A Smooth M&A Integration: Investing in culture, coaching, and mentoring

Acquisitions are critical strategic tools for businesses seeking growth, diversification, and competitive advantage. However, the success of a transaction is not solely determined by financial metrics or strategic fit.

The integration of distinct corporate cultures, along with effective coaching and mentoring, plays a pivotal role in realizing the full potential of a merger or acquisition. Understanding the importance of culture, coaching, and mentoring is paramount in ensuring the smooth integration of teams.

Cultural dynamics

Culture presents itself through every aspect of an organization, influencing behaviors, decision-making, and overall operations and performance. During an acquisition, cultural clashes can present significant hurdles, potentially derailing the integration process and jeopardizing the transaction’s success. Conducting cultural due diligence identifies potential synergies and areas of misalignment. The acquired company and its employees often feel threatened, primarily by the unknown. Remember this dynamic when integrating the new team into the existing platform and operating environment.

Integration challenges often arise due to differences in communication styles, decision-making processes, and work habits. These differences can lead to friction among teams and resistance to change from employees wary of the new corporate landscape. Addressing these cultural differences requires a strategic approach, emphasizing the importance of cultural integration in achieving a seamless transition. Successful acquirers prioritize integration because losing existing employees is rarely a good alternative.

The role of coaching

Coaching helps prepare leadership teams for the complexities of M&A transactions. Effective coaching can equip leaders to anticipate challenges, address resistance, and foster collaboration among merging entities. Leaders are encouraged to lead by example, demonstrating adaptability and a commitment to the unified vision of the merged organization. Nevertheless, many employees have not gone through a similar acquisition and can be surprised by the sometimes challenging and time-consuming process.

Effective coaching by an advisor helps build a resilient leadership team that can navigate the uncertainties of M&A, ensuring that the closing, as well as the integration process, is aligned with the strategic objectives of the transaction.

Mentoring for success

Mentoring is another critical element of a successful M&A integration. Mentors provide guidance and support to help mentees adapt to the new corporate culture, understand their roles and responsibilities, and explore career development opportunities after the merger. The presence of mentors can significantly ease the transition for employees, helping them to see change as an opportunity rather than a threat.

Mentors facilitate cultural adaptation by sharing their experiences and insights, which can help employees transition more efficiently and effectively. They also advocate for their mentees, ensuring that their concerns are heard and addressed in the new organizational setup.

Structure and culture

Franchise networks come in all shapes and sizes, which can affect culture. Family-run enterprises can often operate like true local small businesses, serving their employees and the communities where they are located. Large firms can run more like a corporation with formal corporate structure and practices. Mergers and acquisitions among widely different-sized organizations will have the greatest adjustment for employees.

Franchise brands also affect the culture of their franchisees. Brands can lose their focus on serving the franchisees’ best interests. They can get caught up in unit economics, growth, fee income, and serving their investors. All of these can have significant effects on franchisees currently in the system and potential franchisees attracted to the system.

Over time, companies may lose sight of the cultural elements that made them successful. Focusing on short-term objectives and immediate challenges can lead to a gradual erosion of the core values and principles that once defined the organization. Employees may become disconnected, lamenting, “This is not the same organization I started working for.” Franchisees can have the same attitude as culture changes, resulting in similar statements, such as, “The franchisor doesn’t care about my profitability anymore.” Both developments are problematic. A culture that took many years to develop and cultivate can disappear in a fraction of the time.

Be strategic

To effectively integrate culture, coaching, and mentoring into M&A processes, companies should establish clear guidelines, goals, and responsibilities. By emphasizing the collaboration of cultures with the mindset that “1+1=3,” you help create a unified and synergistic environment.

Proactive communication and dialogue are essential to avoid misunderstandings and rumors that could undermine the integration process. Establishing a post-merger coaching and mentoring framework can support employees throughout the integration, driving engagement and retention.

The success of M&A transactions extends beyond financial considerations. Understanding and integrating cultural dynamics, coupled with effective coaching and mentoring, are crucial for realizing the full potential of mergers and acquisitions. By fostering a collaborative and supportive environment, companies can navigate the complexities of M&A and achieve sustainable growth and success.

Tori Wagner is a vice president with C Squared Advisors, an advisory firm focusing on multi-unit franchisees and franchisors. She has worked with franchisees for more than a decade, advising clients through M&A transactions and raising debt and equity capital to support strategic initiatives. Contact her at 508-769-0097 or [email protected].

Share this Feature

Recommended Reading:

STAY CONNECTED

Subscribe to our newsletters to stay informed on the hottest trends in Franchising.

FRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Franchise Growth

- Franchise Operations

- Open New Units

- Franchise Leadership

- Franchise Marketing

- Technology

- Franchise Law

- Franchise Awards

- Franchise Rankings

- Franchise Trends

- Franchise Development

- Featured Franchise Stories

FEATURED IN

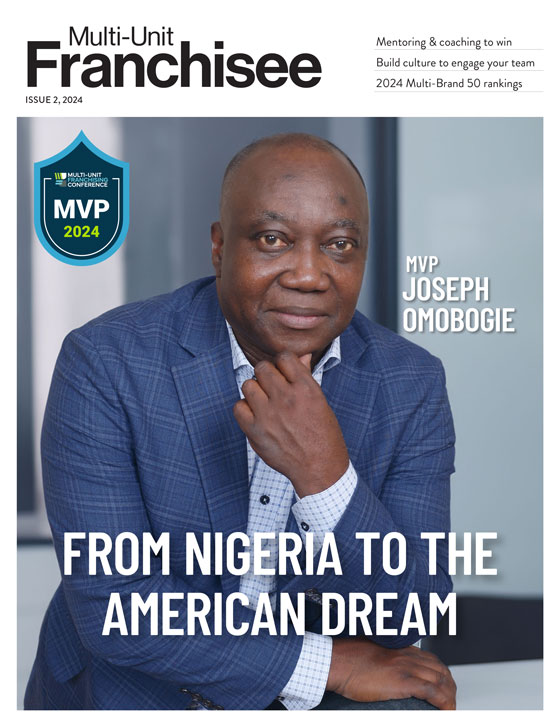

Multi-Unit Franchisee Magazine: Issue 2, 2024

$300,000

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.