And while interest rates for capital to fund expansion have remained low since March, each new deal still is problematic for lenders, who must factor in all the uncertainty, past, present, and future as Covid continues to rage in early 2021.

Flynn points out another reason for deals taking longer: banks are still dealing with the forbearance they gave borrowers in 2020.

Scharich also notes the uncertainties still remaining around PPP loans regarding repayment, forgiveness, taxes, accounting, and legal paperwork, which can drag out deal timelines even further.

YEAR OF THE DRIVE-THRU

Drive-thrus in 2020 provided a big competitive advantage to restaurant brands that already had them, or that were able to add or build them quickly. Drive-thrus also have permanently changed the distribution model for food franchises, says Davis, accelerating the adoption of an existing trend by 2 or 3 years.

“You can see it when you’re driving, with long lines at the drive-thrus,” says Stein. Drive-thrus, he says, allow home-bound consumers to be out doing something—but safely from inside their vehicles as food brands ramp up and promote their “contactless” service at the drive-thru window, in the parking lot for pickup, and for home delivery.

“If you have drive-thrus and a delivery system, you’re doing great. If you’re a sit-down, you’re probably getting killed,” says Stein.

Flynn says that his Applebee’s were well-positioned going into the pandemic, with dedicated parking spaces for customers to pick up their order or have employees run it out to their car. “We already had the technology in place,” he says. He also emphasized the importance of marketing that capability to let consumers know your stores have a good online ordering and payment system in place.

“The digital aspect is very important,” says Davis. “Those already functional digitally, where customers did not have to interact with employees, clearly are the winners.”

Covid also has accelerated the trend of both franchisors and franchisees investing in delivery technologies with Doordash, Uber Eats, and a plethora of local delivery services. To reduce the cost, some brands are working on a “hybrid” model, expanding their online reach through the third-party websites, but delivering it themselves to control the “last mile” to the customer’s door and ensure that brand standards and food quality are maintained. The delivery model is still evolving, with the jury still out on how much of this shift will be permanent if-and-when Covid finally recedes and people start eating out again.

2021 OUTLOOK

“I think there’s going to be a tremendous amount of opportunity in 2021,” says Zuccarello. “Given what we’ve gone through, the natural tendency for buyers will be caution. I think that folks who tend to see the future, see down the road, will make some tremendous acquisitions.”

On the seller side, he says, people who had a good run before and through Covid might want to look really hard at this situation as well. And on the acquisition side, he thinks there will be a lot of opportunity. “It will be a different dynamic when buying a business, but people who have the capabilities and like to do deals will be back at it.”

“Over the course of my career, the best buys we’ve made have been when other people aren’t buying,” says Flynn. “I’d advise people to take a very long-term view and, if you can, use the opportunity of a crisis to buy at a lower price. It’s probably worth the risk.”

“For me, there’s always been a difference between risk and uncertainty. Uncertainty is you can’t measure it, it could go either way. Risk is the removal of uncertainty and can be analyzed,” says Robins. “I can’t measure the risk. So it makes investing for the future uncertain.”

So is it a great time for buyers and sellers? “I don’t know if that’s correct,” says Flynn. “The financing markets are not totally stabilized yet, making it very difficult to understand and value companies until things settle down.”

Nevertheless, Flynn has been actively looking to acquire hundreds of Wendy’s and Pizza Hut units, made available by NPC International’s bankruptcy. “The potential sale of NPC to [Flynn Restaurant Group] would create a franchisee on a scale far beyond any other U.S. company, giving the company six brands, restaurants across the U.S., and annual sales of $3.9 billion,” wrote Jonathan Maze in Restaurant Business in December.

FINAL ADVICE

- “Everybody thinks there are bargains galore, but that’s just not true,” says Stein.

- Don’t base your decisions going forward on the pandemic thought process, says Monroe. “Life is not linear. What’s permanent? I would be concerned about building ghost kitchens, or coming up with a new brand. I’m a brand guy. People buy brand equity.”

- “Deals are probably going to take more time,” says Davis. “There’s less certainty and less debt availability. So do your homework with your lender and make sure they’re supportive. And be creative! Get some conversations started if you want to buy. Don’t wait for the deals to come to you. Try to be proactive and go after the opportunity. Sellers are motivated to move quickly, and sometimes a preemptive offer is more attractive than going through an elongated sales process.”

- As ever, if you’re looking to sell, “Be sure your house is in order, with clean financials, documentation, and an annual forecast,” advises Friar. Speak with M&A advisors, financial advisors (tax, retirement, timing), attorneys, and discuss the psychology of selling with anyone and everyone who might be affected, from partners to lenders, family to friends. “The M&A process is still very new for many sellers, so it’s good to start well in advance. Look at your retirement plans and timetable and tax consequences a year or two before you even go down this road.”

Share this Feature

Recommended Reading:

FRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Franchise Growth

- Franchise Operations

- Open New Units

- Franchise Leadership

- Franchise Marketing

- Technology

- Franchise Law

- Franchise Awards

- Franchise Rankings

- Franchise Trends

- Franchise Development

- Featured Franchise Stories

FEATURED IN

Multi-Unit Franchisee Magazine: Issue 1, 2021

$500,000

$500,000

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.