Hardwired To Fail? Why We Need to 'Think About Thinking'

"After a crisis, we tell ourselves we understand why it happened and maintain the illusion that the world is understandable. In fact, we should accept the world as incomprehensible much of the time." -- Daniel Kahneman

After many years of relative calm, volatility returned to global markets in a noticeable way last fall. Pundits rushed to put context around the volatility--an arguably futile exercise if the above quote from one of the founding fathers of behavioral finance is to be believed. None of the woes blamed for the pummeling were new: trade wars, Iraq, Iran, Syria, rising interest rates, mid-term elections, strengthening inflation, Brexit, Italian bonds, and U.S. Federal Reserve policy, to name a few.

While economic fundamentals in the U.S. remain strong, there seems to be a growing unease, both about how much better things can get and how much longer this strength can be maintained. While we would hardly call the market's performance a "crisis," it did bring into stark relief some of the psychological ways that investors can do themselves harm over the short run. To be wise stewards of long-term assets, we must think about our thinking, often overriding our instincts during stressful market times.

Cognitive bias

The word "bias" has been in the news a lot lately across a broad spectrum of human endeavor. It's frequently been accorded a negative overtone, but all of us are born with cognitive (thinking) biases. It's how our species has continued to thrive. To understand how our biases may be affecting our long-term well-being, the key is to identify the particular biases we lean on most. To choose a more helpful course when needed, we must "think about our thinking."

Wikipedia lists 21 pages of cognitive bias with more than 185 examples of how our biology tilts our behavior. We deploy biases so frequently that we often don't recognize them. We suspect that increased volatility is here to stay, so the ability to recognize--and circumvent--our inherent biases may come in handy in the months and quarters ahead.

- Anchoring is the tendency to pin one's decision-making on a single (often recent) point of reference. Remember the headlines about the Dow breaching 20,000? Anchoring to market levels, individual stock or bond price levels, interest rates, etc. can shift our focus from where it needs to be: the relationship between price and economic value.

- Recency bias is the propensity to give recent history or events too much weight in decision-making, thereby discounting the potential effects of other events. Faulty analysis presumes history repeats itself, particularly recent history. But thorough analysis incorporates changing demographics, personal finance, and political, environmental, and economic shifts that affect both near- and long-term events.

- Confirmation bias involves seeking evidence that supports one's viewpoint, whether intentionally or unintentionally. Poking holes in one's theories and asking, "What if X didn't happen that way?" is a vital component of thorough due diligence. Probabilistic thinking and analysis also can help broaden horizons by facilitating analysis of a wide range of potential outcomes. Investing is seldom either/or (growth vs. value, active vs. passive) as much as it's X and Y. Dynamic, diversified portfolios contain a mix of investments to cushion from and participate in a variety of potential outcomes.

- Availability heuristic or cascade. Basically, the more an item is repeated, the more it becomes believed. For example, the notion that a 20 percent decline means a bear market is just an oft-repeated headline, not a hard-and-fast rule.

- Overconfidence effect. Having one decision or bet "pay off," especially in a big and/or emotion-filled way, has been shown to release powerful endorphins. Our brains are naturally drawn to such powerful chemical rewards and prompt us to seek more of the same.

- Loss aversion and negativity bias is the tendency to be more pained by losses than excited by gains. Humans also have a greater propensity to recall negative events, particularly when they were laced with strong emotion, and to react with undue force to future situations that evoke those memories.

- Herding instinct. We have survived for millennia by being part of the pack. Even today, when we are excluded from a group our brains flood our bodies with negative chemicals that come from the same sites as those for physical pain. We are hardwired to want to be part of the "in" crowd. That knowledge is why going against the investment herd, trimming when markets are up and headlines positive, can seem so terrifying. Developing a plan to regularly rebalance based on basic valuations and ranges established during quieter market times can circumvent these powerful influences.

The list of cognitive biases goes on, but the bottom line is similar: as part of our species' long-run survival, our brains are wired to seek order, consistency, and routine. None of these is prevalent in day-to-day markets, no matter how much effort we expend trying to predict outcomes. As such, we need to set up systems (regular rebalancing, valuation, and probability analysis, dollar-cost averaging in and out of assets) to circumvent some of our worst tendencies. And to take the time to pause, reflect, and think about our thinking--especially when volatility is rampant.

Carol Schleif, CFA, is deputy chief investment officer at Abbot Downing, which provides products and services through Wells Fargo Bank and its affiliates and subsidiaries. She welcomes questions and comments at [email protected].

Share this Feature

Recommended Reading:

FRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Franchise Growth

- Franchise Operations

- Open New Units

- Franchise Leadership

- Franchise Marketing

- Technology

- Franchise Law

- Franchise Awards

- Franchise Rankings

- Franchise Trends

- Franchise Development

- Featured Franchise Stories

FEATURED IN

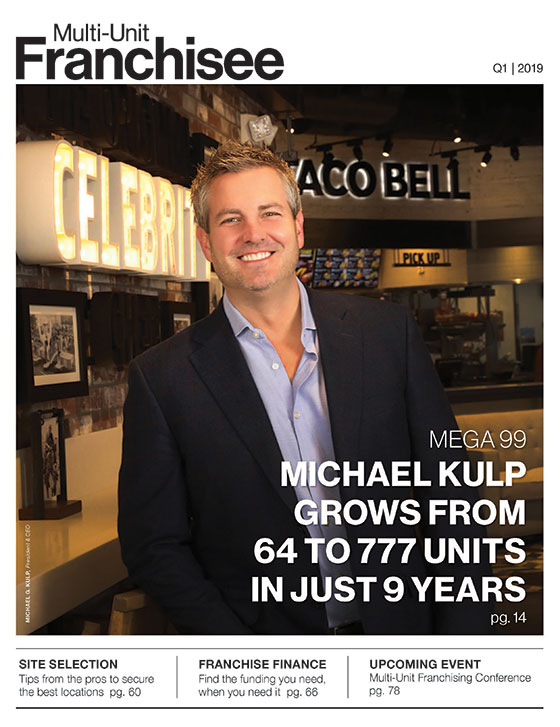

Multi-Unit Franchisee Magazine: Issue 1, 2019

$100,000

$84,500

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.