Finance

Access to capital is the lifeblood of franchise growth. Restricted lending policies of the past few years continue to be a challenge for franchisees, who need access to capital, whether to survive or expand. Lenders today are searching for solid franchisee organizations to do business with, but what exactly are they looking for? Learn what bankers, franchise lenders, private equity firms, and other capital sources want to see in a borrower - and make sure you are managing your organization in ways that make you attractive to lenders.

Learn more about the franchise finance and capital marketplace, and what factors are affecting your chances to borrow the capital you need to grow.

"Obviously, if my sales are going up I will have more cash!" Think again. Growth costs money, yet most entrepreneurs believe that much of their growth can be funded from their growing company.

- Rod Bristol

- 19,831 Reads 15 Shares

A tax expert shares four ways multi-unit operators can keep a handle on their property tax values and even lower the amount they pay.

- Matthew Fossey

- 7,136 Reads 15 Shares

I have just returned from a three-week trip where I presented programs for a client in India, the Philippines, Malaysia, and Singapore. I then went on to present two additional programs for a client in Australia who has many multi-unit restaurant owners.

- Rod Bristol

- 11,188 Reads 5 Shares

The new presidential administration wasted no time jumping in, even before Inauguration Day. A steady stream of potential cabinet appointees was ushered in and out of Trump Tower in New York City, accompanied by the most intense media scrutiny we can recall for an incoming administration in recent memory.

- Carol Schleif

- 7,272 Reads 3 Shares

For a very long time, franchisees and franchisors maintained an arm's-length relationship: the franchisee sent the franchisor a sales report and a royalty check each month and the franchisor pretty much left them alone.

- Rod Bristol

- 8,637 Reads 18 Shares

Franchisees and investors say the economy is trending up and that regulatory relief and tax reform could provide further benefit for business operators.

- Multi-Unit Franchisee

- 4,699 Reads 41 Shares

Report finds franchise brands disclosing financial information more than ever, providing greater transparency and greater access to capital from lenders.

- Multi-Unit Franchisee

- 5,572 Reads 19 Shares

"If you always do what you've always done..." You know the ending to this old saw, and when it comes to your company's financial results it is absolutely true.

- Rod Bristol

- 18,595 Reads 1,023 Shares

The recent U.S. election cycle, more than any other in recent memory, tapped into deep angst within both major parties and the electorate at large.

- Carol M. Schleif

- 30,772 Reads 2 Shares

Uncertainty is the bane of business. Although the regulatory environment of the past few years seemed bent on attacking the franchise business model, the early drama and politics of the incoming administration seem to be creating a new kind of uncertainty.

- Eddy Goldberg

- 34,409 Reads 1 Shares

Politics, federal law, and franchisee assets. There are several significant steps that can be taken to help reduce estate taxes.

- Hugh Roberts

- 31,046 Reads 1,022 Shares

Multi-unit franchisees talk about the ramifications of employee pay as the DOL's Overtime Rule remains in limbo.

- Multi-Unit Franchisee

- 16,632 Reads

Franchisees take action by speaking out at a public hearing when a proposed IRS rule threatens the valuation of interests in closely held businesses.

- Eddy Goldberg

- 23,245 Reads 1 Shares

Unit-level economics (ULE) is the latest fancy phrase for the fundamental concept of franchisee profitability. The old-school franchise concept of caring only about a monthly sales report and a royalty check and, if the franchisee was not profitable, reselling the territory in 18 months is dead.

- Rod Bristol

- 28,442 Reads 1,021 Shares

Minimum wage increases will be ringing in the New Year in states across the country. The Service Employees International Union (SEIU) continues to push for greater increases in minimum wage. Wage increases will not only affect employees but also business owners and consumers.

- Multi-Unit Franchisee

- 19,656 Reads

An Analysis of Franchise Systems over a 6-Year Period Indicated that Systems with Item 19 Disclosures Achieved Significant Growth While Others Declined.

- Multi-Unit Franchisee

- 16,203 Reads 2 Shares

Private equity can provide a great growth or exit strategy for your franchise operation, but it is critical to consider and understand the rules of engagement. Make sure you know how to form the appropriate partnership with respect to your goals, and understand what you get and what you give up.

- Champ Rawls

- 17,595 Reads

After decades of seemingly inviolable correlations, shifts in markets, demographics, interest rates, and politics suggest that change may be in the offing.

- Carol M. Schleif

- 26,466 Reads 8 Shares

Financing Equipment For Your Franchise Locations Can Be A Big Investment. Here Are 5 Key Considerations To Make When Considering Financing Or Leasing Options.

- Biz Durling

- 14,753 Reads 13 Shares

If your business is on a calendar year, you've finished your first-quarter operations. Hopefully, your accountant or bookkeeper gave you your financial reports by April 15--both an income statement and a balance sheet--and you spent time reviewing them.

- Rod Bristol

- 19,083 Reads 1 Shares

How financing and site selection strategies play a significant role in multi-unit franchisee expansion.

- John T. Hewitt

- 17,596 Reads 13 Shares

If you are in a scenario where your business is doing great but you have little or no liquidity, make it a priority to free up cash.

- Champ Rawls

- 17,329 Reads

Do you know the seven drivers of gross margin? More important, do you know how to actually manage them in your business?

- Rod Bristol

- 16,959 Reads 1,021 Shares

After an extended period of complacency, markets have whipsawed in 2016. Will this level of heightened volatility continue?

- Carol Schleif

- 15,653 Reads 2 Shares

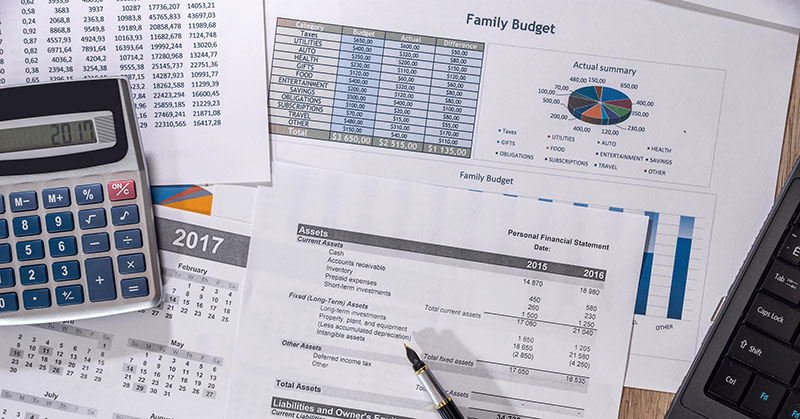

By now you've completed all of your financial budgeting and planning for 2016, have it set up on a month-by-month basis, and have organized your financial reporting to be able to measure your progress both on actuals to date and performance to plan.

- Rod Bristol

- 15,132 Reads 1 Shares

As we saw in graphic detail this past August-October, interim market swings in both directions can be violent. Major markets around the globe experienced their first correction in more than half a decade, only to make it all back up and then some within a couple of weeks.

- Carol M. Schleif

- 14,226 Reads 2 Shares

New Census Bureau data finds franchise businesses accounted for 560,086 establishments and 10.8 million jobs in 2012.

- Multi-Unit Franchisee

- 9,991 Reads

Most markets around the globe have performed well following the lows reached during the financial crisis.

- Carol M. Schleif

- 7,416 Reads

As we enter summer each year, businesses with a seasonal sales cycle can change significantly. If you are lucky, this is your busy season with expanded revenue and, hopefully, expanded profits and cash flow.

- Steve LeFever and Rod Bristol

- 10,814 Reads 1 Shares

There are many misconceptions about how to go about valuing your business. In general, most business owners have a value in their mind that is usually several times more than the actual value a sophisticated, competent buyer ultimately pays.

- Rod Bristol

- 17,319 Reads 10 Shares

| Page 1 of 5 | ^ Return to Top | 1 2345Next |

| ADVERTISE | SPONSORED CONTENT |

FRANCHISE TOPICS

- Multi-Unit Franchising

- Get Started in Franchising

- Franchise Growth

- Franchise Operations

- Open New Units

- Franchise Leadership

- Franchise Marketing

- Technology

- Franchise Law

- Franchise Awards

- Franchise Rankings

- Franchise Trends

- Franchise Development

- Featured Franchise Stories

Subscribe

| ADVERTISE | SPONSORED CONTENT |

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.

The multi-unit franchise opportunities listed above are not related to or endorsed by Multi-Unit Franchisee or Franchise Update Media Group. We are not engaged in, supporting, or endorsing any specific franchise, business opportunity, company or individual. No statement in this site is to be construed as a recommendation. We encourage prospective franchise buyers to perform extensive due diligence when considering a franchise opportunity.