Growing Broke?: "Financial Gap" -- Know Before you Grow

"Obviously, if my sales are going up I will have more cash!"

Think again. Growth costs money, yet most entrepreneurs believe that much of their growth can be funded from their growing company. The sad truth is that, invariably, businesses on a continuous high-growth curve run out of cash and blow up.

Wouldn't it be helpful to have a financial tool that, in about 10 minutes, would enable you to predict, using your company's financial structure, how much money it takes to grow? There is, and that is what I would like to teach you in this column.

Fundamentally, there are only four sources of money to grow a business: 1) your equity (yours, neighbors, family, extended family, and anyone else you can talk into giving you money to help fund the cash-eating beast); 2) your suppliers giving you trade credit, which usually lasts only about 60 days, and after that you're on COD; 3) your retained earnings (usually small because we hire accountants to keep them that way to avoid paying taxes); and 4) the bank, your credit cards, and hard money lenders.

Determining our "Financial Gap" gives us the ability to go to the bank and answer two critically important questions: 1) How much will we need at various levels of growth?; and 2) How long will we need it?

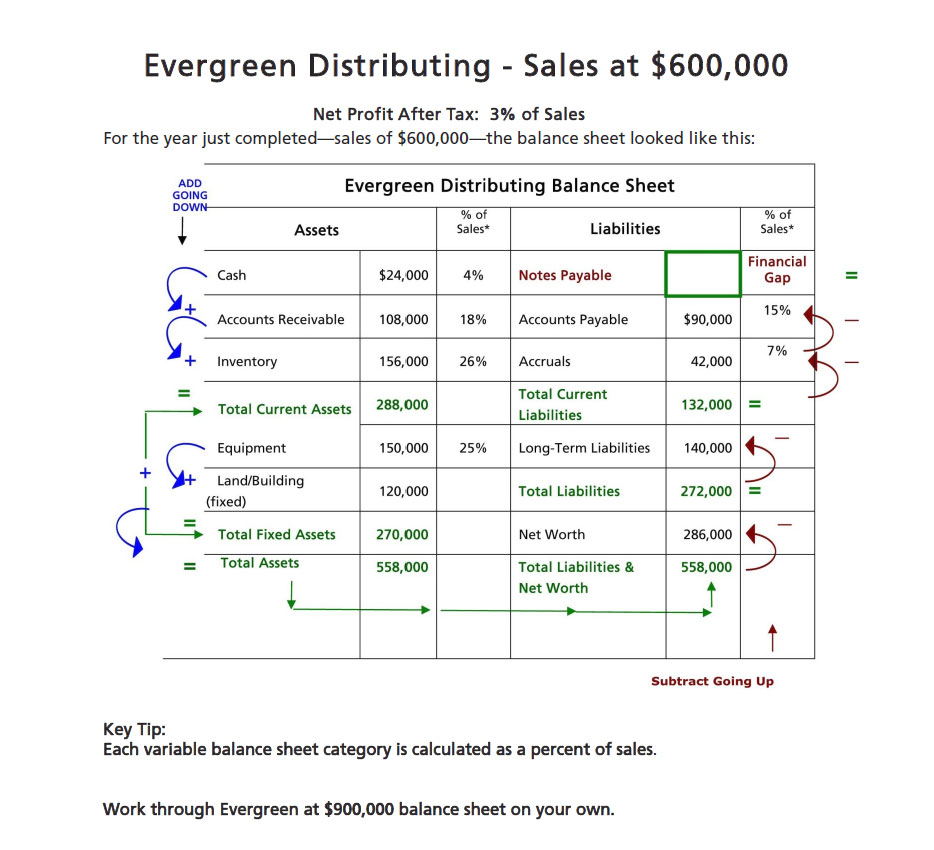

To calculate Financial Gap, we're going to do something entirely weird: we're going to take your balance sheet and cut it in half right below Total Assets. Then we're going to put Total Assets and Total Liabilities and Net Worth side by side as in the Evergreen Distributing illustration.

Then it gets even weirder. We're going to use the process of calculating your Variable Assets and Variable Liabilities--not as a percentage of Total Assets as you would normally expect, but as a percentage of the sales those Assets and Liabilities support.

So as you can see in the illustration, Evergreen Distributing, with sales of $600,000, has a balance sheet with Cash of $24,000, which represents 4% of those sales, Accounts Receivable at $108,000 representing 18% of sales, and so on. Then, as you can see, we calculate both the Variable Assets and Variable Liabilities in this process. (For a balance sheet illustrating this point, email me at the address below.)

Once we have those amounts calculated, we add going down the left-hand side of the balance sheet and calculate Total Assets. Amazingly enough, the balance sheet still has to balance, even when it's side by side, so those Total Assets now are moved over to the right-hand side and become our Total Liabilities and Net Worth.

Now things get even weirder, and totally counter-intuitive! As you can see, following the diagram, we're going to subtract going up the right-hand side of the balance sheet, taking our Total Liabilities and Net Worth and subtracting out Net Worth, leaving us with just Total Liabilities. We then subtract out our Current Liabilities, our Accruals, and Accounts Payable and find out that in the year Evergreen had sales of $600,000 they needed no short-term borrowing from the bank to create those sales.

Act II: Sales increase

Now, using that same financial structure, we are going to grow and project Evergreen at $900,000 of sales and predict very accurately what it will require in new money to pay for it--in this case, we're calculating our short-term line of credit.

Remember those four sources of money to grow? We're going to use one of them right now. We're going to project our earnings for next year at 3% of sales of $900,000 (the same 3% that they were at $600,000), which is $27,000. We are going to add them to our old Net Worth of $286,000 and create a new Net Worth of $313,000. In other words, we are using all of our retained earnings for next year to help fund our growth. But, as we will see, that will not be enough!

Now, using the same financial structure as we had at $600,000, we're going to calculate all of our Variable Assets and Variable Liabilities, based on the same percentages, but at a higher sales level.

At $900,000 in sales, Cash in Evergreen will go from $24,000 to $36,000, (4% of $900,000), Receivables will go to $162,000, (18% of $900,000), and so on for the rest of the calculations. Now we complete the process by adding, again going down the left-hand side of the balance sheet and discover that at $900,000 in sales, Evergreen will use $777,000 in Total Assets to create it. Even at this higher level of sales, the balance sheet still has to balance. That $777,000 now goes to the right-hand side and becomes our new Total Liabilities and Net Worth.

Now, repeating the weirdness, we subtract going up the right-hand side of the balance sheet and discover that for Evergreen to grow to $900,000 in revenue, the owners will need $126,000 in new debt to fund it. Thus, calculating Financial Gap gives you the great advantage to "Know Before You Grow."

The complete Financial Gap process is taught in our Profit Mastery University curriculum. Please contact us for more information.

Rod Bristol is executive vice president at Profit Mastery. For more than 30 years, franchisors and franchisees have improved their financial performance and unit profitability by following the Profit Mastery process: financial training, benchmarking, and accountability/bankability modeling. Learn more at www.profitmastery.net, 800-488-3520 x13 or email [email protected].

Share this Feature

Recommended Reading:

FRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Franchise Growth

- Franchise Operations

- Open New Units

- Franchise Leadership

- Franchise Marketing

- Technology

- Franchise Law

- Franchise Awards

- Franchise Rankings

- Franchise Trends

- Franchise Development

- Featured Franchise Stories

FEATURED IN

Multi-Unit Franchisee Magazine: Issue 4, 2017

$400,000

$250,000

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.