History Lessons: Investing for the long haul

There is the oft-repeated notion that history repeats itself. In market terms, the equivalent is watching participants’ moods swing from greed to fear and back again as they anchor to the recent past and rapidly move on from various traumas. Witness how the meme, crypto, and SPAC crazes of early 2021 quickly followed the bear market of 2020.

As a 40-year observer of markets, I’ve watched it happen time and again: both in broad markets (1987 crash, 1995–2000 tech boom, 2001–02 crash, 2006–08 housing bubble, 2008–09 crash, 2009–2019 bull market, 2020 crash and subsequent bull market); and in industries and asset classes (biotechnology three times, energy twice, technology three times so far, emerging markets, currency, IPOs, leveraged buyouts, SPACs, meme stocks, and a host of other things great and small). You get the picture.

Basically, when the good times are rolling, we seek news and economic tidbits that support that theory. When the prevailing mood changes, we find anecdotes to support the new theory. When enough investors are new and/or inexperienced, the current environment seems as if it will go on forever. A unique combination of momentum (“go with what’s working”) and inertia (“don’t fight the trend”) rule the day… that is, until some sort of exogenous shock causes a rewrite in thinking. Markets hate vacuums and regime change periods—which is precisely what we’re in the midst of, as detailed in my previous column.

Market participants like to convince themselves that markets are predictable based on economic performance or prospects, but therein lies part of the problem. The ability to predict is underwritten by being able to outline a pattern for underlying behavior, as asset markets consist of a compendium of aggregate <human decisions>.

As such, influenced by fear, greed, demographics, and, increasingly, by social media, trends take shape and morph quickly, even if fundamentals don’t move that rapidly. Look at all the 1,000-point swings in April and May trading, or the swings in market cap that wiped trillions in value off key stocks whose quarterly margins disappointed a little.

Unlike predicting the weather, which uses increasingly sophisticated models based on jet streams, ocean flows, temperature observations, and the like, stock market modeling at its core is based on human behavior—a notoriously unpredictable variable in the short term. So what is a long-term investor to do?

- Keep the long-term in focus. Despite all the interim wiggles and confounding moves, markets over the long haul trend upward, reflecting the growth of the U.S. economy. In any given year, there are major events to obsess over, yet the Dow has progressed from just over 1,000 to around 33,000, just during the span of my career. The Nasdaq has risen from 1,000 to 11,000 since just the early 2000s. Staying the course through interim volatility (or better yet, using that volatility to help periodically reapportion your assets) can aid your long-term net worth by putting the magic of compounding to work.

- Ensure that cash needed for important things in the next few years is not in the market. Your kids’ college tuition or the down payment for your second home should be parked in places that don’t move based on the latest Instagram or Twitter feed.

- Diversification matters. Keeping assets in a myriad of places/investments gives you a toehold in a variety of potential market outcomes. The classic definition of a market bottom is when an asset or asset class stops going down and begins to rise even as the headlines remain dour. If you’re not already invested you could easily miss much of the upmove, as those tend to happen explosively and when least expected.

- A bird’s-eye view matters. As you are making financial decisions, be sure to factor in all your assets: your 401(k) or ESOP, your share of the business, the accounts you have spread around among your college roommates-turned-financial-advisors, etc. Understanding what you own where and assessing over- or underexposure, as well as tax impacts, can have a noticeable impact on your long-term progress.

- Understand the difference between investing and trading. Keep your eyes tuned to the long pull and ignore the siren song of following the latest fad. This can be difficult as you will also be naturally drawn to wanting in early on the next big technology. Traditional and social media frequently get the idea or direction right, but often for the wrong reasons. Take the cryptocurrency craze. Rather than pick a specific early winner, dig deeper and figure out how to play the trend (in this case, the buildout of block chain infrastructure), taking the time to research the technology itself, how it might be used, and what components will be necessary to make it run.

- Acknowledge that investing wisely for the long pull is often a nerve-racking process. You often need to buy or buy more when prices go “on sale” (as long as the long-term fundamentals remain intact), and sell when everyone else wants to buy and the headlines are the most glowing.

The bottom line is that investing for the long haul has tended to work, even when history does repeat itself. Folks often point to the 1970s or early 2000s as being an awful period to invest in. While certain asset classes underperformed, others did quite well and economic progress continued. Whether or not history repeats, you can make your own future by having and executing your own plan.

Carol Schleif is deputy chief investment officer at BMO Family Office, a wealth management advisory firm delivering investment management services, trust, deposit, and loan products and services through BMO Harris Bank. To learn more visit www.bmofamilyoffice.com.

Share this Feature

Recommended Reading:

FRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Franchise Growth

- Franchise Operations

- Open New Units

- Franchise Leadership

- Franchise Marketing

- Technology

- Franchise Law

- Franchise Awards

- Franchise Rankings

- Franchise Trends

- Franchise Development

- Featured Franchise Stories

FEATURED IN

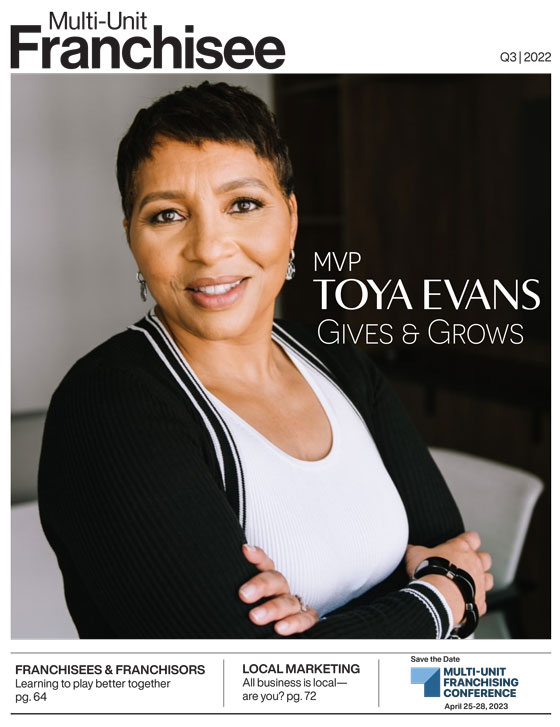

Multi-Unit Franchisee Magazine: Issue 3, 2022

$150,000

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.