Ten-Year Horizon: Factoring in Today's Ongoing Trends

Forecasting is a tricky business, involving equal amounts of data crunching, interpreting economic and general news events, common sense, and guessing. Like the weather, the shorter term the economic forecast, the more likely it will be close to reality.

Unfortunately, multi-unit operators must make investment decisions that have consequences for the next decade or more. We are only modestly affected by near-term economic event, so I will put greater emphasis on the last two forecasting factors--common sense and guessing--to see what some of the most influential trends might be for the next decade.

Let's start with the cost of capital. We have been in a cyclical 30-year decline. While access to capital is perhaps the biggest issue confronting unit expansion and acquisition today, the cost of capital is a relatively minor factor in budgeting and ROI decisions. Simply put, capital is cheap and has been for some time. I wouldn't count on that being the case for much longer because of globalization.

Money is a fungible commodity and will flow to the most attractive risk-adjusted opportunities. Over the next decade the most attractive investment options, relatively speaking, will be in the developing countries of the world. It is there that the demand for capital will be greatest and the willingness to pay for it the highest. These are some of the same countries that have been major buyers of our government's rapidly growing levels of debt. As these countries switch from being net exporters of capital to being net importers, the cost of our capital will rise.

Of course, Congress's unwillingness to address the long-term structural issues that are raising our government's demand for capital to dangerous levels will also cause long-term rates to rise. That was the real message behind S&P's downgrade shot across the bow in April. Also putting upward pressure on interest rates will be the $1.4 trillion of mortgage-backed securities that mature by the end of 2014, with another $1 trillion by the end of 2018.

Mass customization is a trend that represents both a threat and an opportunity for franchising. A hundred years ago you could buy a car in your choice of black. Fifty years ago you could buy a car with three option packages. Today you can have a car made to your customized specifications. Customization will become the norm in the next decade, driven by Generation Now. The threat to franchising is that much of the franchise model is built around doing the same thing, the same way, each time. The opportunity is to successfully execute on the 1970s Burger King ads with the tagline, "Have it your way." It's doable--it just needs to be a major focus.

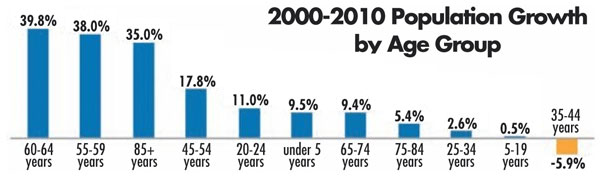

Two major demographic changes are coming in the next decade. Asian and Hispanic minorities are the fastest-growing race categories in the U.S. Hispanics are now the largest minority, not only nationwide but also in 191 metropolitan areas, up from 159 in 2000.

Further, we now have a barbell-shaped age demographic, with the fastest-growing concentrations in the over-55 and under-19 categories. While this represents a more difficult challenge for marketers of products that span generations (because the messaging needs to be so different for each), it creates significant opportunities for brands focusing on one side of the barbell because the two age extremes are very large.

The trends noted here are influencing how franchising is being conducted. Here are some of the changes I've observed during the past decade:

- a greater emphasis on specialty sectors for both food and non-food, likely anticipating the previously described demographic trends;

- the number of new franchise brands has dramatically increased since 2000;

- specialty foods, fruit drink, and three ethnic restaurant sectors represented the fastest-growing food sectors; and

- of the service sectors with the fastest growth in franchise brands, three of the top four were in the healthcare and fitness categories.

Also, there has been consistent downward pressure on initial investment levels for existing brands. Although this likely has been the result of the economic downturn, it is a good thing to have under way as the cost of capital begins to rise in coming years.

Despite all the attention given to developing countries, the U.S. will continue to be the largest economy and dominant power in the world until at least 2020. For the next decade it also will be the second-highest contributor to global growth after China. The trends I've outlined will influence the future direction of franchising and the opportunities for multi-unit operators, and they are already well under way. Be mindful of the capital, customization, and demographic trends that will influence future consumer buying patterns as you prepare to make those 10-year bets.

Darrell Johnson is CEO of FRANdata, an independent research company supplying information and analysis for the franchising sector since 1989. He can be reached at 703-740-4700 or [email protected].

Share this Feature

Recommended Reading:

FRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Franchise Growth

- Franchise Operations

- Open New Units

- Franchise Leadership

- Franchise Marketing

- Technology

- Franchise Law

- Franchise Awards

- Franchise Rankings

- Franchise Trends

- Franchise Development

- Featured Franchise Stories

FEATURED IN

Multi-Unit Franchisee Magazine: Issue 3, 2011

$65,000

$20,000

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.